News

Jay Bhattacharya will become the latest leader of the CDC on an acting basis, days after Jim O’Neill stepped aside.

FEATURED STORIES

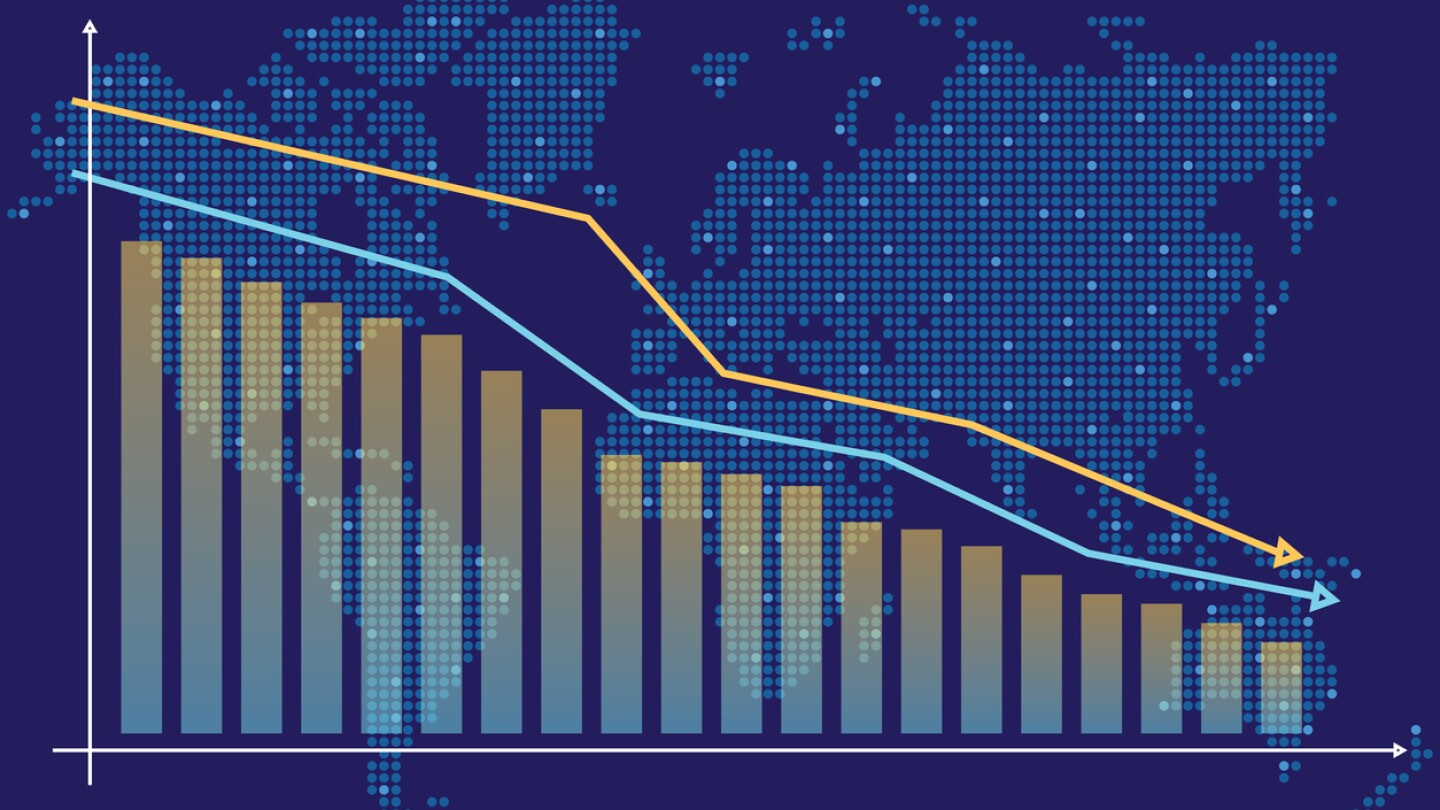

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

Long an R&D company that partnered off assets, RNAi biotech Ionis Pharmaceuticals shifted in 2025 to bring two medicines to market alone. Analysts are already impressed—and there’s more to come in 2026.

Regulatory uncertainty is no longer background noise. It is a material investment risk that reshapes how capital is deployed and pipelines are prioritized.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

Calico will leverage 9MW3811’s anti-inflammatory mechanism to advance its mission of addressing aging-related diseases.

While ALTO-203 missed its depression-related endpoints, improvements in EEG biomarkers, attention and wakefulness point to signals of drug activity, William Blair said, though the analysts pointed to other indications as potentially more promising for future development.

In the race to make the most tolerable obesity drug, there seems to be no clear winner—at least not according to analysts parsing the data presented at the American Diabetes Association annual meeting this week.

