This year, Novo Nordisk and Merck announced significant layoffs, with Novo planning to axe about 9,000 employees and Merck projecting it could let go of roughly 6,000. Meanwhile, Bayer, Bristol Myers Squibb, Novartis and Pfizer have also made noteworthy cuts.

Six Big Pharma companies’ recent and planned staff cuts since the biopharma bubble burst could cost over 39,000 employees their jobs, based on BioSpace tallies.*

- Novo Nordisk plans to cut about 9,000 employees globally in a bid to generate around $1.25 billion in annualized savings by the end of 2026, the company announced this month.

- Merck has projected it could lay off about 6,000 staffers globally as part of a multiyear restructuring program announced in July that’s expected to save $3 billion by the end of 2027.

- Bristol Myers Squibb has disclosed layoffs affecting 2,714 employees since announcing last year the first of two significant cost-cutting measures.

- Bayer’s headcount dropped by 12,492 between the end of second-quarter 2023 and the end of Q2 2025, based on quarterly reports. Much of that reduction has stemmed from an operational change announced in January 2024.

- Based on BioSpace tallies, Pfizer has cut up to 1,702 people since announcing the first of two cost-cutting programs meant to generate about $6 billion in savings.

- Since announcing in 2022 a new organizational structure and operational model that would affect up to 8,000 jobs, Novartis has laid off 2,186 employees, based on BioSpace tallies.

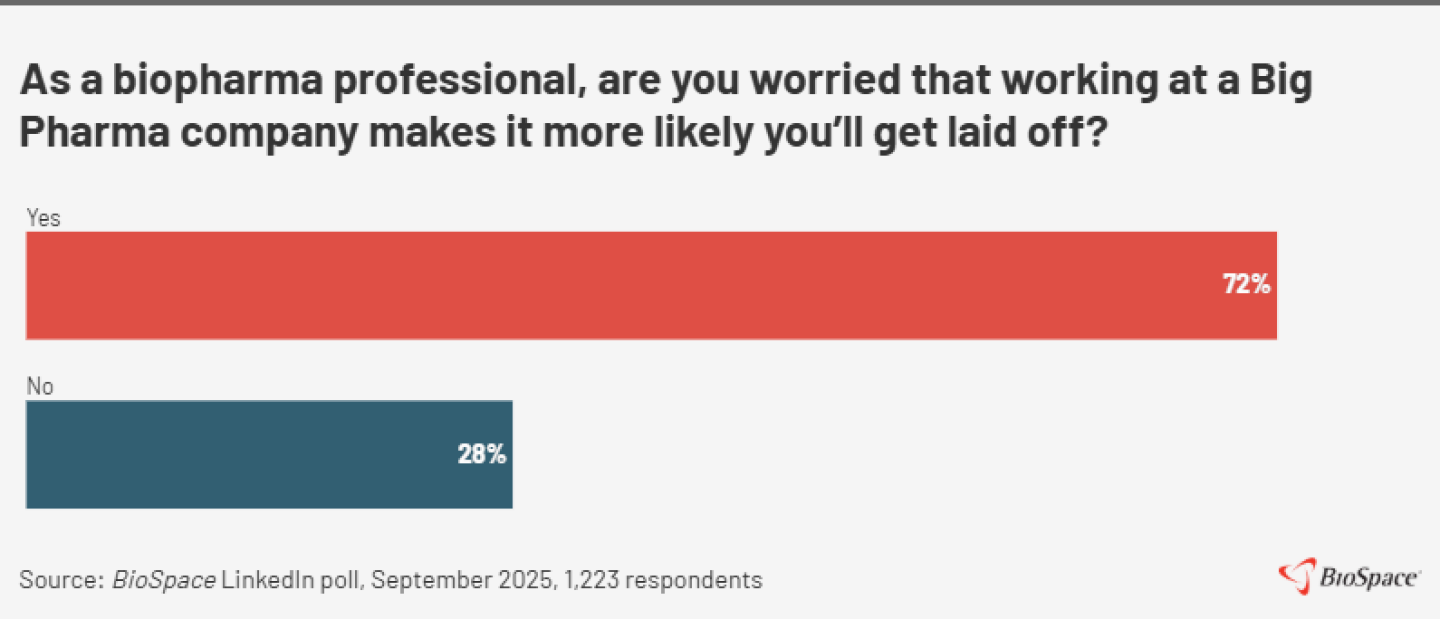

Getting caught up in Big Pharma layoffs is a concern for many biopharma professionals, based on a BioSpace LinkedIn poll this month. It found that 72% of respondents are worried that working at one of these companies makes it more likely they’ll get let go.

