Business

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

FEATURED STORIES

The rare disease drugmaker is facing potential competitors for achondroplasia drug Voxzogo. Is a big M&A deal with two approved assets enough to maintain investor interest?

A rapturous response to data published last year for Pelage’s hair loss candidate overwhelmed the biotech. Now, the company is ready to show the world the science behind the breakthrough.

Pfizer, Eli Lilly, Novartis, Bristol Myers Squibb and AstraZeneca are all ramping up the use of AI, but drug discovery is not the primary success story—yet.

Subscribe to BioPharm Executive

Market insights and trending stories for biopharma leaders, in your inbox every Wednesday

THE LATEST

Artificial intelligence is making it faster to get drug candidates to the clinic, but to gain a competitive advantage, companies must have a strong foundation of data.

Investment in the development of new antimicrobials is falling rapidly, even as the global public health threat of antimicrobial resistance is growing increasingly severe worldwide.

The pharma giant announced Tuesday that Mikael Dolsten is leaving his role as chief science officer after more than 15 years. Pfizer is conducting an external search for a replacement with Dolsten staying on to assist in finding his replacement over next several months.

As Novo Nordisk’s weight loss drug enters the Chinese market, its patent is expiring in two years and biosimilar competition is rising.

The blood plasma pharma is considering a buyout offer from the founding family and asset manager Brookfield, which would delist the company from the Spanish and Nasdaq markets.

Eli Lilly on Monday announced a $3.2 billion all-cash deal to purchase Morphic and its pipeline of oral integrin therapies in a move to expand the pharma’s presence in the autoimmune diseases space.

Despite an uncertain legislative path to becoming law, the BIOSECURE Act has already impacted the biopharma industry’s confidence in Chinese service providers and prompted efforts to diversify manufacturing partners.

Moderna on Tuesday announced it has been awarded $176 million by a consortium funded by the Biomedical Advanced Research and Development Authority to develop an mRNA-based vaccine to counter H5N1 avian influenza.

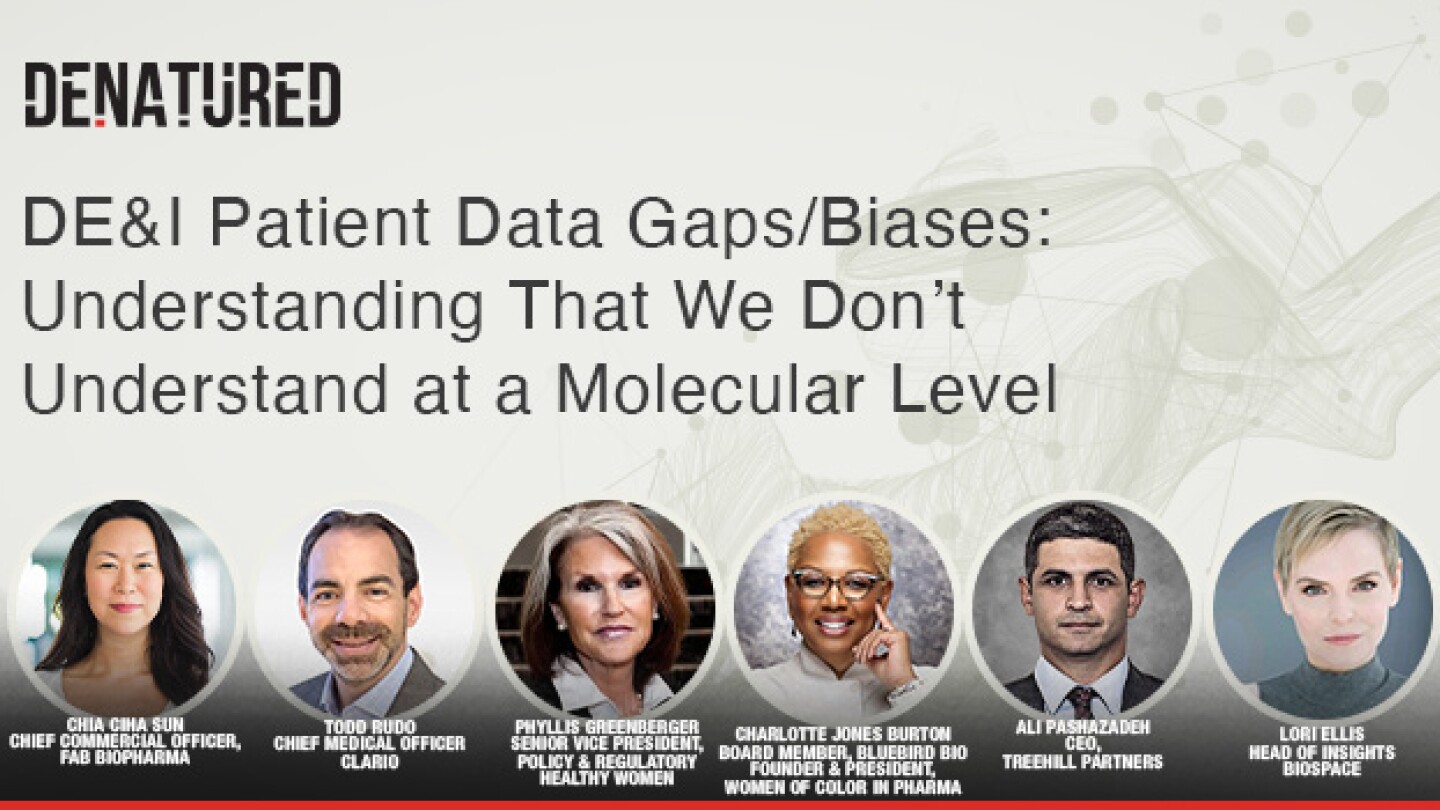

This week on Denatured, Head of Insights Lori Ellis and guests discuss the implications of not addressing the DE&I data gaps for the future.

Daiichi Sankyo has secured a victory in its patent arbitration with Seagen, nabbing a $47 million award for attorneys’ fees and other costs, plus interest. However, a larger patent battle with Pfizer remains.