News

FEATURED STORIES

Competing with giants like Takeda and Moderna, the plucky biotech believes it has unlocked a future with an easy, yearly oral vaccine.

The limited supply of this common reagent is set to drive drug prices higher, but there are ways for companies to lessen the impact.

Suppliers are investing in production to support deals with AstraZeneca, Bayer and other drugmakers that are advancing radioisotope-based cancer therapies.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

While the former Biden administration showcased the Inflation Reduction Act as a key victory in the fight over high drug prices in the U.S., Trump has so far been mum on how the controversial law could evolve in the coming years.

Fractyl Health is deprioritizing a type 2 diabetes trial in favor of a pivotal study of its endoscopy treatment Revita and parting with around 22 employees in an attempt to extend its runway into 2026.

Biogen’s effort to buy Sage against the board’s wishes and a long-time effort by investor Alcorn to scuttle Aurion’s IPO underscore the cutthroat nature of biopharma dealmaking.

The approval of Axsome Therapeutics’ Symbravo for migraine with or without aura came alongside the greenlight for Vertex’s non-opioid treatment Journavx.

Novartis was among the most prolific pharma dealmakers in 2024, a trend that it expects to continue with more bolt-on deals this year to set up for sustainable long-term growth.

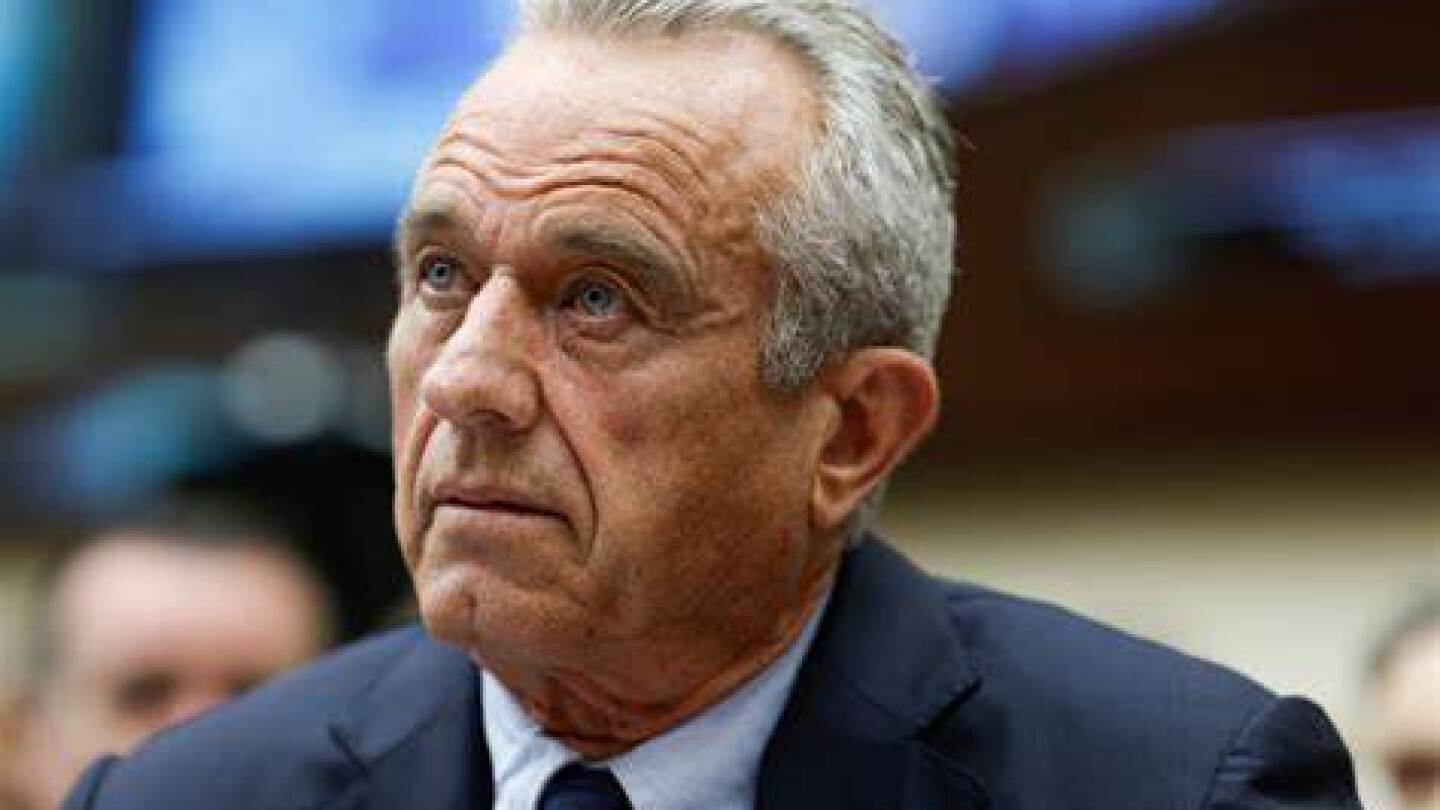

Senators on the Health, Education, Labor and Pensions committee were critical of Kennedy’s long history as an anti-vaccine campaigner.

Blackstone joins other big investors such as ARCH Venture Partners and Bain Capital Life Sciences in pumping billions of dollars into the industry.

The greenlight for Journavx (suzetrigine), which comes on the heels of a $7.4 billion opioid settlement, could spark momentum in the fledgling non-opioid pain space.

Analysts were unfazed by the news that Takeda will cease development of soticlestat after Phase III failures, while responding positively to the announcement that Julie Kim will take the helm of the Japanese giant in 2026.

CAR T–focused biotech Cargo Therapeutics surprised and disappointed analysts when it announced that it would discontinue a mid-stage trial of its lead program, firi-cel.