News

The company plans to divest a drug it has made for 40 years, citing increasing production costs and falling prices.

FEATURED STORIES

Corsera Health’s Chief Operating Officer Rena Denoncourt and CFO Meredith Kaya speak with BioSpace about the biotech’s mission and vision for the next generation of cardiovascular care.

Billions of dollars’ worth of cancer drugs are discarded each year. Manufacturers must refund Medicare for some of this waste. A data-driven approach offers a practical path to greater efficiency.

Sales of Merck’s longtime oncology blockbuster Keytruda will erode more starkly in about 2033 rather than 2029, predicts Bloomberg Intelligence, translating to some $22 billion more in revenue.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

Following the FDA’s refusal to review Moderna’s investigational mRNA flu vaccine last week, Commissioner Marty Makary faced questions from the U.S. president about the agency’s handling of vaccines. It’s a clear signal that the tension long brewing at the drug regulator has now gone all the way to the top.

THE LATEST

While some analysts forecast the tariffs could mean billions in additional industry expenditure, others expect the overall impact to be “manageable.”

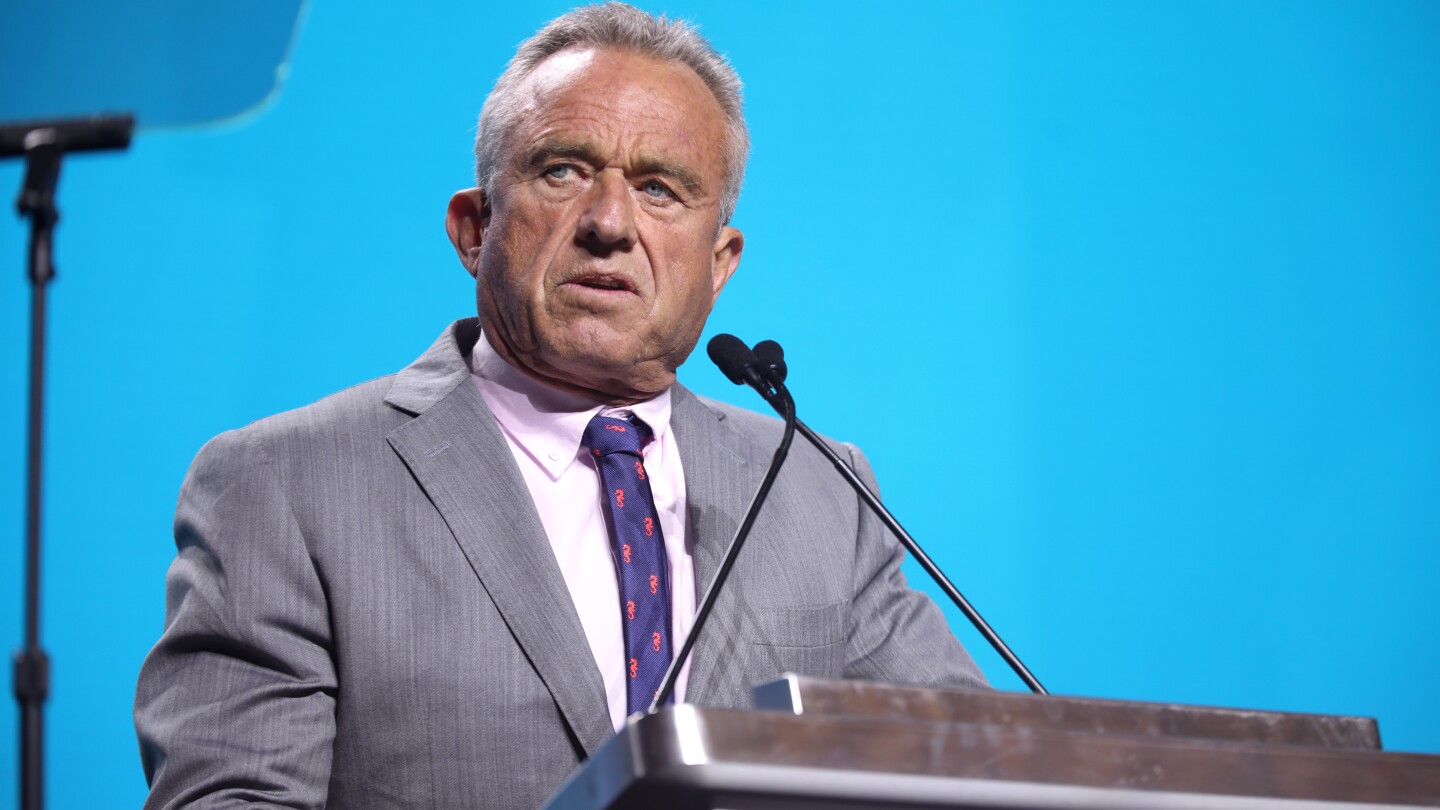

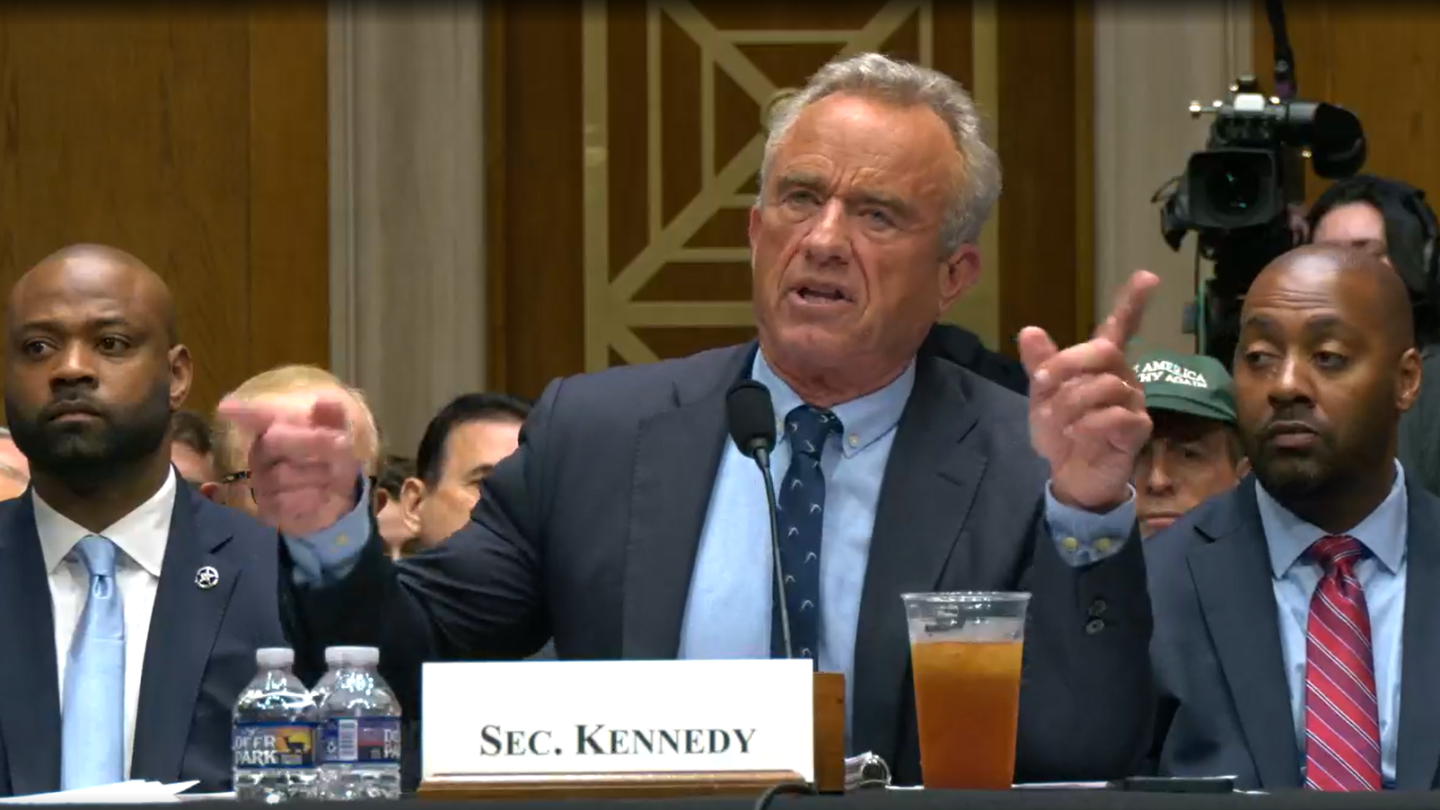

In a post on X, Health Secretary Robert F. Kennedy Jr. alleged that the Vaccine Injury Compensation Program has “devolved into a morass of inefficiency, favoritism, and outright corruption.”

