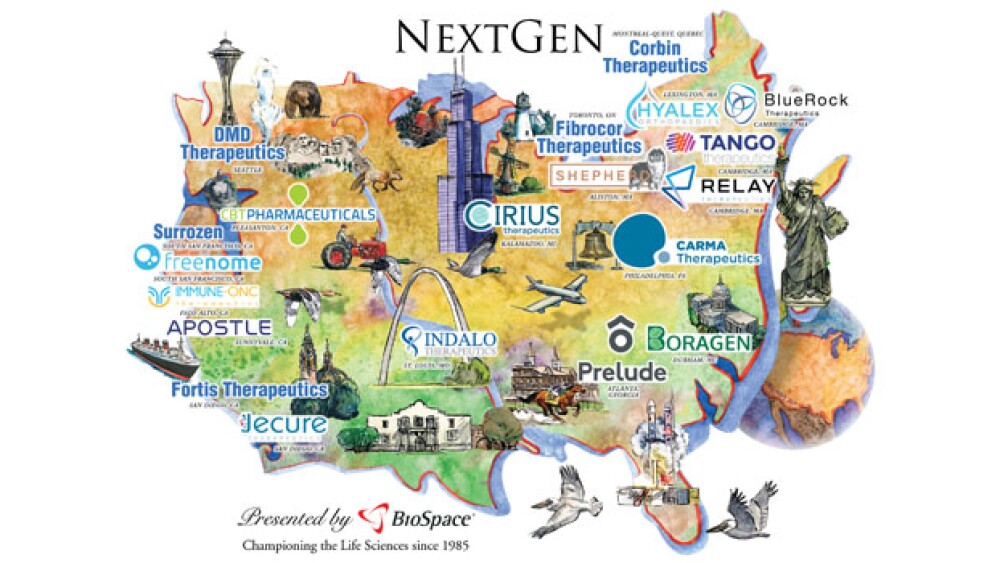

BioSpace is proud to present its NextGen “Class of 2018,” a list of 20 up-and-coming life science companies in North America that started up no earlier than 2015.

BioSpace is proud to present its NextGen Bio “Class of 2018,” a list of 20 up-and-coming life science companies in North America that started up no earlier than 2015.

To come up with this Top 20, BioSpace sorted companies into that age grouping, and they were then weighted by a number of different categories and finally ranked in a cumulative fashion, based on the points awarded for each category. These categories were: Finance, Collaborations, Pipeline, Sales and Editorial (view methodology below).

The NextGen Bio Class of 2018 is a stellar group of companies that are already making an enormous impact on the industry now and will into the future. Congratulations to this group!

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Points: 37

Founded: 2016

Location: Ontario, Canada; Cambridge, MA, New York, NY

Notable:

• In December 2016, BlueRock launched with a $225 million Series A financing, led by Bayer AG and Versant Ventures.

• BlueRock focuses on cell therapies to regenerate heart muscle in patients who have had a heart attack or have chronic heart failure, as well as in patients with Parkinson’s diseases.

• BlueRock’s programs are in collaboration with Toronto-based McEwen Centre for Regenerative Medicine and University Health Network (UHN) and New York-based Memorial Sloan Kettering Cancer Center (MSKCC), and a manufacturing platform partnership with Toronto-based CCRM.

• The overall approach is focused on iPSC intellectual property invented by Nobel Prize winner Shinya Yamanaka of Kyoto University (Japan) and licensed from iPS Academia Japan.

Points: 29

Founded: 2016

Location: Atlanta, Ga.

Notable:

• Prelude Fertility was founded with a $200 million investment by entrepreneur Martin Varsavsky; the company’s business model is aimed at in vitro fertilization and egg freezing.

• Started with an investment in the largest in vitro fertilization clinic in the Southeast, Reproductive Biology Associates of Atlanta, and its affiliate, My Egg Bank, the largest frozen donor egg back in the U.S.

Points: 16

Founded: 2016

Location: Cambridge, Mass.

Notable:

• Relay launched in September 2016 with a $57 million Series A financing, led by Third Rock Ventures with participation from D.E. Shaw Research.

• On Dec. 14, 2017, Relay closed on a Series B round worth $63 million. The round was led by BVF Partners, with new investors GV (formerly Google Ventures), Casdin Capital, EcoR1 Capital and Section 32. Existing investors Third Rock Ventures and Alexandria Venture Investments participated.

• The company focuses on the relationship between protein motion and function.

Points: 15

Founded: 2016

Location: South San Francisco, Calif.

Notable:

• Closed a $65 million Series A round led by Andreessen Horowitz and joined by GV (Google Ventures), Polaris Partners, Charles River Ventures, Eric Schmidt’s Innovation Endeavors, Spectrum 28, and Asset Management Ventures. Previous investors included Data Collective and Founders Fund.

• Is utilizing an Adaptive Genomics Engine (AGE) to evaluate genetic health and diagnoses based on cell-free DNA data in the blood for early detective of cancer and other diseases.

• Working with the University of California, San Francisco, Moores Cancer Center at UC San Diego Health and Massachusetts General Hospital.

Points: 12

Founded: 2016

Location: San Diego, Calif.

Notable:

• Formerly known as Octeta Therapeutics, launched with a $40 million Series A in April 2017. A previous $16 million was raised by Octeta.

• Company’s lead product is MSDC-0602K, a second-generation insulin sensitizer to treat NASH, which is actively enrolling patients in a Phase IIb clinical trial for NASH and liver fibrosis.

Points: 11

Founded: 2017

Location: Durham, N.C.

