News

In this episode of Denatured, you’ll be listening to Jane Hughes, President of R&D and Co-founder of Verdiva Bio, and Jon Rees, CEO and Co-founder of MitoRx Therapeutics. We’ll discuss next-generation obesity solutions tackling GLP-1’s muscle loss and adherence challenges, through innovative muscle preservation, oral administration and combination therapy.

FEATURED STORIES

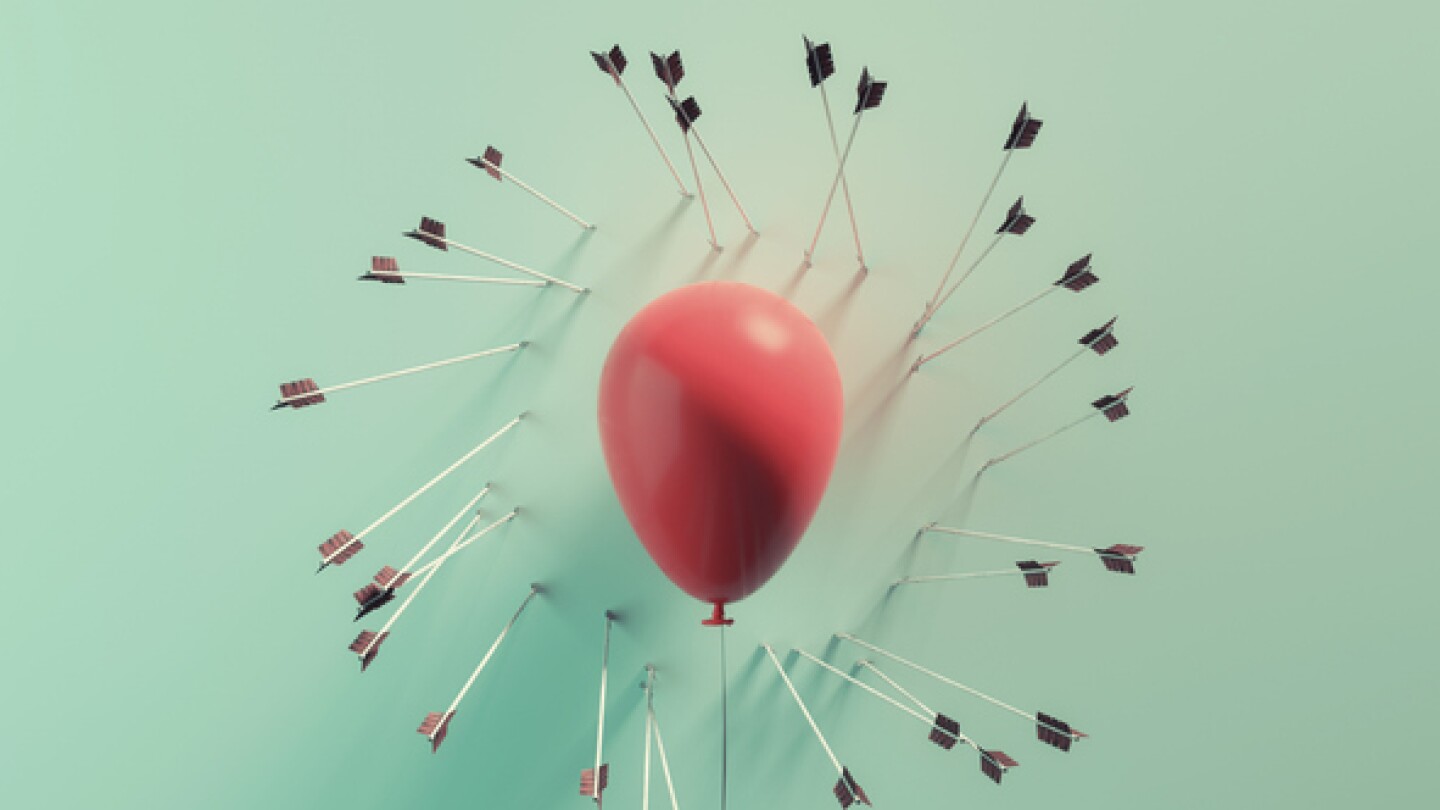

Many scientists-turned-CEOs paradoxically abandon scientific principles when it comes to commercializing their innovations. But applying the scientific method to business decisions can help life science entrepreneurs avoid common pitfalls, attract investment and ultimately bring transformative technologies to market.

FDA vouchers are normally a coveted prize for biopharma companies, but a surprise rejection for Disc Medicine’s rare disease drug has biopharma reconsidering.

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

A report from analysts at Jefferies suggested that new screenings for metachromatic leukodystrophy and Duchenne muscular dystrophy could bump sales of the gene therapy Libmeldy by more than $100 million.

BioMarin Pharmaceutical has faced a rocky road, promising and then backing off revenue targets and cutting assets that have underperformed. But Amicus’ rare disease portfolio is already bringing in $600 million annually.

After 27 years in business, Cytokinetics hopes to pit its own cardiac myosin inhibitor against one it initially developed—now owned by Bristol Myers Squibb—in a market worth billions. Aficamten has a PDUFA date of Dec. 26.

Insmed pointed to a strong placebo response as the reason for the trial’s failure.

With zasocitinib, Takeda is looking to challenge Bristol Myers Squibb’s kinase inhibitor Sotyktu, for which the Japanese pharma is running a head-to-head study in plaque psoriasis. Takeda expects to file for zasocitinib’s FDA approval next year.

The filing comes as Novo fights tooth-and-nail with rival Lilly to regain its footing at the top of the weight loss market.

In this episode of Denatured, Jennifer Smith-Parker speaks to Kenneth Galbraith, CEO of Zymeworks and Josh Smiley, president and COO of Zai Lab, about how renewed confidence is driving biotech entering 2026.

The money replaces a small portion of a contract Moderna lost when the Department of Health and Human Services canceled $760 million in backing to develop the vaccine, called mRNA-1018.

Participants in a Phase III trial who switched to Eli Lilly’s orforglipron after 72 weeks of treatment with Wegovy or Zepbound largely maintained their weight loss for up to a year.

The tickets could go to the lipid-lowering pill enlicitide decanoate and the antibody-drug conjugate sacituzumab tirumotecan, though a spokesperson for the HHS did not confirm the news.