As to whether Big Pharmas or smaller biopharmas are safer bets for avoiding layoffs, Eric Celidonio, founder and managing partner of Sci.bio Recruiting, a biopharma recruiting firm, opted for the former.

“Big Pharma has traditionally been safer,” he told BioSpace. “It still is safer.”

Regarding why that’s the case, Celidonio noted that biotech funding has significantly dried up while Big Pharma is experiencing a very slow trend up. Still, when it comes to Big Pharma layoffs, he said he very seldom talks to people who don’t feel vulnerable at some level.

Following is an overview of Novo, Merck, BMS, Bayer, Pfizer and Novartis’ layoffs in the past few years—and the cuts yet to come.

Novo Nordisk Plans to Axe Roughly 9,000

Denmark-based Novo Nordisk’s planned layoffs of about 9,000 of its 78,400 employees globally is expected to include around 5,000 employees in Denmark. Cuts started this month. The company is letting go of 263 staffers at its U.S. headquarters in Plainsboro, New Jersey, effective Dec. 31, according to a Worker Adjustment and Retraining Notification (WARN) Act notice.

In its announcement about the planned layoffs, Novo said its restructuring will simplify the organization, improve decision-making speed and reallocate resources toward its growth opportunities in diabetes and obesity, including commercial execution initiatives and research and development programs.

The cuts are the first major move under new President and CEO Maziar Mike Doustdar, who was appointed to his position in July. He noted in the announcement that Novo’s markets are evolving, particularly in obesity, which has become more competitive and consumer-driven.

“Our company must evolve as well,” Doustdar said. “This means instilling an increased performance-based culture, deploying our resources ever more effectively, and prioritising investment where it will have the most impact – behind our leading therapy areas.”

The reorganization is not the first time in recent years that Novo has let employees go. The company cut 86 employees in Seattle in 2023, according to a WARN notice.

Merck Projects Layoffs of Around 6,000

Germany-based Merck’s projected layoffs that could affect around 6,000 employees will be spread across administrative, sales and research and development roles. The restructuring, which also involves paring down the pharma’s global footprint and manufacturing network, will support the launches of more than 20 products nearing the market, according to the company.

Merck plans to increase research and development investments at the same time, CEO Rob Davis noted during a July 29 earnings call. Because the company will move resources from slower-growth to fast-growing areas of the business, the restructuring program is more of a reallocation than a cut, Davis noted.

Since the restructuring news broke, Merck has had two rounds of mass cuts. In August, Merck disclosed in a WARN notice that it will let go of 58 people at its U.S. headquarters in Rahway, New Jersey, effective Nov. 14. In September, media outlets reported that the company will end research and discovery efforts in the U.K., a move that includes pulling out of the Francis Crick Institute and the London BioScience Innovation Center, leaving 125 employees jobless.

Merck also laid off staff earlier this year, prior to the restructuring announcement. It let go of 163 employees at a Pennsylvania manufacturing site it was shutting down. Those layoffs started May 16 and will continue into 2026, according to a March WARN notice.

Bristol Myers Squibb’s Cuts Now Over 2,000

In April 2024, New Jersey–based BMS, which had already been cutting staff following Christopher Boerner taking over as CEO in November 2023, announced a strategic productivity initiative. That initiative included cutting roughly 2,200 jobs by the end of 2024, with the goal of generating about $1.5 billion in cost savings through 2025. BMS wanted to optimize operations by reducing management layers, among other cost-cutting measures, according to an investor presentation. The pharma said it would use the resulting savings to fund innovation, focusing on research and development programs with the highest potential return on investment with an eye toward long-term growth.

In February 2025, BMS added another cost-cutting initiative, this one meant to generate $2 billion in savings through 2027. In its fourth-quarter earnings release, the company said the new savings would come from organizational design changes and enhanced operational efficiency. The goal was to become a “leaner, more efficient company while investing behind growth brands and promising areas of science,” according to the earnings release.

Since the April 2024 announcement, BMS has disclosed layoffs affecting 2,714 employees. Some cuts don’t take effect until 2026. Most of the people losing their jobs—2,410—were in Lawrenceville, New Jersey, where BMS has two locations: its corporate headquarters and a facility that houses its commercial, global product development and supply, research and development and enabling functions.

Bayer’s Layoffs Since End of Q2 2023 Top 12,000

In January 2024, about half a year after Bill Anderson became CEO and just months after he expressed disappointment in company performance, Germany-based Bayer moved to a dynamic shared ownership operating model. Meant to cut back on bureaucracy and hierarchies as well as boost operational efficiency, the model involved restructuring the workforce.

