News

The company plans to divest a drug it has made for 40 years, citing increasing production costs and falling prices.

FEATURED STORIES

Corsera Health’s Chief Operating Officer Rena Denoncourt and CFO Meredith Kaya speak with BioSpace about the biotech’s mission and vision for the next generation of cardiovascular care.

Billions of dollars’ worth of cancer drugs are discarded each year. Manufacturers must refund Medicare for some of this waste. A data-driven approach offers a practical path to greater efficiency.

Sales of Merck’s longtime oncology blockbuster Keytruda will erode more starkly in about 2033 rather than 2029, predicts Bloomberg Intelligence, translating to some $22 billion more in revenue.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

Following the FDA’s refusal to review Moderna’s investigational mRNA flu vaccine last week, Commissioner Marty Makary faced questions from the U.S. president about the agency’s handling of vaccines. It’s a clear signal that the tension long brewing at the drug regulator has now gone all the way to the top.

THE LATEST

The high court found that members of a task force that determines what preventive drugs must be covered can be removed at will by HHS Secretary Robert F. Kennedy Jr.

The revamped and “more anti-vax skewed ACIP committee” at the CDC “has a bone to pick with mRNA vaccines,” according to Truist Securities analysts. Meanwhile, the FDA moves forward on having Pfizer/BioNTech and Moderna update labels for their COVID vaccines.

The FDA found that data from a single Phase II study were “insufficient” to justify an accelerated approval review for sevasemten in Becker muscular dystrophy.

Altimmune’s pemvidutide failed to significantly improve fibrosis in MASH patients in a Phase IIb study. The biotech crashed 53% in the aftermath of the readout.

Calico will leverage 9MW3811’s anti-inflammatory mechanism to advance its mission of addressing aging-related diseases.

While ALTO-203 missed its depression-related endpoints, improvements in EEG biomarkers, attention and wakefulness point to signals of drug activity, William Blair said, though the analysts pointed to other indications as potentially more promising for future development.

In the race to make the most tolerable obesity drug, there seems to be no clear winner—at least not according to analysts parsing the data presented at the American Diabetes Association annual meeting this week.

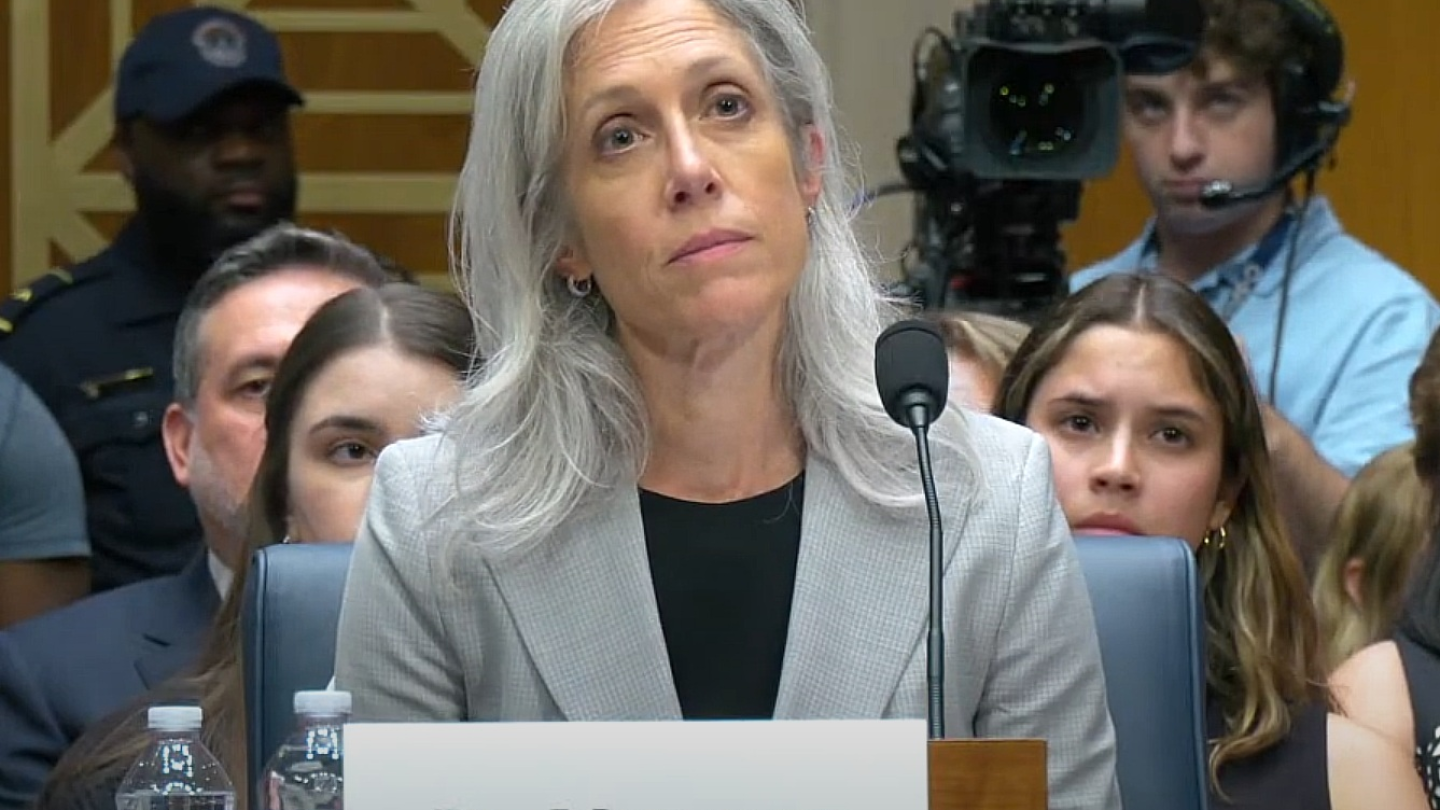

Susan Monarez, already acting director of the CDC, said during her confirmation hearing that she sees no causal link between vaccines and autism.

Jefferies analysts called the proxy filing, which is a standard disclosure after a merger agreement, “much more intriguing than normal” given the regulatory turmoil it revealed.

Minovia’s lead product is MNV-201, an autologous hematopoietic stem cell product that is enriched with allogeneic mitochondria.