Despite rehiring hundreds of FDA, CDC and NIH employees, the Department of Health and Human Services is still a skeleton of its former self under Health Secretary Robert F. Kennedy Jr.

TIGIT-targeting therapies have largely disappointed in recent months, with failed studies, terminated partnerships and shuttered businesses. Here are five biopharma players staying alive with differentiated candidates against the once promising immuno-oncology target.

After the FDA rejection of Zurzuvae in one type of depression and the triple failure of neuro asset dalzanemdor, Sage was searching for a path forward at the end of December 2024. Biogen CEO Chris Viehbacher spied a possible deal, but the smaller company wasn’t interested.

Bioinformatics is on the rise, forecasted to grow by about $16 billion from 2024 to 2029 given its value to managing mass datasets critical to modern drug discovery and development. Two talent acquisition experts share how the field has evolved in the past few years and which skills are most in demand.

Novartis is falling farther behind AbbVie, which expanded its JAK inhibitor Rinvoq into giant cell arteritis in April.

Health Secretary Robert F. Kennedy Jr. endorsed the expanded use of RSV vaccines for people 50 through 59 years old who are at risk of severe disease.

FEATURED STORIES

Slashing adverse drug reactions through pharmacogenetics and advanced AI could help rehabilitate the pharmaceutical industry’s reputation amid mounting criticism.

Analysts believe that Gilead’s new PrEP drug Yeztugo could reach peak sales of $4.5 billion. Not if GSK has anything to say about it.

In the United States, only 31.4 % of phase II/III clinical trials in oncology are successfully completed1. The causes of this dramatic economic and time-consuming loss are, among others, protocol design and patient recruitment challenges.

Why did two private equity firms with more than $460 billion under management want a little old gene therapy biotech called bluebird bio? We wanted to know.

Cell and gene therapy leaders say the agency’s decision to remove the Risk Evaluation and Mitigation Strategies that had been attached to approved CAR T cancer therapies reflects “thoughtful consideration of real-world evidence” and “regulatory trust.”

Big Pharmas like Eli Lilly, Sanofi and Novartis headed back to the dealmakers table multiple times, with 32 total deals counted across the industry for the first half.

FROM BIOSPACE INSIGHTS

Are long R&D cycles, overwhelming literature reviews, or patent bottlenecks slowing your path to innovation? In the fast-evolving life science landscape, AI is no longer a luxury, it’s a necessity.

LATEST PODCASTS

The high court sides with HHS on HIV PrEP drugs; Health Secretary RFK Jr.’s newly appointed CDC vaccine advisors discuss thimerosal in flu vaccines, skip vote on Moderna’s mRNA-based RSV vaccine; FDA removes CAR T guardrails; AbbVie snaps up Capstan for $1.2B to end first half; and psychedelics take off again with data from Compass and Beckley.

In this episode presented by IQVIA, BioSpace’s head of insights Lori Ellis discusses the FDA’s first draft guidance for AI in drug development, published in January 2025, with Archana Hegde, senior director, pv systems and innovations at IQVIA.

Robert F. Kennedy Jr. testified in front of largely combative congresspeople on vaccine policy, his MAHA report and more; the mass leadership exodus at the FDA continues as CDER and CBER shed key staff; Kennedy’s revamped CDC vaccine advisors convene for their first meeting; Novo and Lilly present new data at the American Diabetes Association’s annual meeting; and BioSpace recaps BIO2025.

Subscribe to Genepool

Subscribe to BioSpace’s flagship publication including top headlines, special editions and life sciences’ most important breaking news

SPECIAL EDITIONS

BioSpace did a deep dive into executive pay, examining the highest compensation packages, pay ratios and golden parachutes—what a CEO would get paid to leave.

A new generation of checkpoint inhibitors is emerging, with some showing more promise than others. From recent TIGIT failures to high-potential targets like VEGF, BioSpace explores what’s on the horizon in immuno-oncology.

Peter Marks, the venerable head of the FDA’s Center for Biologics Evaluation and Research, has been forced out. In this special edition of BioPharm Executive, BioSpace takes a deep dive into the instability of the HHS.

DEALS

-

The rise of monoclonal antibodies brought back hope for stalling or reversing the devastating neurodegenerative disease. Big Pharma has taken notice with a handful of high-value deals, GlobalData reports.

