News

Following the FDA’s refusal to review Moderna’s investigational mRNA flu vaccine last week, Commissioner Marty Makary faced questions from the U.S. president about the agency’s handling of vaccines. It’s a clear signal that the tension long brewing at the drug regulator has now gone all the way to the top.

FEATURED STORIES

Many scientists-turned-CEOs paradoxically abandon scientific principles when it comes to commercializing their innovations. But applying the scientific method to business decisions can help life science entrepreneurs avoid common pitfalls, attract investment and ultimately bring transformative technologies to market.

FDA vouchers are normally a coveted prize for biopharma companies, but a surprise rejection for Disc Medicine’s rare disease drug has biopharma reconsidering.

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

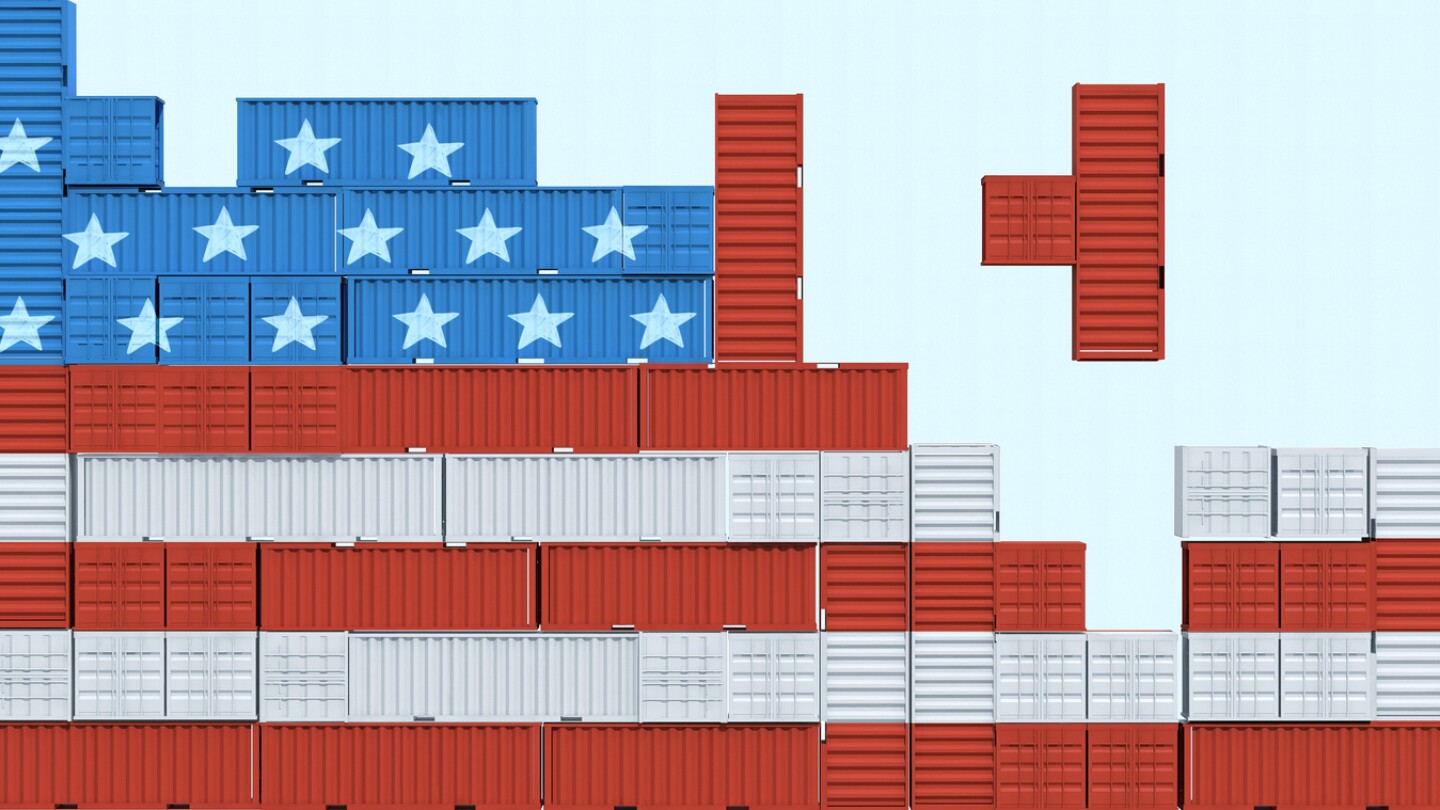

Biotech was starting to show signs of recovery after years of investor pullback—until new tariffs and economic uncertainty sent fresh shockwaves through an already fragile market.

Paul Stoffels left his perch as J&J’s chief scientific officer in 2022 to replace Galapagos’ founding CEO Onno van de Stolpe, inheriting a company that had suffered a series of clinical failures since its 1999 creation.

Alnylam and BridgeBio are competing for people who are switching from Pfizer’s blockbuster ATTR amyloidosis drug tafamidis while all three companies are fighting for new patients.

Roche is committing $50 billion while Regeneron inked a $3 billion manufacturing deal with Fujifilm, allowing the pharma to “nearly double” its U.S. large-scale manufacturing capacity.

Combining Trodelvy with Keytruda and pushing it into the frontline setting could “potentially double” the ADC’s market in metastatic triple-negative breast cancer, according to analysts at Truist Securities.

Analysts at Leerink Partners said in a Monday note that DESTINY-Breast09’s findings “could support an approval” for Enhertu in first-line HER2+ metastatic breast cancer.

Novo Nordisk filed for approval of an oral, 25-mg formulation of its weight loss blockbuster “earlier this year,” according to a company spokesperson.

FDA Commissioner Marty Makary last week announced a directive that would limit industry participation in the agency’s advisory committees. But not only do company reps serve only as non-voting members, a 1997 law actually requires industry involvement.

California-based Tempest Therapeutics is laying off 21 of its 26 full-time employees. The cuts come while the biotech is exploring strategic alternatives, including a merger or acquisition, as it tries to move its investigational PPARα antagonist into late-stage development.

Disruptive conditions are typical in non-Western markets. The U.S. industry, thrown into a period of significant change as the Trump administration overhauls HHS and considers implementing tariffs, could learn a thing or two by looking overseas.