News

The framework, first introduced by FDA Commissioner Marty Makary and Center for Biologics Evaluation and Research head Vinay Prasad in November, was criticized for lacking detailed guidance. Agency leaders elucidated on the pathway for personalized medicines on Monday.

FEATURED STORIES

The first gene therapies approved to treat sickle cell disease in December 2023 are struggling on the market. But there are glimpses of forward momentum as Vertex and Genetix Bio provide updates.

After last year’s ‘stampede’ for FGF21 assets, the focus for the metabolic dysfunction-associated steatohepatitis space has shifted toward differentiated approaches, such as THR-β agonists and combination treatments, that seek to mirror the commercial success of Madrigal’s Rezdiffra.

Maintaining America’s momentum demands that policymakers resist policies that undermine research and development incentives.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

Following the FDA’s refusal to review Moderna’s investigational mRNA flu vaccine last week, Commissioner Marty Makary faced questions from the U.S. president about the agency’s handling of vaccines. It’s a clear signal that the tension long brewing at the drug regulator has now gone all the way to the top.

THE LATEST

In advance of this week’s CDC vaccine advisory meeting, HHS Secretary Robert F. Kennedy Jr. restacked the committee, claiming problematic industry ties within the previous group. Experts say ACIP had long navigated COIs appropriately and that the new appointees risk the apolitical nature of membership.

Looking for a biopharma job in San Diego? Check out the BioSpace list of eight companies hiring life sciences professionals like you.

Analysts at William Blair say dapiglutide’s 11.6% weight reduction at 28 weeks could still be better, given that Zealand’s study predominantly included men and enrolled patients with lower BMI at baseline.

Harliku is the only FDA-approved drug for alkaptonuria, a rare condition characterized by skin discoloration, arthritis and heightened risks of heart failure and stroke.

Exemptions to new export control policies have allowed companies to ship patients’ biological materials to foreign laboratories, including those in China and other adversarial nations, according to the FDA.

California’s life sciences jobs led the nation last year, according to a new California Life Sciences (CLS) report. However, employment growth slowed and could continue slowing. CLS President and CEO Mike Guerra discusses the critical factors influencing California’s success.

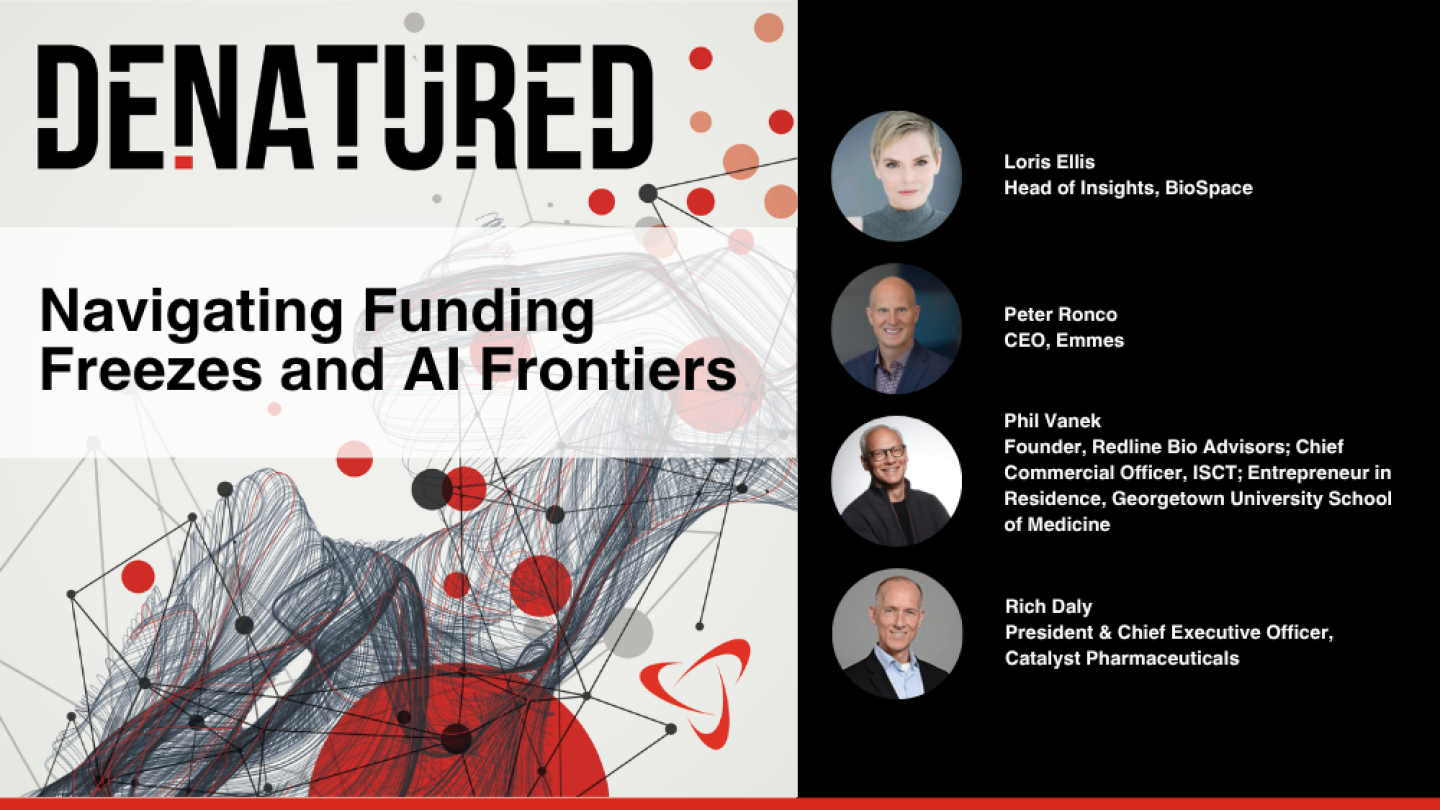

In this episode of Denatured, BioSpace’s Head of Insights Lori Ellis discusses key themes from BIO and DIA, including the funding environment, with Rich Daly, CEO of Catalyst Pharmaceuticals, Peter Ronco, CEO of Emmes Corporation, and Phil Vanek, founder of Redline Bio Advisors.

The well-respected director of the FDA’s cell and gene therapy office was seen as a stabilizing and trustworthy voice inside the quickly reshaping FDA, especially since the late-March exit of CBER Director Peter Marks.

After the delayed approval of its next-generation COVID-19 vaccine, Novavax now awaits the first meeting of the recently overhauled CDC vaccine advisory committee next week. Throughout a tumultuous season, the Maryland-based company is relying on agility and a diverse pipeline to stay ahead of rapidly changing regulations.

Lenacapavir, to be marketed as Yeztugo, could “redefine the PReP market,” according to analysts.