-

Jefferies analysts called the proxy filing, which is a standard disclosure after a merger agreement, “much more intriguing than normal” given the regulatory turmoil it revealed.

-

Minovia’s lead product is MNV-201, an autologous hematopoietic stem cell product that is enriched with allogeneic mitochondria.

-

Flagship Pioneering’s ProFound Therapeutics will use its proprietary technology to mine the expanded proteome for novel cardiovascular therapeutics. Novartis has promised to pay up to $750 million per target, though it has not specified how many targets it will go after.

-

Leading companies spent $1.4 billion upfront on licensing deals and embarked on vast R&D programs. Clinical setbacks mean many companies are unlikely to ever recoup their investments.

WEIGHT LOSS

-

With PN-477, Protagonist is directly going up against Eli Lilly, which is advancing retatrutide, also a triple-G agonist, in a Phase II trial.

-

Altimmune’s pemvidutide failed to significantly improve fibrosis in MASH patients in a Phase IIb study. The biotech crashed 53% in the aftermath of the readout.

-

In the race to make the most tolerable obesity drug, there seems to be no clear winner—at least not according to analysts parsing the data presented at the American Diabetes Association annual meeting this week.

-

Eli Lilly’s tirzepatide is expected to be worth $62 billion annually by 2030, according to Evaluate. That valuation would be three times larger than what AbbVie’s blockbuster Humira ever achieved.

-

Robert F. Kennedy Jr. testified in front of largely combative congresspeople on vaccine policy, his MAHA report and more; the mass leadership exodus at the FDA continues as CDER and CBER shed key staff; Kennedy’s revamped CDC vaccine advisors convene for their first meeting; Novo and Lilly present new data at the American Diabetes Association’s annual meeting; and BioSpace recaps BIO2025.

POLICY

-

An open letter signed by more than 50 industry executives blasts a “fundamentally, fatally flawed” report that urges greater restrictions on the abortion pill.

-

As an office of the executive branch, the Department of Health and Human Services “does not have the authority” to implement sweeping changes to the structure of the agency as created by Congress, a judge wrote.

-

Kennedy wants to expand the injury compensation program to include COVID-19 vaccines, while also stretching the “statute of limitations” to more than three years.

-

In an open letter addressing the Trump administration’s proposed budget cuts to HHS, the executives urged Congress to continue “robust federal funding” for scientific research, which they say will help maintain U.S. biotech leadership globally.

-

The revamped and “more anti-vax skewed ACIP committee” at the CDC “has a bone to pick with mRNA vaccines,” according to Truist Securities analysts. Meanwhile, the FDA moves forward on having Pfizer/BioNTech and Moderna update labels for their COVID vaccines.

Looking for a new opportunity in New Jersey? These nine companies have open roles that could be a great fit for you.

Whether you’re moving on or being moved out, how you leave can shape your reputation more than how you led.

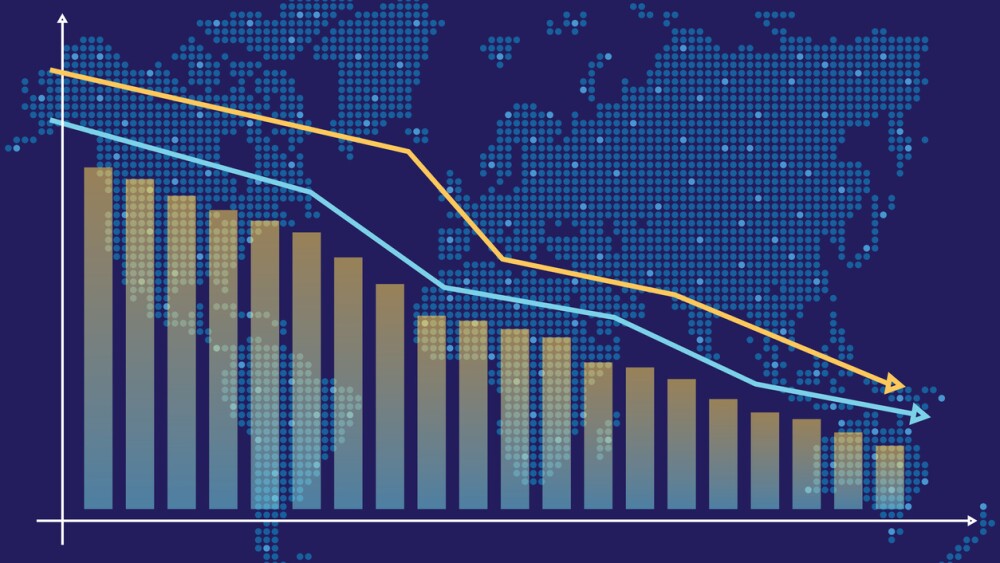

Year-over-year BioSpace data show biopharma professionals faced increased competition for fewer employment opportunities during the first quarter of 2025.