BMS is spinning out a new company with five immunology assets, including oral drugs being developed for systemic lupus erythematosus and plaque psoriasis, and $300 million in funds from Bain Capital.

The swift FDA action removes an overhang from Sarepta and allows Elevidys to return to the market without another safety study, as had been feared, Jefferies analysts said Monday.

In a Phase Ib/IIa trial, 91% of patients receiving the highest dose of trontinemab were amyloid negative after seven months of treatment, representing what B. Riley Securities called a “paradigm shift” to first-generation FDA-approved antibodies.

The German giant is looking to develop new drugs for undisclosed eye diseases using Re-Vana’s extended-release injectable platform to supply drugs to the eye for months at a time.

The star of GSK’s Hengrui partnership is the COPD candidate HRS-9821, which will complement the pharma’s respiratory pipeline that’s anchored by the anti-asthma drug Nucala.

Health Secretary Robert F. Kennedy Jr. wants to remove all members of the USPSTF for being too “woke,” according to reporting by the Wall Street Journal. An HHS spokesperson, however, says no final decision has been made about the panel.

Brazilian authorities said the death was unlikely to have been caused by Elevidys and was instead more in line with severe infection exacerbated by immunosuppression.

Despite the failure of its Recognify-partnered inidascamine, Jefferies analysts do not expect a definitively negative stock impact on atai, given the company’s promising psychedelic pipeline.