News

Korsana’s lead program uses a next-generation shuttling technology to improve delivery into the brain and lower the incidence of amyloid-related imaging abnormalities.

FEATURED STORIES

Regulatory uncertainty is no longer background noise. It is a material investment risk that reshapes how capital is deployed and pipelines are prioritized.

Long an R&D company that partnered off assets, RNAi biotech Ionis Pharmaceuticals shifted in 2025 to bring two medicines to market alone. Analysts are already impressed—and there’s more to come in 2026.

An analysis finds that pharmas frequently file multiple similar patents on drugs, then use them as the basis for questionable litigation against would-be competitors.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

Passage Bio’s workforce reduction could affect about 32 people, leaving the company with 26 employees as it continues evaluating a treatment for frontotemporal dementia with granulin mutations.

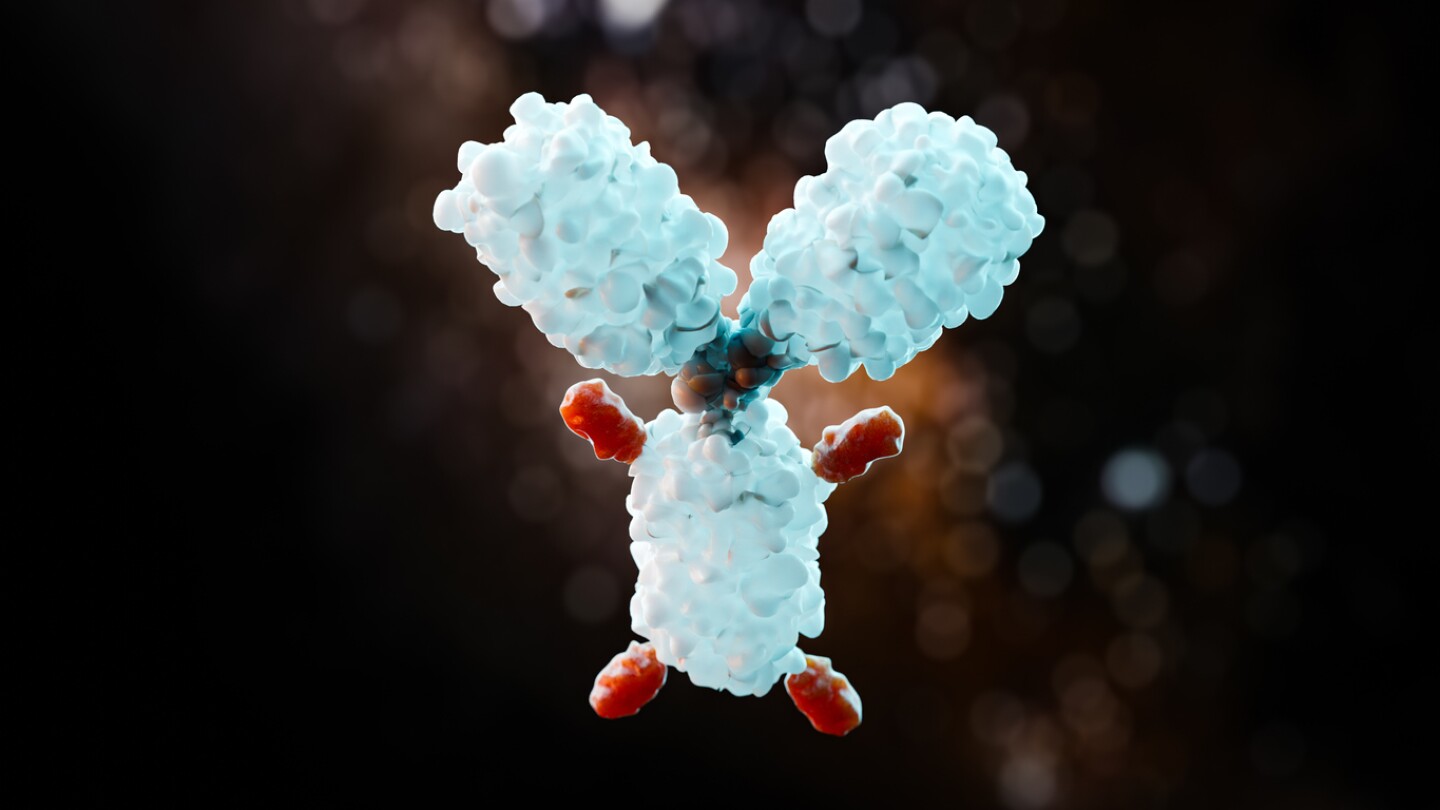

On the heels of an FDA approval for its monoclonal antibody Bizengri, Merus will generate three novel cancer-targeting antibodies that it will pass over to Biohaven to link into antibody drug-conjugates.

Biogen’s proposed acquisition comes after two difficult years of regulatory and clinical challenges, during which shares of Sage Therapeutics have fallen by more than 90%.

Among Intra-Cellular’s neuropsychiatric assets is Caplyta, a pill approved for schizophrenia and bipolar depression and proposed for major depressive disorder.

Gilead’s investment will let it assess the therapeutic potential of targeting STAT6, a transcription factor involved in IL-4 and IL-13 signaling, which in turn are known inflammatory targets.

Emraclidine was the centerpiece of AbbVie’s $8.7 billion acquisition of Cerevel in December 2023 but failed two mid-stage trials. Tavapadon, meanwhile, has been a more rewarding asset for the pharma, clearing three Phase III Parkinson’s studies in 2024.

Metsera will use its IPO proceeds to fund the Phase III development of its injectable, ultra-long-acting GLP-1 therapy MET-097i, which last week achieved 11.3% weight loss in a Phase IIa study.

The first major deal of JPM 2025 will give GSK a promising small molecule drug for gastrointestinal stromal tumors.

Benefiting from technological and conceptual groundwork and positive early data, gene therapies are advancing in the clinic for cardiovascular diseases including congestive heart failure, chronic refractory angina and cardiomyopathy.

An FDA committee’s September 2024 vote to limit the use of Merck’s Keytruda and BMS’ Opdivo in stomach and esophageal cancers based on PD-L1 expression levels reflects an emerging trend that leverages ever-maturing datasets.