Learn how to extract the full value from executive coaching, starting with being open and honest with your coach.

Just raising the alarm won’t drive action. Use these three steps to turn insights into solutions that leadership can’t ignore.

Learn about making the most of interview feedback, navigating bonus clawbacks and networking for niche roles.

HOTBEDS

REPORTS

In this Employment Outlook report, BioSpace explores current workforce sentiment, job activity trends and the prospective job and hiring outlook for 2025, particularly as it compares to the previous year.

BioSpace’s third report on diversity, equity, inclusion and belonging in life sciences examines dramatic shifts in attitude around diversity initiatives.

CANCER

-

Pfizer insists that the discontinuation of the Phase II study was due to recruitment difficulties and was not linked to maplirpacept’s safety or efficacy.

-

In a detail-thin announcement, Amgen said that adding bemarituzumab to chemotherapy improved overall survival, though analysts pledged to wait for more data on safety and tolerability before assessing the drug.

-

The FDA delivered two notable approvals for RSV immunization, UroGen overcame a negative advisory committee vote to secure an approval in bladder cancer, and more key regulatory nods from the past month.

-

Gilead is betting up to $750 million on Kymera’s anti-CDK2 molecular glue for solid tumors, while Sanofi elected to move forward with another protein degrader from the biotech, designed to target immune-mediated diseases.

-

In May, Revolution Medicines projected its cash and equivalents of $2.1 billion would last into the second half of 2027. With new funding from Royalty Pharma, the biotech has withdrawn that runway end date.

NEUROSCIENCE

-

The high court sides with HHS on HIV PrEP drugs; Health Secretary RFK Jr.’s newly appointed CDC vaccine advisors discuss thimerosal in flu vaccines, skip vote on Moderna’s mRNA-based RSV vaccine; FDA removes CAR T guardrails; AbbVie snaps up Capstan for $1.2B to end first half; and psychedelics take off again with data from Compass and Beckley.

-

BPL-003 showed “robust” efficacy data in treatment-resistant depression, according to analysts from Jefferies, who noted that the asset could hit peak market sales of $1 billion. The results clear the way for the asset’s late-stage development and for the completion of a proposed merger with atai Life Sciences.

-

Digging into a prespecified analysis for the mid-stage study, INmune Bio identified some clinical and biological benefits of its TNF inhibitor in patients with early Alzheimer’s disease who have at least two biomarkers of inflammation.

-

The FDA found that data from a single Phase II study were “insufficient” to justify an accelerated approval review for sevasemten in Becker muscular dystrophy.

-

While ALTO-203 missed its depression-related endpoints, improvements in EEG biomarkers, attention and wakefulness point to signals of drug activity, William Blair said, though the analysts pointed to other indications as potentially more promising for future development.

CELL AND GENE THERAPY

-

The pivotal trial for Neurogene’s Rett syndrome gene therapy makes use of baseline controls and a rigorous endpoint that could help ensure a broader label for the drug product, if approved, according to analysts.

-

The all-cash buyout, which gives AbbVie access to Capstan Therapeutics’ in vivo edited CAR T therapy for B cell–mediated autoimmune diseases, adds to a growing sense of momentum in M&A, according to BMO Capital Markets.

-

Changing how biopharmas package their products, how regulators review new drugs and how mutated genes are fixed could make ultrarare disease treatments possible.

-

The FDA is assessing the need for “further regulatory action” on Sarepta’s Duchenne muscular dystrophy gene therapy in the aftermath of two patient deaths, though the regulator has not yet specified what action this could be.

-

Isaralgagene civaparvovec is a “potential best-in-class gene therapy for Fabry disease,” according to analysts at H.C. Wainwright. Sangamo plans to use pivotal Phase I/II data to build an accelerated approval case for the asset.