The deal focuses on ICT01, a monoclonal antibody being tested in acute myeloid leukemia. ImCheck is also developing assets in infectious disease and other oncology indications.

While the threat of tariffs dies down for the pharma industry, President Donald Trump is reportedly weighing a new investigation that could result in import taxes against U.S. trading partners that don’t pay enough for drugs.

Pfizer, Merck, AstraZeneca and Bristol Myers Squibb were among the many biopharmas showing off novel cancer modalities at ESMO, with antibody-drug conjugates, bispecific antibodies and kinase inhibitors demonstrating encouraging efficacy and safety for various cancers.

Two patients experienced grade 3 liver enzyme elevations that were deemed related to Terns’ investigational obesity pill TERN-601.

For $1.2 billion upfront and up to $10.2 billion in milestones, Takeda will gain access to a bispecific antibody fusion protein targeting both the PD-1 and IL-2 pathways, among other assets.

This represents Alector’s second failed neurodegenerative asset in a year, after an AbbVie-partnered asset missed in Alzheimer’s last November. On latozinemab for frontotemporal dementia, Alector was working with GSK, which fronted $700 million in 2021 to collaborate on two programs.

FEATURED STORIES

The number of employees laid off increased year over year during the first quarter. BioSpace recaps the five largest rounds of layoffs, which included BMS and Novartis cuts.

At the intersection of radiation and precision, Novartis, Bayer, AstraZeneca and more hope to cash in on a radiopharmaceuticals market that could top $16 billion by 2033.

To more effectively treat neurodegenerative conditions, we first need diagnostic tools that lend a more complete picture of protein aggregates in the brain.

As the Trump administration slashes funding for HIV-related research and infrastructure, Gilead, Immunocore and more are targeting the next goalpost: a cure.

With President Donald Trump expected to deliver a drug pricing order on Monday that Big Pharma and patient groups alike have railed against, the industry’s tumultuous ride is far from over.

Yes, according to leading vaccine physician Paul Offit, who denounced the new placebo-controlled trial requirements for vaccines and sought greater clarity: “I don’t know what they’re talking about.”

LATEST PODCASTS

In this episode, Lori and guests discuss practical approaches regarding artificial intelligence and investor and industry confidence in its current state.

BioMarin’s new business strategy leaves investors with questions; Lykos CEO steps down; Terns releases compelling data on oral weight loss candidate; and more.

Eli Lilly offers weight loss drug Zepbound directly to consumers while Novo Nordisk continues to struggle with supply challenges for its own GLP-1s. Meanwhile, gene therapies for retinal diseases target competitive market, and layoffs persist.

Job Trends

Thermo Fisher Scientific Inc., the world leader in serving science, released its 2023 Corporate Social Responsibility report, which provides an overview of the company, its CSR priorities and the progress enabled by its more than 120,000 colleagues.

Subscribe to GenePool

Subscribe to BioSpace’s flagship publication including top headlines, special editions and life sciences’ most important breaking news

SPECIAL EDITIONS

In this deep dive, BioSpace investigates China’s rise as a biotech powerhouse.

In this deep dive, BioSpace explores the next big thing in obesity.

BioSpace did a deep dive into biopharma female executives who navigated difficult markets to lead their companies to high-value exits.

DEALS

-

The deal has secured Novartis the chance to work with Ratio Therapeutics on a novel drug candidate that could fortify the Big Pharma against competition from would-be radiopharmaceutical rivals such as BMS and Lilly.

-

The acquisition will give BioNTech full ownership of an investigational bispecific antibody targeting the PD-L1/VEGF-A pathways, a hot area in oncology that could potentially replace standard checkpoint inhibitors for cancer treatment.

-

Novo Holdings’ acquisition of Catalent has ignited concerns from industry stakeholders, who fear that the consolidation could limit competition, but there is also the possibility that the deal could represent an opportunity for smaller-scale CDMOs to find new partners.

-

With $70 million upfront and more than $1.8 billion on the line, Roche will gain access to Flare’s drug discovery engine to bolster its oncology pipeline.

