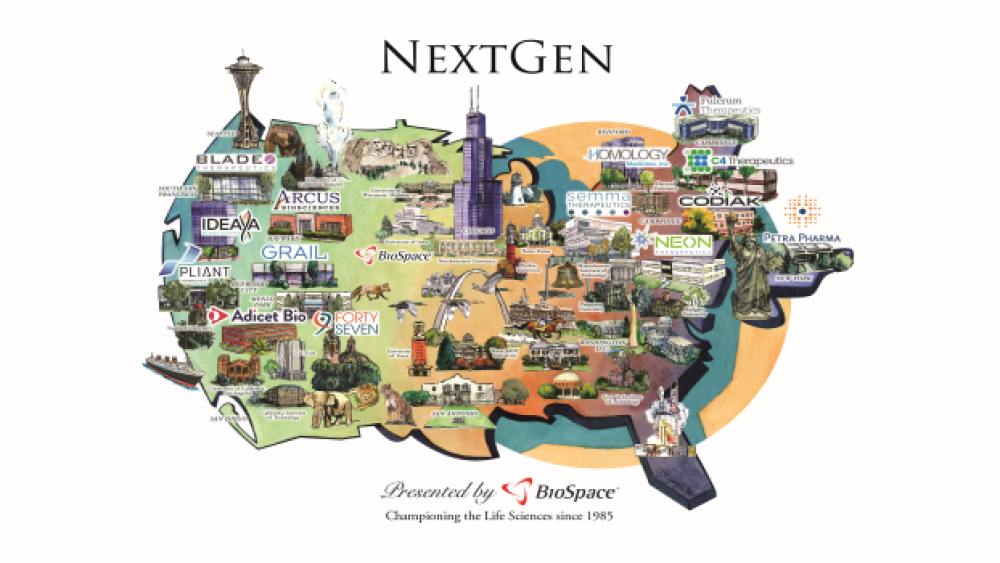

BioSpace is proud to present its NextGen “Class of 2017,” which is a list of 20 up-and-coming life science companies that launched no earlier than 2014.

BioSpace is proud to present its NextGen “Class of 2017,” which is a list of 20 up-and-coming life science companies that launched no earlier than 2014.

To come up with this Top 20, BioSpace sorted companies into that age grouping, and they were then weighted by a number of different categories and finally ranked in a cumulative fashion, based on the points awarded for each category. These categories were: Finance, Collaborations, Pipeline, Sales and Editorial (view methodology).

The NextGen Bio Class of 2017 is a stellar group of companies that are already making an enormous impact on the industry now and in the future. Congratulations!

In 2017, Massachusetts claimed nine companies in the Top 20 and regained the top spot. California slipped from the top spot on this list compared to last year with eight companies in the Top 20, followed by one company each in New York, North Carolina and Missouri.

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

1. Denali Therapeutics

Points:55

Founded:2015

Location: South San Francisco, Calif.

Notable:

• Raised $347 million in venture capital funding in two rounds from five investors.

• Filed in August in Europe to start a Phase I trial for a small molecule RIP1 inhibitor with CNS-penetrant properties.

• Acquired San Diego-based Incro Pharma to access its RIP1 inhibitor program.

• Signed a license deal with Genentech to develop and commercialize l LRRK2 inhibitors to treat Parkinson’s disease.

• Signed an R&D and licensing deal with Washington State University in St. Louis for antibodies for ApoE, linked to Alzheimer’s.

• Signed R&D deal with Blaze Bioscience.

• Agreed to other partnerships with ALS Therapy Development Institute, Aptuit, Evotech, Massachusetts General Hospital, The Michael J. Fo2x Foundation, PatientsLikeMe and the UC San Diego School of Medicine.

2. C4 Therapeutics

Points:20

Founded:2015

Location: Cambridge, Mass.

Notable:

• Raised Series A financing worth $73 million, from Cobro Ventures, joined by The Kraft Group, Cormorant Asset Management, EG Capital, Roche , Novartis and unidentified angel investors.

• Entered into a strategic collaboration deal with Roche in January to develop novel drugs in the field of targeted protein degradation (TPD). Potential value of the deal and milestone payments is more than $750 million.

• Working to develop a new class of TPD therapeutics for a broad range of diseases. Its Degronimid platform uses highly selective small molecule binders to target proteins linked to diseases, and facilitate their rapid destruction and clearance from the cell via the natural ubiquitin/proteasome system (UPS).

Points:19

Founded:2015

Location: Cambridge, Mass.