Changes started quickly. Just two months later, Bayer had trimmed its executive roster from 14 to eight members. Two months after that, the company shared it had decreased headcount by about 1,500 jobs, mostly management positions in its pharmaceuticals, crop science and consumer health divisions. Bayer later shared in its second-quarter earnings presentation that it had cut 3,200 employees since the start of the year.

Flash forward to May 2025, and the pharma noted in its first-quarter earnings presentation that it had let go of about 2,000 people during the first quarter. That brought the total number of roles cut since July 2023 to roughly 11,000, according to the pharma—a number that rose to 12,492 at the end of second-quarter 2025, when the company reported 89,556 employees, down from 102,048 at the end of Q2 2023.

Despite Bayer’s expectation stated in the restructuring announcement that jobs cuts should be done by the end of this year, during last month’s earnings call, Anderson said he expects additional layoffs over the next 18 months or so. The company’s Q2 2025 report alluded to cost savings not being as high as expected.

Pfizer Cuts Total Roughly 1,700 So Far

In October 2023, New York–based Pfizer, which had about 83,000 employees worldwide, announced a multiyear cost realignment program meant to generate $3.5 billion in savings through 2024. The company was looking to weather a steep drop in its COVID-19 product sales. Earlier this year, a spokesperson told BioSpace that Pfizer has raised intended savings to about $4.5 billion by the end of 2025.

The pharma disclosed additional cost cuts in a May 2024 SEC filing: a multiyear manufacturing optimization program meant to generate about $1.5 billion in savings by the end of 2027.

After announcing the cost realignment program, Pfizer let go of about 850 employees in 2023. Most layoffs came in November of that year, affecting employees in Connecticut, Ireland, Michigan and the U.K. The largest cut was in Ireland. According to media reports, Pfizer laid off around 500 staffers in Sandwich, Kent.

In 2024, layoffs totaled up to roughly 700 people, although some cuts were not effective until this year. Workforce reductions affected employees in Colorado, Kansas, Ireland, North Carolina and Washington. The largest cut, reported by The Irish Times, involved up to 210 manufacturing jobs across three sites in Ireland, with some end dates taking place this year.

Layoffs have continued in 2025, totaling 156 so far and including 100 people in Bothell, Washington, where effective dates started Aug. 25, according to a WARN notice. Pfizer has now let go of up to 1,702 people since announcing its cost realignment program.

Novartis Eyes Up to 8,000 Job Cuts

Since announcing its new organizational structure and operational model in 2022, Switzerland-based Novartis’ layoffs of 2,186 employees, some of which aren’t effective until next year, include 1,012 people at its U.S. headquarters in East Hanover, New Jersey. If up to 8,000 jobs total are cut, it would represent about 7% of the company’s workforce at the time of the announcement. Novartis’ restructuring was intended to save about $1 billion in operations costs by 2024.

In addition to layoffs, structural changes have included the pharma integrating its oncology and pharmaceuticals business into what it dubbed an innovative medicines business. Novartis also created separate business organizations for its U.S. and international operations.

Cuts following the restructuring announcement began in November 2022, when the company laid off 285 employees in East Hanover, according to a WARN notice. They picked up in 2024, when Novartis let go of 1,278 employees, some of whose end dates were in future years. That number includes 680 people in product development who were not part of the restructuring program, according to Reuters. A Novartis spokesperson told BioSpace at the time that many of those 680 jobs would shift to other “established hubs” over the next two years.

Cuts have continued in 2025, totaling 520 people so far. Most layoffs this year have been in East Hanover, where Novartis is letting go of 485 employees through June 26, 2026, according to WARN notices.

Signs of Recovery for Biopharma

Celidonio was not concerned about recent Big Pharma cuts and pointed toward encouraging signs for what’s ahead for biopharma. For example, he said, there are many promising new technologies just taking hold that offer immense promise for unmet needs, and people will always pay for quality of life.

“We’ve been in a bit of a lull, but we’ll bounce back from it,” he said.

*To tally layoffs, BioSpace compiles data for known workforce reductions. The number of employees affected is identified or estimated primarily through information in company press releases, WARN notices, SEC filings and other media outlets’ reports or via confirmation from company officials.

Not all companies disclose downsizing, and some share only the percentage of staff affected. Some biopharmas provide total numbers retrospectively rather than disclosing individual workforce reductions as they happen.

Want more job market insights? Subscribe to Career Insider to receive our quarterly life sciences job market reports, career advice and more.