While Imvax’s autologous immunotherapy IGV-001 missed the primary endpoint of progression-free survival in a Phase IIb trial, the company will request a meeting with the FDA to discuss next steps for “synergistic” treatment.

Trontinemab lowered amyloid levels below the threshold of positivity in 92% of treated patients.

This week’s meeting of the Advisory Committee on Immunization Practices will be led by Kirk Milhoan, a physician and pastor who recently claimed that COVID-19 vaccines contained a contamination that causes cancer.

Agentic AI can help FDA staff manage meetings, conduct pre-market reviews and validate reports, among other tasks, though the agency emphasized that using this technology is optional for its employees.

U.K.-based pharmas will not face tariffs as long as Donald Trump is president, according to the agreement.

Following Novo Nordisk’s price cuts for its own GLP-1 medicines, Eli Lilly is offering discounts for the obesity drug purchased through LillyDirect. Both pharmas recently struck a deal with the White House for cheaper prices via the yet-to-be-launched TrumpRx.

FEATURED STORIES

Following up on previous, dimly received issuances, a new set of ideas published by the FDA to streamline regulatory pathways for cell and gene therapies ‘for small populations’ is receiving a warmer welcome—but experts warn it will take more to turn the tide for the fraught therapeutic space.

J&J still holds the top deal of the year by value with its $14.6 billion buy of Intra-Cellular in January, but the next four biggest acquisitions came in the past four months.

The two most historically deal-conservative Big Pharmas have the most money to play with for a major M&A transaction, according to a recent Stifel analysis.

A new analysis from SRS Acquiom puts into perspective the headline values seen when a company announces a backloaded M&A deal. Biotechs have much on the line when they agree to deals with massive potential but little upfront.

Talks between pharma and successive U.K. governments have failed to deliver the market access terms that the industry wants, contributing to a pullback in investment.

Companies are moving from using AI for distinct operations to applying the technology for control and optimization of the whole production process.

FROM BIOSPACE INSIGHTS

United States Pharmacopeia is recruiting expert volunteers from academia, industry, regulatory and healthcare to develop, revise and approve medicine, dietary supplement and food ingredient standards and solutions used in more than 150 countries to improve global public health. The volunteers will serve from 2025 to 2030.

LATEST PODCASTS

In this bonus episode, BioSpace’s Vice President of Marketing Chantal Dresner and Careers Editor Angela Gabriel take a look at Q2 job market performance, layoffs and wider employment trends and policies impacting the biopharma workforce.

In this episode presented by Eclipsebio, BioSpace’s head of insights Lori Ellis discusses mRNA and srRNA with Andy Geall of Replicate Bioscience and Alliance for mRNA Medicines, and Pad Chivukula of Arcturus Therapeutics.

H2 2025 catalysts to watch, biopharma implications of President Trump’s tax law, KalVista’s new hereditary angioedema drug that Marty Makary reportedly tried to reject, another lawsuit aimed at Health Secretary Robert F. Kennedy Jr. and a plea from patients with ALS for access to BrainStorm’s NurOwn.

Job Trends

While layoffs have slowed in the second half of the year, according to BioSpace data, companies including Bayer, Bristol Myers Squibb and Johnson & Johnson are cutting hundreds or even thousands of employees in 2024.

Subscribe to GenePool

Subscribe to BioSpace’s flagship publication including top headlines, special editions and life sciences’ most important breaking news

SPECIAL EDITIONS

In this deep dive, BioSpace investigates China’s rise as a biotech powerhouse.

In this deep dive, BioSpace explores the next big thing in obesity.

BioSpace did a deep dive into biopharma female executives who navigated difficult markets to lead their companies to high-value exits.

DEALS

-

Out-licensing drugs to multinational corporations is a natural step for Chinese biotechs, but the recent rise in deals is only scratching at the surface of partnership-ready biotechs in the region.

-

The German giant is looking to develop new drugs for undisclosed eye diseases using Re-Vana’s extended-release injectable platform to supply drugs to the eye for months at a time.

-

The star of GSK’s Hengrui partnership is the COPD candidate HRS-9821, which will complement the pharma’s respiratory pipeline that’s anchored by the anti-asthma drug Nucala.

-

The collaboration focuses on ‘molecular gates,’ a class of molecules that the startup company Gate Bioscience says can stop pathogenic proteins from leaving the cell.

-

The partnership with Matchpoint Therapeutics gets Novartis global rights on all molecules for several unannounced inflammatory diseases identified through the biotech’s discovery platform.

WEIGHT LOSS

-

Health Secretary Robert F. Kennedy Jr. will appear before the Senate Finance Committee Thursday, ahead of a vaccine advisory committee meeting later in September. Meanwhile, deal-making appetite appears healthy, and the weight loss space continues generating clinical data and other news.

-

Novo Nordisk’s Wegovy has been on a winning streak as of late, with a metabolic dysfunction-associated steatohepatitis approval last month and prime position in the oral obesity race.

-

While Eli Lilly’s orforglipron is full speed ahead for a regulatory filing this year, the pharma is also pushing forward with one more Phase II study of naperiglipron, which uses the same scaffold as Pfizer’s failed obesity drugs danuglipron and lotiglipron.

-

In December 2024, Teva also secured FDA approval for the other liraglutide brand Victoza, indicated for type 2 diabetes.

-

Novo Nordisk has brought on other cardiometabolic collaborators this year, including United Laboratories International and Deep Apple Therapeutics.

POLICY

-

Paul Offit, longtime member of the FDA’s vaccine advisory committee and an outspoken critic of Health Secretary Robert F. Kennedy Jr., was recently informed by the Department of Health and Human Services that his services are no longer required.

