News

The company plans to divest a drug it has made for 40 years, citing increasing production costs and falling prices.

FEATURED STORIES

Corsera Health’s Chief Operating Officer Rena Denoncourt and CFO Meredith Kaya speak with BioSpace about the biotech’s mission and vision for the next generation of cardiovascular care.

Billions of dollars’ worth of cancer drugs are discarded each year. Manufacturers must refund Medicare for some of this waste. A data-driven approach offers a practical path to greater efficiency.

Sales of Merck’s longtime oncology blockbuster Keytruda will erode more starkly in about 2033 rather than 2029, predicts Bloomberg Intelligence, translating to some $22 billion more in revenue.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

Following the FDA’s refusal to review Moderna’s investigational mRNA flu vaccine last week, Commissioner Marty Makary faced questions from the U.S. president about the agency’s handling of vaccines. It’s a clear signal that the tension long brewing at the drug regulator has now gone all the way to the top.

THE LATEST

The unsuccessful Phase III results are the latest to suggest that the blockbuster cancer drug is finally bumping up against its limits after racking up around 50 approvals since getting its first FDA nod in September 2014.

The San Diego–based company’s molecules avoid the well-trod GLP-1 pathway in favor of an alternate route in the gut.

The settlement is the largest deal to date with the people primarily who played an “instrumental role” in driving the opioid crisis, according to the office of Massachusetts Attorney General Andrea Joy Campbell.

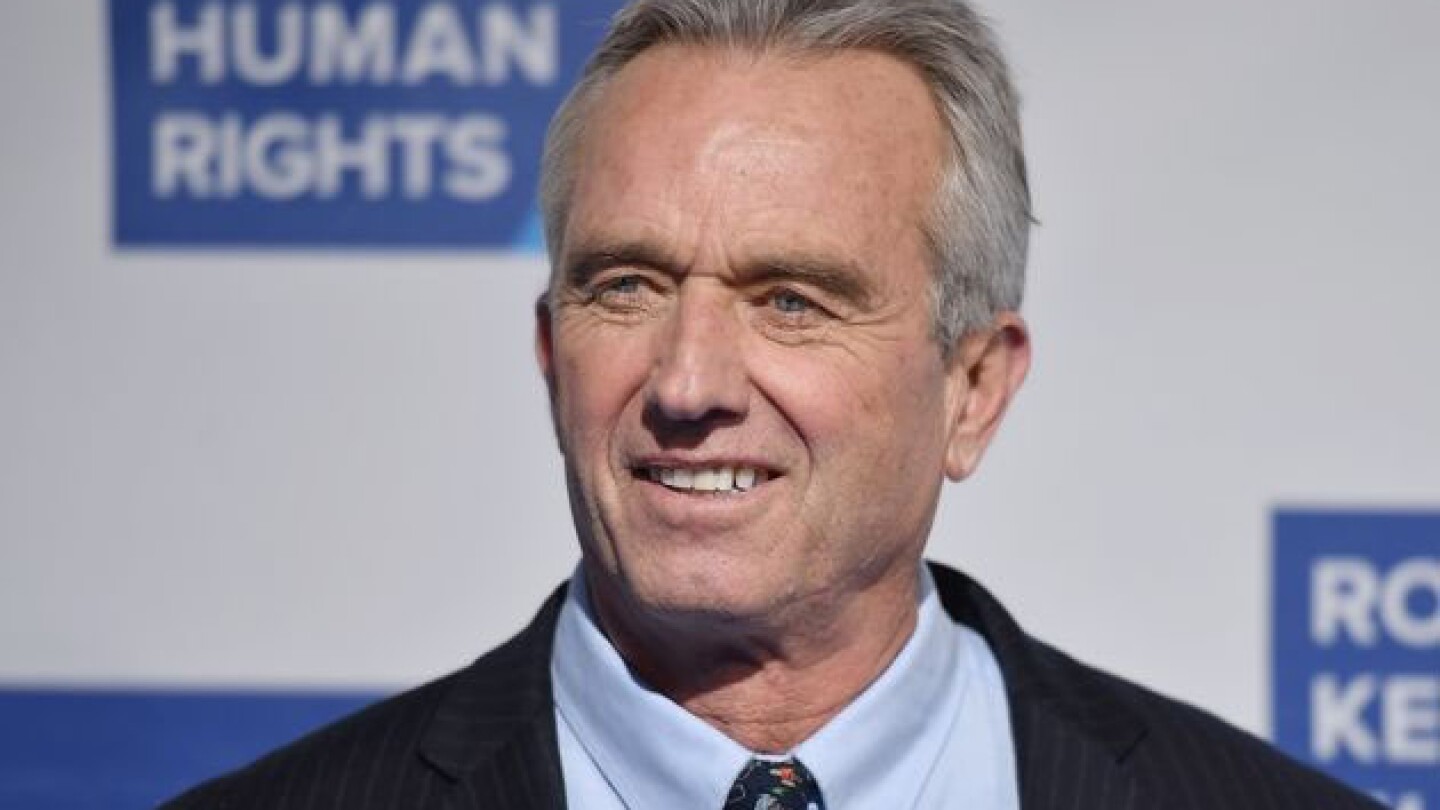

Robert F. Kennedy, Jr.’s recent disclosures have revealed several potential conflicts of interest, including investments in two biopharma companies.

Vigil Neuroscience reported a strong safety profile and 50% sTREM2 reduction in an early-stage trial for VG-3927, potentially representing a new avenue for treating Alzheimer’s disease.

Protein degradation–focused Neomorph nabs its third Big Pharma deal of around $1.5 billion in less than a year.

In a good-news-bad-news week for Biogen, the company will cut an undisclosed number of employees, just as a higher dose of its Ionis-partnered therapy Spinraza for spinal muscular atrophy will be considered by the FDA and EMA.

Looking for a biopharma job in New Jersey? Check out the BioSpace list of eight companies hiring life sciences professionals like you.

M&As are stressful for multiple reasons, including role changes and getting laid off when staffs combine. Two talent experts share tips for navigating the transition period of your company’s merger or acquisition.

Turn your career aspirations into reality with this step-by-step guide to creating and implementing a strategic professional development plan for 2025.