Notable:

• Launched with a $10 million Series A that included Alexandria Venture Investments, ARCH Venture Partners, Bayer, Bill & Melinda Gates Foundation, Elanco Animal Health, Flagship Pioneering, Hatteras Venture Partners, Mountain Group Capital, Pappas Capital and Syngenta Ventures.

• The company is a small molecule development company that focuses on the unique chemical properties of Boron chemistry for crop protection and animal health, and fungicides.

Points: 11

Founded: 2017

Location:

Notable: Lexington, Mass.

• Launched in May 2017 with a $16 million Series A financing led by Canaan Partners with participation from Osage University Partners and Johnson & Johnson Innovation – JJDC.

• Utilizing technology licensed from Stanford University, Hyalex developed a synthetic biomaterial that can be used in knee joint replacement.

Points: 9

Founded: 2016

Location: Pleasanton, Calif.

Notable:

• CBT closed closed on a $9.75 million Series A financing in August 2016 led by Orbimed Asia, which along with $5 million in seed funding from its parent company, Crown Bioscience International, brings its operating capital to $14.75 million.

• The company has four development-stage assets, including CBT-101, an oral c-Met inhibitor that targets the epithelial to mesenchymal transition (IEMT) pathway in cancers.

• CBT’s CBT-501 began enrollment in a Phase I trial in March 2017 for solid tumors in the U.S.

• CBT-101 is in a Phase I clinical trial in China with its China partner, Beijing Pearl Biotechnology Co.

Points: 9

Founded: 2016

Location: Montreal-Quest, Que.

Notable:

• Corbin spun out of AmorChem in July 2017 with $1 million (Canadian) in seed funding.

• All rights to the USP15 technology initially held by AmorChem was transferred to Corbin.

• Corbin signed an exclusive, worldwide, license with McGill University on a USP15-based drug discovery platform in order to screen compound libraries and identify the first USP15 inhibitor for multiple sclerosis or other inflammation-based diseases.

Points: 8

Founded: 2017

Location: Cambridge, Mass.

Notable:

• Tango launched in March 2017 with a $55 million series A from Third Rock Ventures.

• The company has a product engine based on DNA sequencing and CRISPR-based target discovery, with three areas of drug development: loss of tumor suppressor gene function, multiple oncogenic drivers, and immune evasion.

Points: 8

Founded: 2016

Location: Aliston, Mass.

Notable:

• Founded by David Hysong after being diagnosed with adenoid cystic carcinoma (ACC) with former Genzyme senior vice president Gene Williams, to focus on rare cancers.

• Pipeline is in preclinical development in collaboration with the National Cancer Institute (NCI), University College London, and the Massachusetts Institute of Technology (MIT).

Points: 6

Founded: 2016

Location: Philadelphia, Penn.

Notable:

• Launched with an undisclosed amount of funding through Upstart within PCI Ventures at the University of Pennsylvania to commercialize new cellular therapies based on CAR-T.

• Financing was co-led by AbbVie Ventures and HealthCap with participation by Grazia Equity and IP Group.

Points: 5

Founded: 2017

Location: San Diego, Calif.

Notable:

• Launched with a $20 million Series A round by Versant Ventures to develop programs for non-alcoholic steatohepatitis (NASH) and fibrosis.

Points: 5

Founded: 2017

Locaion: St. Louis, Mo.

Notable:

• A $9 million venture funding in August 2017.

• Formed by the merger of Antegrin Therapeutics and Cascadian Therapeutics to focus on fibrosis.

Points: 4

Founded: 2016

Location: La Jolla, Calif.

Notable:

• Founded with an $18 million Series A in September 2016 led by Avalon Ventures and joined by Bregua, Lilly Asia Ventures, Osage University Partners, and Vivo Capital.

Points: 4

Founded: 2017

Location: South San Francisco, Calif.

Notable:

• Closed a $33 million Series A financing led by The Column Group in February 2017.

• One of the company’s founders, Roeland Nusse, the Virginia and Daniel K. Ludwig Professor of Cancer Research and Professor of Developmental BIology at Stanford University School of Medicine, won the 2017 Breakthrough Prize in Life Sciences for his work on the Wnt pathway.

Points: 3

Founded: 2016

Location: Palo Alto, Calif.

Notable:

• A Series A financing of $7 million in September 2016 by investors that include Fame Mount Limited and CLI Ventures.

• One of the company’s founders is Charlene Liao, former project team leader at Genentech.

Points: 3

Founded: 2017

Location: Toronto, Ont.

Notable:

• Founded in January 2017 by Evotech AG and MaRS Innovation with $2.1 million in financing to focus on fibrosis.

Points: 1

Founded: 2017

Location: Sunnyvale, Calif.

Notable:

• Raised $2.35 million in one round from Amino Capital, ShangBay Capital, Westlake Ventures, and individual investors.

• Co-founder is David Dongliang Ge, former president of BioSciKin and former director of Bioinformatics at Gilead Sciences.

• Focused on developing a bioinformatics-enabled nanotechnology aimed for early cancer detection.

Points: 1

Founded: 2015

Location: Seattle, Wash.

Notable:

• Raised $400,000 seed money from Ryan’s Quest, Michael’s Cause and Pietro’s Fight, to work on a potential treatment for Duchenne muscular dystrophy (DMD).

• Company’s lead candidate, DMD-813, has reduced inflammation and muscle damage in mice.

• Company was spun out of the University of Washington by biotech entrepreneur Ron Berenson.

Check out last year’s top 20 life science startups: NextGen Bio “Class of 2017.”

|