Notable:

• Launched in late 2015 with a $55 million Series A led by Third Rock Ventures and joined by Clal Biotechnology Industries and Access Industries.

• Signed license agreements with the Broad Institute, Dana-Farber Cancer Institute, and Massachusetts General Hospital.

• Entered a clinical trial collaboration with Bristol-Myers Squibb in December 2015 to evaluate NEO-PV-01 and Opdivo (nivolumab).

Sanquin for Peptide-MHC Assay Technology.

• Signed Collaborative Research Agreement with the Netherlands Cancer Institute.

• Starting a Phase Ib clinical trial for NEO-PV-0 with Opdivo this year.

4. Arcus Biosciences

Points:16

Founded:2015

Location: Hayward, Calif.

Notable:

• Has six compounds in its product pipeline in discovery or drug optimization.

• Launched with $120 million in two financings. First, it raised $30 million from its founders, and $39.7 million from The Column Group, Foresite Capital, Novartis and Celgene . Then it raised another $70 million, which was oversubscribed and expanded from $50 million to include new investors GV, Invus, Taiho Ventures, DROIA Oncology Ventures and Stanford University.

5. Forty Seven

Points: 16

Founded: 2016

Location: Menlo Park, Calif.

Notable:

• Completed the first half of a committed $75 million Series A round in February. Series A was led by Lightspeed Venture Partners and Sutter Hill Ventures with participation from Clarus Ventures and GV (formerly Google Ventures).

• Licensed the rights to multiple immune-oncology programs from Stanford University. The license includes rights to over 100 issued or pending U.S. or foreign patents that cover the antibody Hu5F9-G4 and several other novel immune checkpoint inhibitors and cancer-specific antibodies.

• Identifies lead molecule as Hu5F9-G4, a humanized monoclonal antibody against human CD47 that has possible applications in multiple tumor types.

• Has Hu5F9-G4 in two clinical studies, one in a liquid tumor for AML and another in an undisclosed solid tumor.

6. Semma Therapeutics

Points:16

Founded:2015

Location:Cambridge, Mass.

Notable:

• Launched in 2015 with $44 million Series A led by MPM Capital, along with Fidelity Biosciencs, ARCH Venture Partners and Medtronic .

• Entered an undisclosed agreement with Novartis focused on developing a cell therapy for Type 1 diabetes.

• Acquired in November by Providence, R.I.-based CytoSolv, which is focused on developing ways to suppress the immune system with stem cell technology.

• Joined an affiliation in June with The Harvard Stem Cell Institute (HSCI), Brigham and Women’s Hospital (BWH), the Joslin Diabetes Center, and the Dana-Farber Cancer Institute (DFCI) to establish the Boston Autologous Islet Replacement Program (BAIRT).

• Received a grant in September 2015 for $5 million from the California Institute of Regenerative Medicine (CIRM).

7. Petra Pharma Corporation

Points: 15

Founded: 2016

Location: New York, N.Y.

Notable:

• Launched with $48 Million Series A.

• Signed an alliance with Weill Cornell Medicine.

• Investing in the company are AbbVie , Alexandria Venture Investments, ARCH Venture Partners, Eli Lilly , Harris & Harris Group, Innovate NY Fund, J&J Innovation , The Partnership Fund for NYC, Pfizer Venture Investments, Watson Fund and WuXi PharmaTech .

8. GRAIL Bio

Points:14

Founded:2016

Location:Redwood, Calif.

Notable:

• Formed by Illumina , which is the majority owner.

• Launched with $100 million in venture capital in January 2016.

• Investing in the company are ARCH Venture Partners, Bezos Expeditions, Bill Gates and Sutter Hill Ventures.

• Will leverage the power of Illumina’s next-generation sequencing technology. The company focuses on using ultra-deep sequencing to detect circulating tumor DNA.

9. Blade Therapeutics

Points:13

Founded:2015

Location: South San Francisco, Calif.

Notable:

• Raised Series A investment of $6.5 million with six investors.

• Added $45 million in Series B financing led by Deerfield Management and joined by Pfizer Venture Investments, and joined by Novartis Institute for Biomedical Research and Bristol-Myers. Existing investors are MPM Capital and Osage University Partners.

• Partnered with the Scleroderma Research Foundation (SRF).

10. Tioma Therapeutics

Points:13

Founded:2015

Location: St. Louis, MO

Notable:

• Launched with $86 million in Series A financing co-led by RiverVest Venture Partners, Novo Ventures, Roche Venture Fund and SR One

• Focuses on immune-oncology therapies, especially anti-CD47 antibodies.