-

With Novo Holdings’ $16.5 billion buyout of Catalent being reviewed by regulators, what work the contract drug manufacturer may or may not be performing for Eli Lilly remains a point of contention.

WEIGHT LOSS

-

Just over a year after striking an obesity deal with Novo Nordisk, an SEC filing shows Flagship Pioneering spinout Omega Therapeutics is days away from bankruptcy and will lay off up to 17 employees.

-

Amid growing concern of the overuse and misuse of obesity drugs, the UK’s pharmacies regulator rolled out stricter guidelines for online pharmacies selling medicines including Novo Nordisk’s Wegovy and Eli Lilly’s Mounjaro.

-

The U.S. Centers for Medicare and Medicaid Services has named Novo Nordisk’s Wegovy, Ozempic and Rybelsus as part of the second round of the IRA drug price negotiation program, even as the pharma challenges the program.

-

Donald Trump continues to make waves in biopharma; Sage rejects Biogen’s unsolicited takeover offer; the obesity space sees more action with new company launches, IPOs and fresh data; and experts get ready for an important era in the Duchenne muscular dystrophy space.

-

It’s been a rocky few months for BioAge Labs, which shuttered a Phase II trial of its lead candidate azelaprag Tuesday after the molecule caused liver-based side effects.

POLICY

-

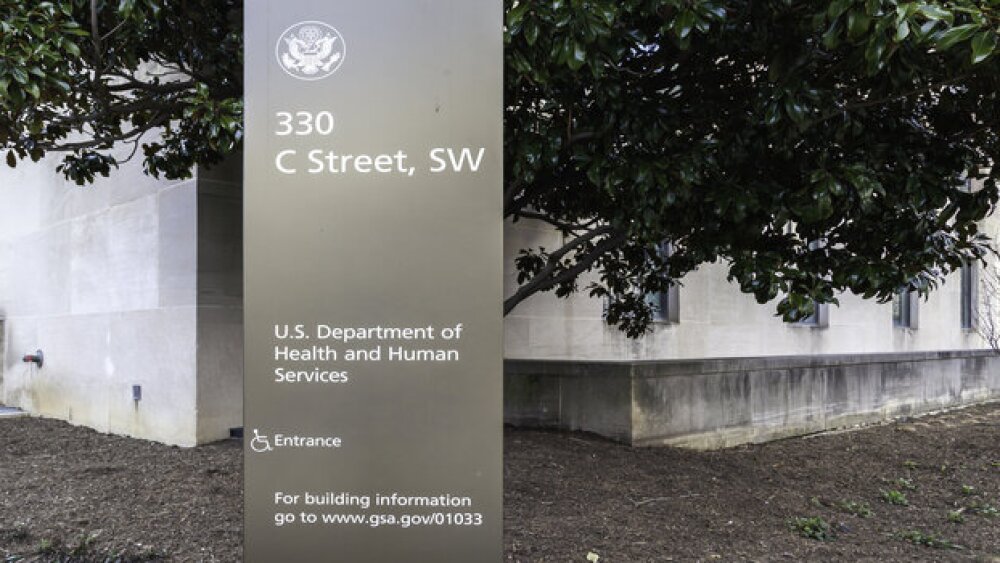

The third cycle of the drug price negotiations will involve drugs under Medicare Part B. New prices are set to take effect in 2028.

-

The Most Favored Nation directive would allow drugmakers to directly sell their products to patients at a lower cost, cutting out what President Donald Trump called “the middlemen.”

-

While industry groups decried the Trump administration’s new drug pricing order, analysts say it lacked details and the teeth to make a major impact without an act of Congress.

-

The package revives President Donald Trump’s much-maligned Most Favored Nation rule but goes further into the private markets and beyond, leveraging the patent system, drug importation and more.

-

The FDA and CDC have also recommended pausing the use of Ixchiq in seniors 60 years and older while safety investigations are ongoing.

Discover the most common departments that make up a BioPharma company, learn about the responsibilities of each department and figure out which role is the right fit for you.

