News

AstraZeneca is relying on several upcoming products to help hit its target of $80 billion in revenue by 2030, including drugs for hypertension, breast cancer and generalized myasthenia gravis, all of which are currently under FDA review.

FEATURED STORIES

Acadia Pharma’s Catherine Owen Adams has formed a group of small- to mid-cap biotechs to advocate against a ‘peanut butter blanket’ approach to drug pricing for small companies.

Drugmakers told the FDA that inflexible post-approval change requirements are among the top regulatory barriers to the reshoring of pharmaceutical manufacturing.

Former European Trade Commissioner Phil Hogan and former US Senator Richard Burr, speaking on a panel at the J.P. Morgan Healthcare Conference, pushed to see a larger picture beyond the Trump administration’s year of chaos and confusion.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

With five CDER leaders in one year and regulatory proposals coming “by fiat,” the FDA is only making it more difficult to bring therapies to patients.

THE LATEST

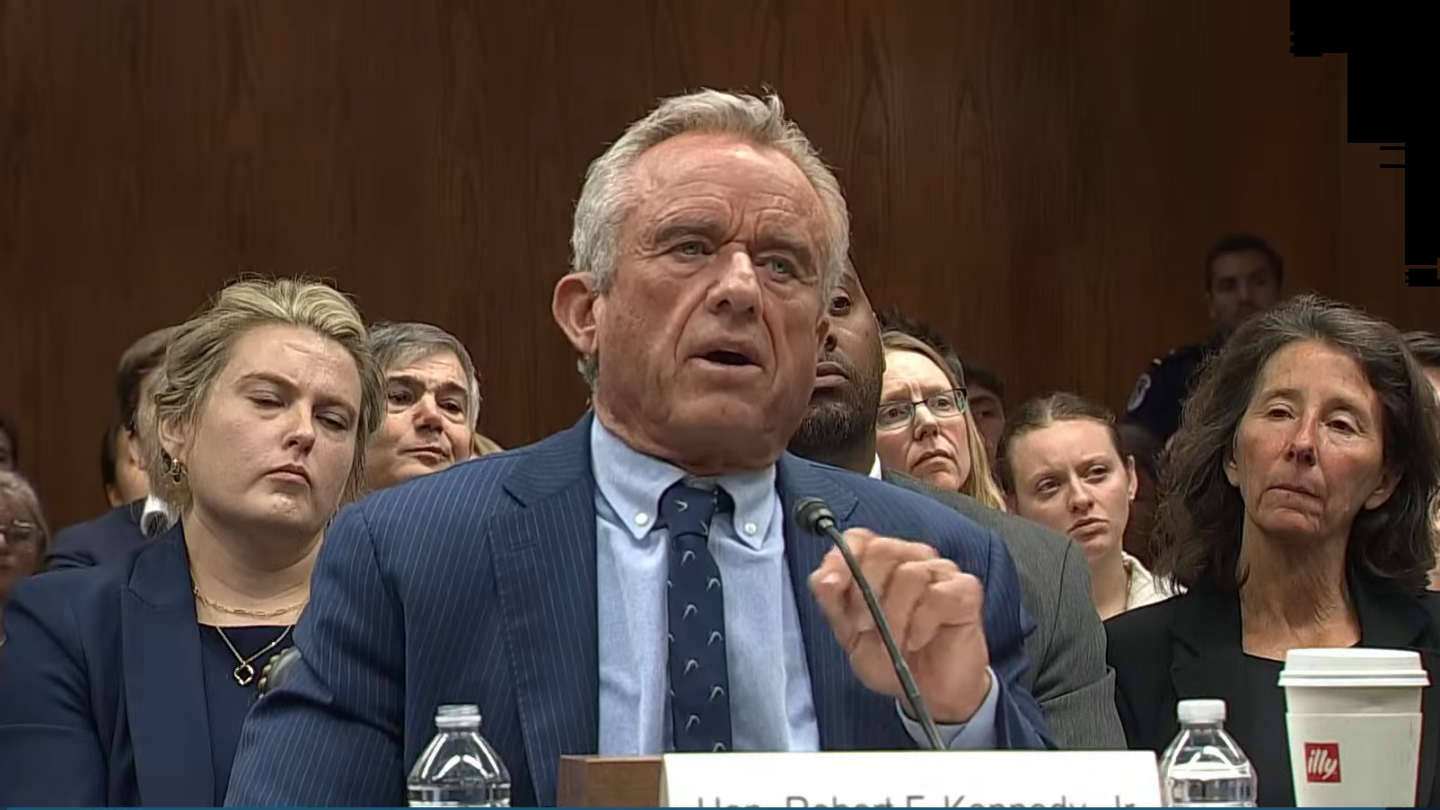

After a tense exchange, Senator Patty Murray (D-WA) told Kennedy that by implementing sweeping cuts to the HHS, he is “enacting his budget,” which “Congress has not passed.”

The ODAC cited concerns with patient populations in clinical trials used to support the proposed expansion. Johnson & Johnson fared better, with the FDA’s cancer advisors voting to recommend Darzalex in patients with a certain type of multiple myeloma.

China continues to be a source of innovation as Pfizer strikes biggest pact yet; HHS provides more info on Trump’s Most Favored Nation executive order; FDA Commissioner Marty Makary and CBER director Vinay Prasad reveal new COVID-19 vaccine strategy following Novavax approval; ODAC underway after chaotic planning; more.

BioSpace examines the busiest corporate venture capital arms in the pharmaceutical industry. Novo Holdings, which made headlines last year with its $16.5 billion Catalent buy, topped the list.

From a higher bar for regulatory clearance to pricing limitations, drug development is more expensive than ever. This has led firms to make tough pipeline decisions early in the development process. The result may be costly for all of us.

The new framework was well-received by biopharma analysts, who say it “largely formalizes” current COVID-19 vaccination trends.

Drugmakers will be expected to commit to aligning U.S. prices with the lowest price set in a group of peer nations for all brand products across all markets that do not currently have generic or biosimilar competition.

Most of the 15 million children with a rare disease have no FDA-approved treatments available to them. And when it comes to the most-rare conditions, there isn’t even a pipeline.

The largest Chinese licensing deal behind Pfizer’s is Novartis’ partnership with Shanghai Argo Biopharma, worth potentially more than $4 billion.

The Most Favored Nation order is unlikely to deliver broad, sustained savings without triggering legal challenges, administrative friction and unintended consequences for both the healthcare sector and patient access.