• Originally founded as Vasculox by William Frazier, professor of Biochemistry, Molecular Biophysics, Cell Biology and Biomedical Engineering at Washington University School of Medicine.

• Focuses on a portfolio of anti-CD48 antibodies.

11. Adicet

Points:11

Founded:2016

Location: Menlo Park, Calif.

Notable:

• Launched in January 2016 with $51 million Series A financing, led by OrbiMed and included Novartis Venture Fund and Pontifax.

• Announced in August a collaboration and licensing agreement with Regeneron , and received a $25 million upfront payment and research funding over a five-year research term.

12. Codiak Biosciences

Points:10

Founded:2015

Location: Woburn, Mass.

Notable:

• Raised $80+ million in Series A and B financing.

• Signed license and sponsored research agreements with The University of Texas MD Anderson Cancer Center in Houston.

13. Morphic Therapeutics

Points:9

Founded:2015

Location: Waltham, Mass.

Notable:

• Launched with a $51.5 million Series A financing round to advance multiple programs into the clinic. Co-led by SR One and Pfizer Venture Investments, joined by Omega Funds and AbbVie Ventures.

• Investing as founders were Polaris Partners, TA Springer and Schroedinger, with ShangPharma Investment Group.

• Has an exclusive tech program that includes proprietary reagents for assays and ultra-high resolution integrin crystal structures.

• Has a founding partnership with Schroedinger that facilitates the rapid and iterative design of development candidates.

14. Ideaya Biosciences

Points:9

Founded:2016

Location: South San Francisco, Calif.

Notable:

• Raised Series A investment round worth $46 million, which included 5AM Ventures, Canaan Partners, Celgene, WuXi Healthcare Ventures, Novartis Institute of Biomedical Research and Alexandria Real Estate.

15. Oncorus

Points:8

Founded:2015

Location:Cambridge, Mass.

Notable:

• Launched with a $57 million Series A financing round led by MPM Capital, and included Deerfield Management, Arkin Bio Ventures, Celgene, Excelyrate Capital, Long March Investment Fund and MPM’s SunStates Fund. In December 2016, Astellas Venture Management, the corporate venture arm of Astellas Pharma, provided Series A financing support, increasing the Series A to $61M.

• Focused on immune-oncology.

• Engineers miRNA binding sites into essential viral genes, so oHS replication and cellular destruction is prevented in healthy cells. Cancer cells lack these specific miRNAs, and Oncorus’ oHSV can replicate in and destroy them.

16. Decibel Therapeutics

Points:7

Founded:2015

Location: Cambridge, Mass.

Notable:

• Launched with a $52 million Series A financing led by Third Rock with participation from SR One.

• Will focus on therapeutics to slow or reverse hearing loss.

• Has identified one near-term clinical candidate and several other targets. It will also focus on pediatric cancer and CF patients who commonly experience hearing loss as a side effect of treatment, and other hearing-related problems.

17. Arrivo BioVentures

Points:7

Founded:2016

Location: Morrisville, NC

Notable:

• Launched with a preferred financing totaling $49 million in committed capital.

• Looking to source and acquire development candidates in or ready for the early stages of human clinical trials.

• Leading investors is Jazz Pharma with Solas BioVentures Fund I, Rex Health Ventures and private investors participating.

18. Fulcrum Therapeutics

Points:6

Founded:2016

Location: Cambridge, Mass.

Notable:

• Launched with $55 million in Series A financing to develop a cross-disciplinary product engine to identify and modulate gene regulatory targets core to disease.

19. Homology Medicines

Points: 6

Founded: 2015

Location: Lexington, Mass.

Notable:

• Launched with $43.5 million Series A preferred stock financing co-led by 5AM Ventures and ARCH Venture Partners. Additional investors included Temasek, Deerfield Management and ARCH Overage Fund. It was founded and incubated with a seed investment within the 4:50 Initiative, the company creation engine of 5AM Ventures.

• Signed a licensing agreement in September with Caltech for worldwide rights to a novel in vivo AAV technology, which it plans to combine with its own next-generation in vivo gene editing and gene transfer tech to develop treatments for CNS disorders, with an initial focus on rare indications.

20. Pliant Therapeutics

Points:5

Founded:2016

Location: Redwood City, Calif.

Notable:

• Launched with $45 million Series A by Third Rock Ventures.

• Has four products in its pipeline that are either in discovery or preclinical development.

|