Like any field, there are upsides and downsides to working in biotech, and educating yourself can help you make an informed decision if you’re considering a career in this industry.

Learn the best tips, tricks, and practices to help yourself to get the first job after college life sciences industry right out of college in our comprehensive guide.

Discover the most in-demand pharma qualifications and how to use them to score your dream job in our comprehensive guide.

Instead of going through pharma job search websites, you should create a powerful LinkedIn profile. Check out Biospace to find out the benefits of having a strong LinkedIn Profile.

Despite the massive financing from venture capitalists that poured into Massachusetts in 2021, Bay State biopharma companies are struggling to find enough talent to fill the number of available jobs.

HOTBEDS

IN CASE YOU MISSED IT

A week into his tenure as head of the FDA’s Center for Drug Evaluation and Research, experts agree that Rick Pazdur is the “ideal fit” to stabilize the agency. And, according to one ex-FDA official, if his CBER counterpart Vinay Prasad tries to supersede Pazdur’s authority, “there will be hell to pay.”

REPORTS

In this Employment Outlook report, BioSpace explores current workforce sentiment, job activity trends and the prospective job and hiring outlook for 2025, particularly as it compares to the previous year.

BioSpace’s third report on diversity, equity, inclusion and belonging in life sciences examines dramatic shifts in attitude around diversity initiatives.

CANCER

-

Merck’s Keytruda holds on to the top spot while AbbVie’s Humira—once the world’s top-selling drug—continues to cede its market share to biosimilar competitors.

-

The approval for the first-line treatment of esophageal squamous cell carcinoma comes shortly after a label expansion for the drug in gastric and gastroesophageal cancers as BeiGene also pushes forward a pipeline of novel cancer therapies.

-

The partners are pushing to expand Enhertu’s list of indications beyond its standing uses in breast, lung and gastric cancers.

-

Protagonist Therapeutics notches a milestone in its pact with Takeda for rusfertide. New data show that many patients with a chronic blood cancer taking the drug didn’t need to have their blood removed to bring down dangerously high hemocrit levels.

-

More than a decade after Merck’s Keytruda and BMS’ Yervoy ushered in the immuno-oncology revolution, the space is at a crossroads, with experts highlighting novel targets, combinations and pre-emptive immunization as the next wave for IO.

NEUROSCIENCE

-

Little information has emerged about osavampator, a potentially first-in-class drug, since its promising Phase II performance last spring.

-

The monthly maintenance regimen, which offers a more convenient frequency than the initially approved treatment schedule for patients with Alzheimer’s, could help with Leqembi’s thus far disappointing uptake and sales.

-

Vigil Neuroscience reported a strong safety profile and 50% sTREM2 reduction in an early-stage trial for VG-3927, potentially representing a new avenue for treating Alzheimer’s disease.

-

In a good-news-bad-news week for Biogen, the company will cut an undisclosed number of employees, just as a higher dose of its Ionis-partnered therapy Spinraza for spinal muscular atrophy will be considered by the FDA and EMA.

-

The drugs’ active ingredient, glatiramer acetate, has been linked to more than 80 cases of anaphylaxis worldwide since December 1996 and six patient deaths.

CELL AND GENE THERAPY

-

By mid-2025, the biotech will split into two entities: a new, as-yet-unnamed innovative medicines specialist and a cell therapy company, the latter of which will inherit the Galapagos name.

-

BioSpace presents 25 noteworthy biopharma startups in ’25; analysts forecast stronger M&A as the J.P. Morgan Healthcare Conference kicks off next week; GLP-1s continue to expand their reach as Novo, Lilly fight against compounders; and a look ahead to five key FDA decisions in Q1.

-

From ADCs and radiopharmaceuticals to cell and gene therapies, eager young startups are betting on advances in biopharma’s most competitive therapeutic spaces—and attracting dollars from Big Pharma.

-

Sangamo is on course to run out of money within months and has now lost access to up to $220 million in milestone payments from Pfizer.

-

The approval concludes what has been a difficult regulatory path for Ryoncil, which suffered FDA rejections in 2020 and 2023.