News

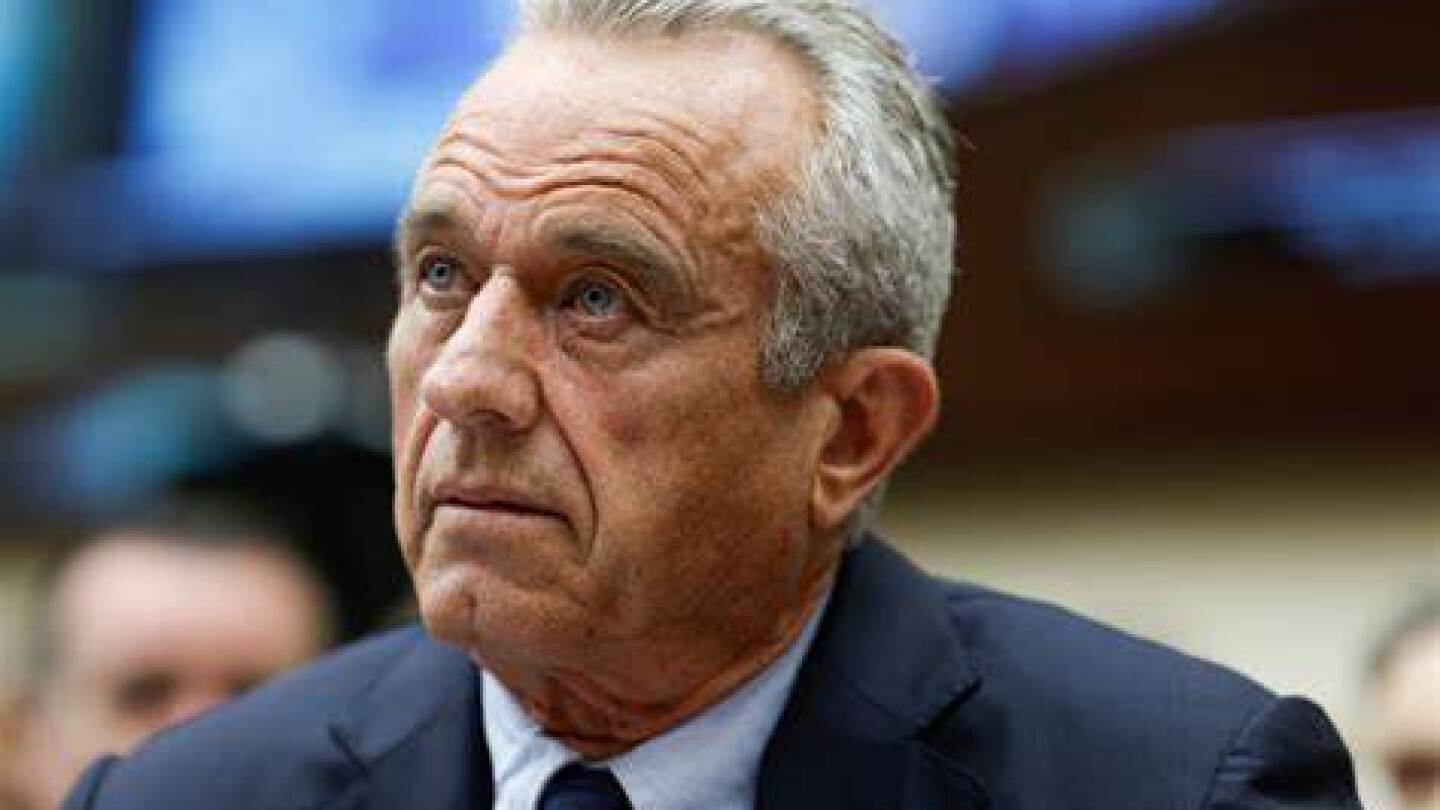

Following the FDA’s refusal to review Moderna’s investigational mRNA flu vaccine last week, Commissioner Marty Makary faced questions from the U.S. president about the agency’s handling of vaccines. It’s a clear signal that the tension long brewing at the drug regulator has now gone all the way to the top.

FEATURED STORIES

Many scientists-turned-CEOs paradoxically abandon scientific principles when it comes to commercializing their innovations. But applying the scientific method to business decisions can help life science entrepreneurs avoid common pitfalls, attract investment and ultimately bring transformative technologies to market.

FDA vouchers are normally a coveted prize for biopharma companies, but a surprise rejection for Disc Medicine’s rare disease drug has biopharma reconsidering.

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

The Platform Technology Designation, which predates the current FDA leadership, is designed to streamline the drug development and review process, particularly for rare diseases.

The lawsuit alleges that HHS leadership knew the records they used to guide their layoff decisions were inaccurate and contained errors.

Genrix’s velinotamig complements Cullinan’s own pipeline, according to William Blair, which added that the deal will put Cullinan in a better position to target autoimmune diseases.

Massachusetts’ life sciences jobs grew by just 0.03% in 2024, according to a new MassBioEd report. Still, the report found encouraging signs for the industry, noting it’s expected to grow by 11.6% by 2029, adding an estimated 16,633 net new positions.

Disappointing results for iluzanebart come shortly after Vigil Neuroscience struck a buy-out deal with Sanofi, but analysts say the outcome is unsurprising and shouldn’t affect the deal.

Eli Lilly joins up with Camurus to make long-acting versions of the pharma’s obesity and diabetes drugs, joining the industry’s growing pipeline of programs that are differentiated by the frequency of dosing.

The FDA plans to “rapidly make available” rare disease drugs and make use of surrogate endpoints to get promising medicines to patients before they clear the traditional efficacy bar for authorization, Prasad said Tuesday.

Recent decisions to reduce health and science research funding and limit the participation of international students and researchers could prove damaging in the short and long term.

Sanofi and BMS paid big money for rare disease and cancer assets, while Regeneron got in the obesity game; AstraZeneca, Gilead and Amgen shone at ASCO; RFK Jr. and the CDC appeared to disagree over COVID-19 vaccine recommendations and several news outlets are questioning the validity of the White House’s Make America Healthy Again report.

J&J has a multi-year head start, but Gilead believes it can win market share by delivering a drug with better safety and at least as good efficacy.