News

Suppliers are investing in production to support deals with AstraZeneca, Bayer and other drugmakers that are advancing radioisotope-based cancer therapies.

FEATURED STORIES

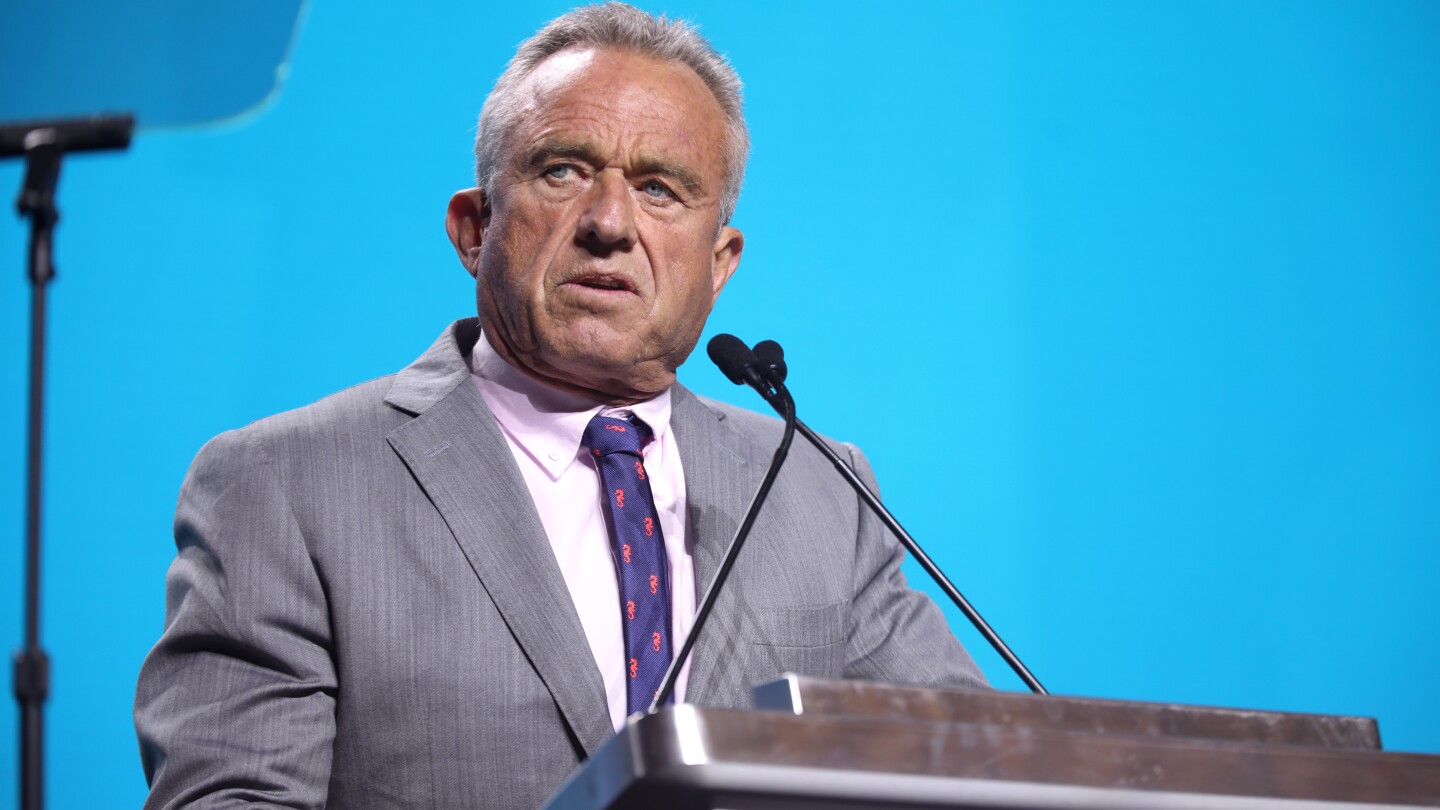

The current state of political affairs in the U.S. does not bode well for the direction of that turn. The country is at real risk of losing its long-held lead in biotech innovation.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

The rare disease drugmaker is facing potential competitors for achondroplasia drug Voxzogo. Is a big M&A deal with two approved assets enough to maintain investor interest?

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA issued a rare Refusal-to-File letter to Moderna over its mRNA-based influenza vaccine application, in an unusual move that sent the biotech’s shares tumbling.

THE LATEST

Roche’s Genentech is betting on the Flagship Pioneering–founded company’s discovery platform called DECODE to find new targets for an undisclosed autoimmune disorder.

The so-called ‘Most Favored Nations’ rule would set drug pricing for Medicare in line with the prices paid by other nations, where drugs can be much cheaper.

Analysts at BMO Capital Markets expect Summit and Akeso’s HARMONi-6 readout to put some pressure on Merck and its blockbuster biologic Keytruda.

Just raising the alarm won’t drive action. Use these three steps to turn insights into solutions that leadership can’t ignore.

Cobenfy’s late-stage flop is BMS’ second high-profile failure in as many weeks. The pharma announced last week that Camzyos was unable to improve disease burden in non-obstructive hypertrophic cardiomyopathy.

Bausch Health has launched a shareholder rights plan—also known as a poison pill defense—designed to prevent any one entity from taking control of the company to the detriment of other shareholders.

Such a change would put the U.S. more in line with guidance in other countries and with the World Health Organization, which recommends one dose for children and adolescents only if they have comorbidities.

In December 2024, the FDA affirmed that the shortage of tirzepatide, marketed as Zepbound for weight loss, had ended, formally barring compounders from producing their knockoff versions of the drug.

FDA Commissioner Marty Makary talks about his plans to revamp drug development and reduce ‘conflicts of interest’ between the agency and pharma industry; Roche and Regeneron jump on the U.S. manufacturing train as Trump’s tariffs loom; and Eli Lilly scores a big win for orforglipron while Novo Nordisk reveals it has applied for FDA approval of its oral semaglutide.

Executives don’t just get paid big bucks to operate a company. Sometimes they get paid millions to walk away.