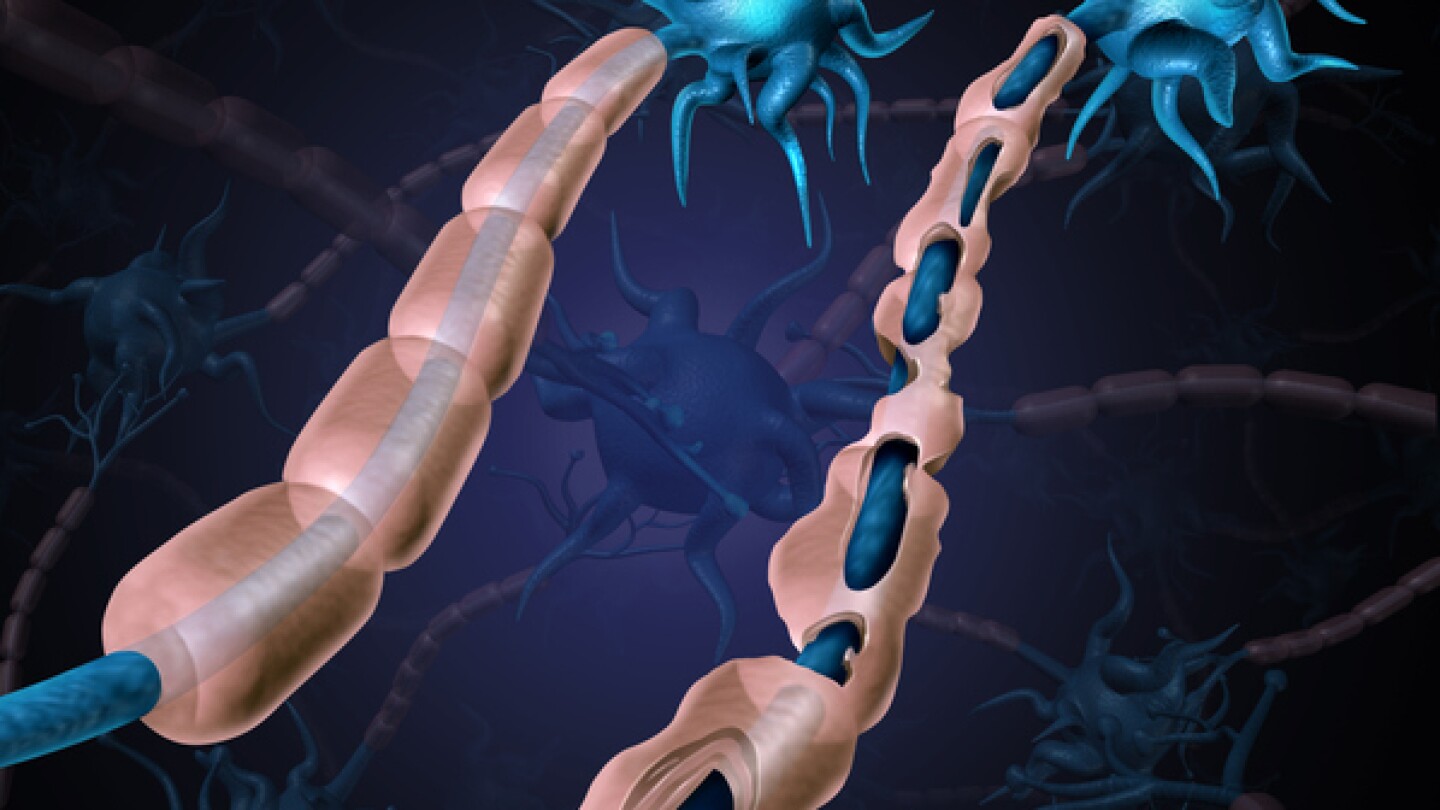

Multiple sclerosis

Sanofi’s multiple sclerosis hopeful tolebrutinib faced dual setbacks on Monday, with a late-stage failure in one form of the disease and yet another regulatory setback in another.

While expressing disappointment, William Blair analysts were unsurprised by the Phase II failure, having assigned the VISTA study a high level of risk given the “mixed” performance of a similar drug in a prior multiple sclerosis study.

The centerpiece of the deal is orelabrutinib, a BTK inhibitor in late-stage development for multiple sclerosis that Biogen once paid $125 million for but abandoned after less than two years of testing.

While Bruton’s tyrosine kinase inhibitors are often hailed as the next big breakthrough in multiple sclerosis, Immunic Therapeutics and others are leveraging neuroprotective targets and remyelination to keep the disease at bay.

The company was expecting a decision from the FDA by Sept. 28 for its oral drug tolebrutinib, but an update to the drug’s application package convinced the agency to take more time to review.

Rumors of Biogen’s disagreements with Eisai have been greatly exaggerated, CEO Chris Viehbacher said during a second quarter earnings call. The partnered Alzheimer’s drug Leqembi saw sales climb 20% for the period.

Second-quarter earnings come amid many high-level challenges for the biopharma industry. How will these five closely watched biotechs fare?

According to CEO Daniel Vitt, clinical and disability-related outcomes are more relevant than brain volume change for drug development in multiple sclerosis.

The new formulation of Keytruda, currently under FDA review, is sparking conflict with Halozyme, which makes enzymes that convert intravenous drugs into injectable versions.

The drugs’ active ingredient, glatiramer acetate, has been linked to more than 80 cases of anaphylaxis worldwide since December 1996 and six patient deaths.

PRESS RELEASES