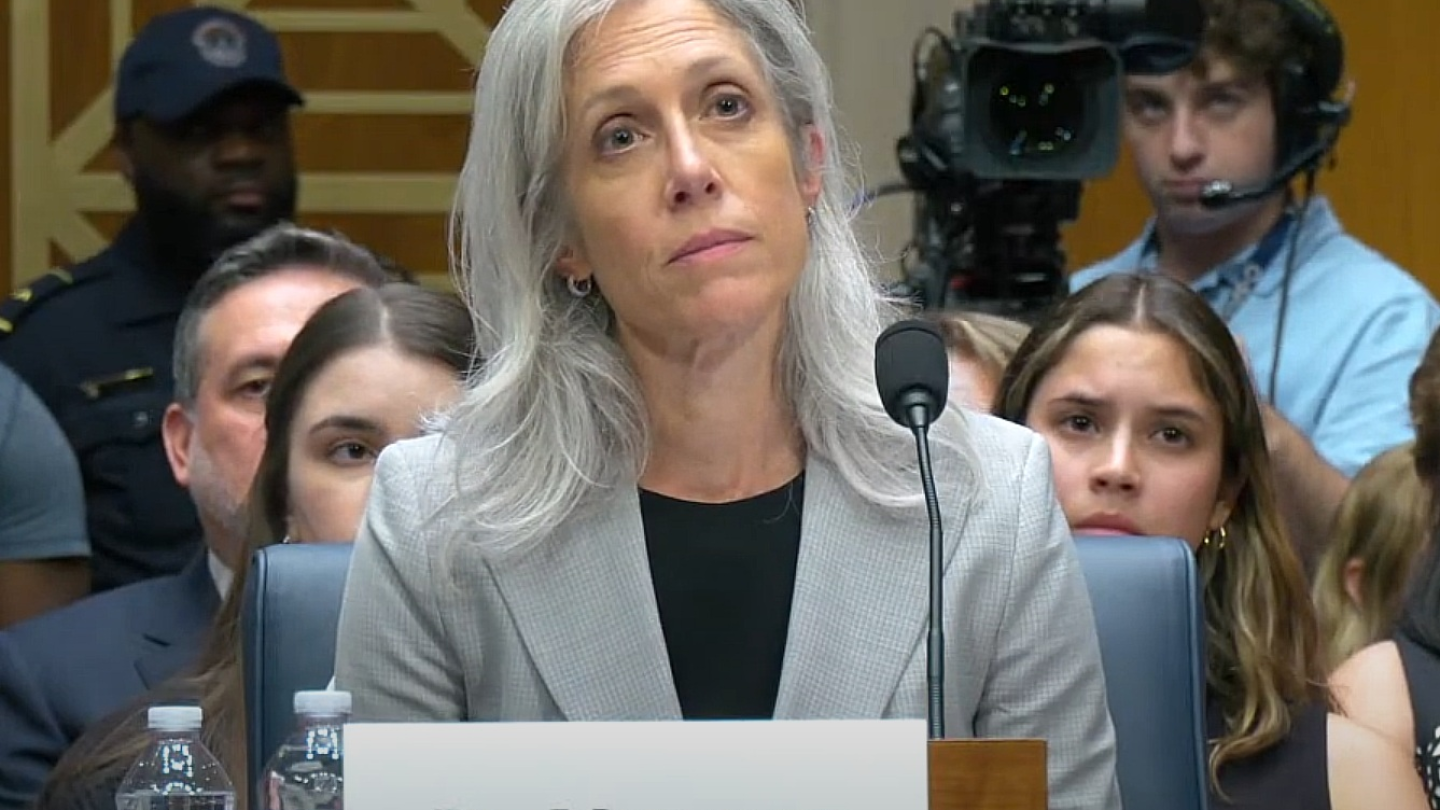

Susan Monarez, already acting director of the CDC, said during her confirmation hearing that she sees no causal link between vaccines and autism.

Jefferies analysts called the proxy filing, which is a standard disclosure after a merger agreement, “much more intriguing than normal” given the regulatory turmoil it revealed.

Minovia’s lead product is MNV-201, an autologous hematopoietic stem cell product that is enriched with allogeneic mitochondria.

Flagship Pioneering’s ProFound Therapeutics will use its proprietary technology to mine the expanded proteome for novel cardiovascular therapeutics. Novartis has promised to pay up to $750 million per target, though it has not specified how many targets it will go after.

Without providing further context, HHS Secretary Robert F. Kennedy Jr. says that Gavi needs to “start taking vaccine safety seriously” by considering “the best science available.”

Peter Marks, who headed the FDA’s Center for Biologics Evaluation and Research before being forced to resign in March, said the agency’s new risk-based COVID-19 vaccine framework contradicts the current administration’s push for transparency and gold-standard science.

Given today’s available local talent pool, biopharma companies are less likely to turn toward international job candidates, according to a talent acquisition expert. Findings from two recent BioSpace LinkedIn polls underscore the issue.