News

The disagreement between Moderna and the FDA has reached a resolution just eight days after the biotech received a Refusal-to-File letter in response to its application for mRNA-1010. Moderna will now seek approval of the vaccine based on age.

FEATURED STORIES

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

Regulatory uncertainty is no longer background noise. It is a material investment risk that reshapes how capital is deployed and pipelines are prioritized.

Long an R&D company that partnered off assets, RNAi biotech Ionis Pharmaceuticals shifted in 2025 to bring two medicines to market alone. Analysts are already impressed—and there’s more to come in 2026.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

The failure in adjuvant melanoma could cause BMS and Opdualag to miss out on a market opportunity that is nearly twice as large as its current approved indication, according to analysts.

Amgen will continue to advance half of the combo, PRMT5 inhibitor AMG 193, for which it is running a mid-stage trial in MTAP-null advanced non-small cell lung cancer.

The experts will assess unblinded data from BEACON-IPF to figure out why a data safety monitoring board recommended suspension of the idiopathic pulmonary fibrosis trial.

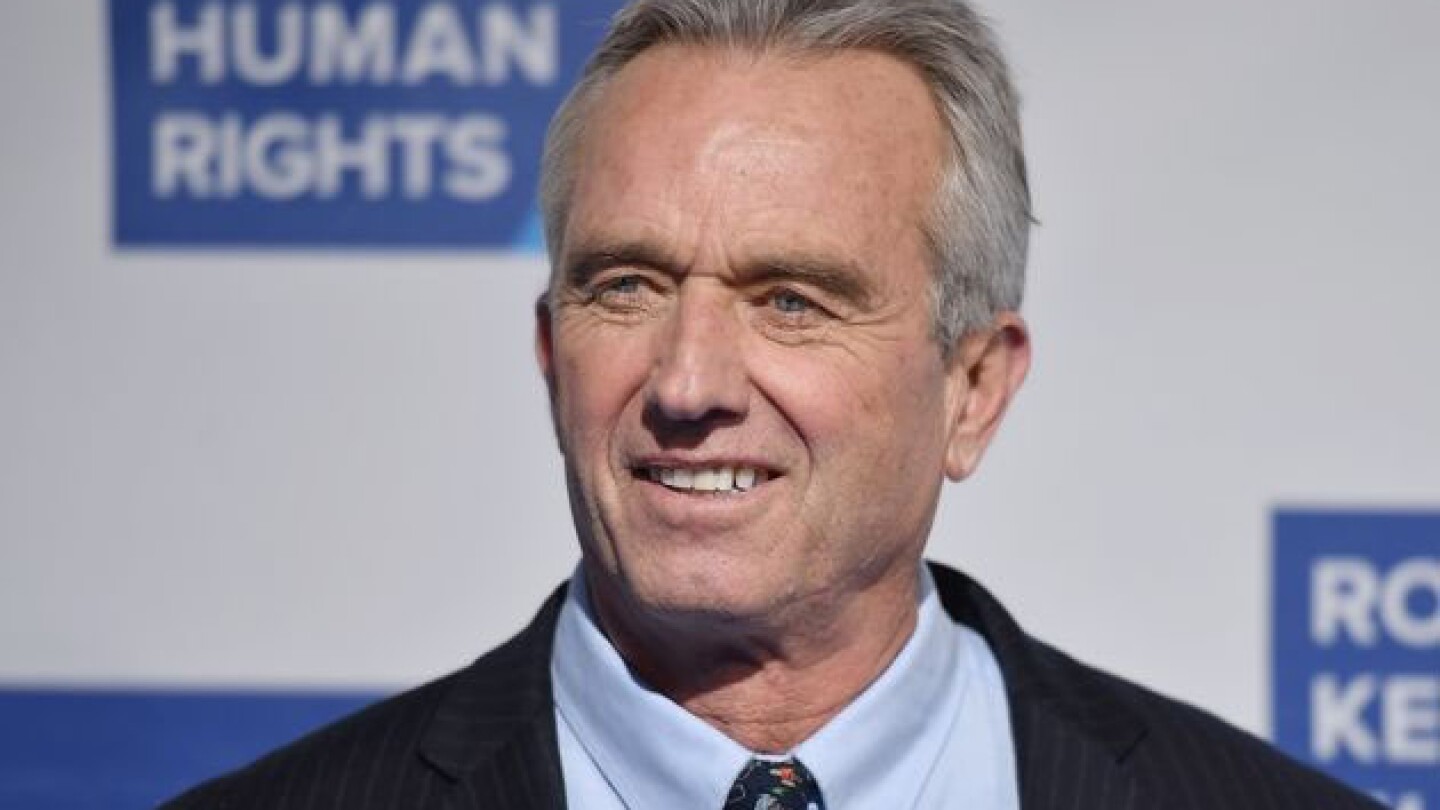

Robert F. Kennedy Jr.—whose history of anti-vaccine rhetoric has had the healthcare and biopharma industries on edge—was confirmed as Health and Human Services Secretary in a Senate vote along party lines.

Encoded’s layoffs will mostly affect its technology and early-stage research and development functions. The move is expected to keep the biotech operational well into 2026.

Obesity drug developers Aardvark, Helicore and Metsera have all netted raises in the past two weeks.

Without providing specific data, Sanofi on Thursday announced that the experimental vaccine did not significantly prevent invasive E. coli disease versus placebo.

In this episode, presented by the Genscript Biotech Global Forum 2025, BioSpace’s Head of Insights Lori Ellis and Tom Whitehead continue to discuss the patient and caregiver experience, where Tom gives his insights to the future of CGTs.

The data, published in JAMA Psychiatry, add to the growing body of evidence supporting the use of GLP-1 receptor agonists for addictive disorders.

Evrysdi is the first, and so far only, noninvasive disease-modifying treatment for spinal muscular atrophy.