-

While trade groups hail the executive order as a national health security opportunity, analysts warn that production costs could go up in the near term.

-

During the COVID-19 pandemic, Health Secretary Robert F. Kennedy Jr.—along with FDA Commissioner Marty Makary and CBER Director Vinay Prasad—argued against vaccine mandates, partly because they limited medical choice. This week, the FDA under their leadership approved updated COVID-19 vaccines with restrictions that do the same.

-

Health Secretary Robert F. Kennedy Jr. will testify before the Senate Finance Committee on Sept. 4, following the ouster of CDC Director Susan Monarez and tapping of HHS Deputy Secretary Jim O’Neill as her interim replacement.

-

The CDC director—the first to be confirmed by the Senate under new legislation—has been ousted after less than a month following internal unrest regarding new, more restrictive approvals for updated COVID-19 vaccines, according to multiple sources.

This week, Carina discusses how to transition into a career in biotech when you don’t have lab experience. Plus, handling difficult interviews and getting a “dry” promotion.

A recent legal decision could signal the ultimate demise of the FTC’s final rule banning most noncompete clauses. A biotech talent expert discusses how that affects biopharma job searches.

For the second quarter of 2024, there were 25% fewer jobs posted live on BioSpace compared to the same quarter of 2023. The year-over-year job response rate rose from 14.6% to 15.3%.

Interviews can be difficult in any field, but especially in a competitive industry like the life sciences. Read on to discover the best way to answer salary interview questions in our guide.

Plus, what to do if your offer is paused and how to manage work anxiety.

If you overidentify with your job, there are ways to find self-worth outside of work, starting with using your transferable skills somewhere else.

HOTBEDS

IN CASE YOU MISSED IT

Also on Thursday, Zealand held its Capital Markets Day in London, outlining the strategy for its weight management franchise in the near-term, including launching five products by 2030.

REPORTS

In this Employment Outlook report, BioSpace explores current workforce sentiment, job activity trends and the prospective job and hiring outlook for 2025, particularly as it compares to the previous year.

BioSpace’s third report on diversity, equity, inclusion and belonging in life sciences examines dramatic shifts in attitude around diversity initiatives.

CANCER

-

For $1.3 billion in aggregate—including upfront and milestone payments—Bayer will get exclusive global access to Kumquat Biosciences’ small-molecule KRAS G12D blocker.

-

Phase Ib data show Hernexeos can elicit a confirmed objective response rate of 44% in patients with HER2-mutated NSCLC who had previously been treated with a directed antibody-drug conjugate.

-

The recent announcement of RFK Jr.’s termination of mRNA vaccine contracts is the latest effort to undermine this promising technology at the federal level. Pharmaceutical companies and private investors must fill the gap and ensure that research into this critical resource continues.

-

Arguably the FDA’s most anticipated decision this month is for a subcutaneous induction formulation of Biogen and Eisai’s Alzheimer’s drug Leqembi, which, according to Eisai, could “help reduce the burden on healthcare professionals and patients.”

-

Strand Therapeutics’ lead asset is STX-001, an intra-tumor self-replicating mRNA therapy that carries a payload expressing the immunomodulatory protein IL-12.

NEUROSCIENCE

-

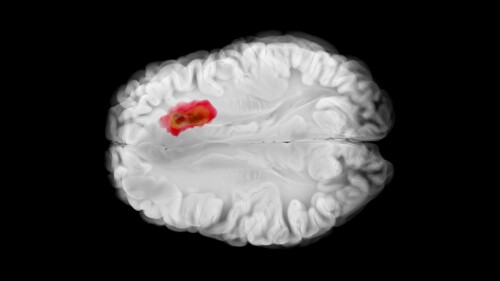

In another blow to Prothena’s neurodegenerative disease portfolio, anti-amyloid candidate PRX012 has run into the same problem that larger peers Biogen and Eli Lilly have battled: high rates of swelling in the brain.

-

AMX0035—approved as Relyvrio in 2022 for amyotrophic lateral sclerosis but voluntarily pulled from the market last year—was unable to distinguish itself from placebo in a mid-to-late-stage trial of progressive supranuclear palsy.

-

Novartis has bet up to $772 million to gain access to BioArctic’s BrainTransporter platform, which was leveraged in a partnership with Eisai to produce Leqembi.

-

Eli Lilly drops a second Phase III readout for orforglipron; AbbVie committed to the psychedelic therapeutics space with the $1.2 billion acquisition of Gilgamesh’s depression asset; the CDC taps vaccine skeptic Retsef Levi to lead its COVID-19 immunization working group; and the FDA prioritizes overall survival in cancer drug development.

-

LB Pharma will test the IPO market to seek funding for a Phase III-ready schizophrenia asset.

CELL AND GENE THERAPY

-

The pivotal Phase II trial is testing Allogene’s CAR T candidate cemacabtagene ansegedleucel for large B-cell lymphoma. ALLO-647 was being used as a preparative lymphodepletion therapy.

-

The FDA greenlit multiple new drugs this month and issued some notable label expansions, including for Eli Lilly’s Kisunla. Meanwhile, the regulator turned away a cell therapy for Duchenne muscular dystrophy and a gene therapy for the rare disease Sanfilippo syndrome.

-

As analysts parsed news of Vinay Prasad’s ouster, worries over drug approval delays, cell and gene therapy impacts and more were top of mind.

-

The swift FDA action removes an overhang from Sarepta and allows Elevidys to return to the market without another safety study, as had been feared, Jefferies analysts said Monday.

-

Brazilian authorities said the death was unlikely to have been caused by Elevidys and was instead more in line with severe infection exacerbated by immunosuppression.