News

The Repertoire partnership is Lilly’s second immunology play of the year, after the acquistion of Ventyx in early January for a pipeline of NLRP3 assets.

FEATURED STORIES

With the biopharma industry performing better of late, analysts, executives and other industry watchers are “cautiously optimistic”—a term heard all over the streets of San Francisco at the J.P. Morgan Healthcare Conference earlier this month.

Bristol Myers Squibb, GSK and Merck are contributing drug ingredients as part of their deals with the White House but are keeping many of the terms of their agreements private.

Some 200 rare disease therapies are at risk of losing eligibility for a pediatric priority review voucher, a recent analysis by the Rare Disease Company Coalition shows. That could mean $4 billion in missed revenue for already cash-strapped biotechs.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

Phacilitate’s annual event dawns as cell and gene therapies reach a new tipping point: the science has hit new heights just as regulatory and government policies spark momentum and frustration.

THE LATEST

The U.K.-based biotech is the latest to cash in on the hot antibody-drug conjugate space, closing a $115.5 million Series A round co-led by Novo Holdings and participation from Eli Lilly.

Patient assistance programs may actually be a two-way street, providing patients with drugs and companies with data.

The blood plasma pharma is considering a buyout offer from the founding family and asset manager Brookfield, which would delist the company from the Spanish and Nasdaq markets.

Eli Lilly on Monday announced a $3.2 billion all-cash deal to purchase Morphic and its pipeline of oral integrin therapies in a move to expand the pharma’s presence in the autoimmune diseases space.

Roche’s tiragolumab, when combined with its PD-L1 blocker Tecentriq, did not significantly improve progression-free and overall survival versus Keytruda and chemotherapy in patients with non-small cell lung cancer.

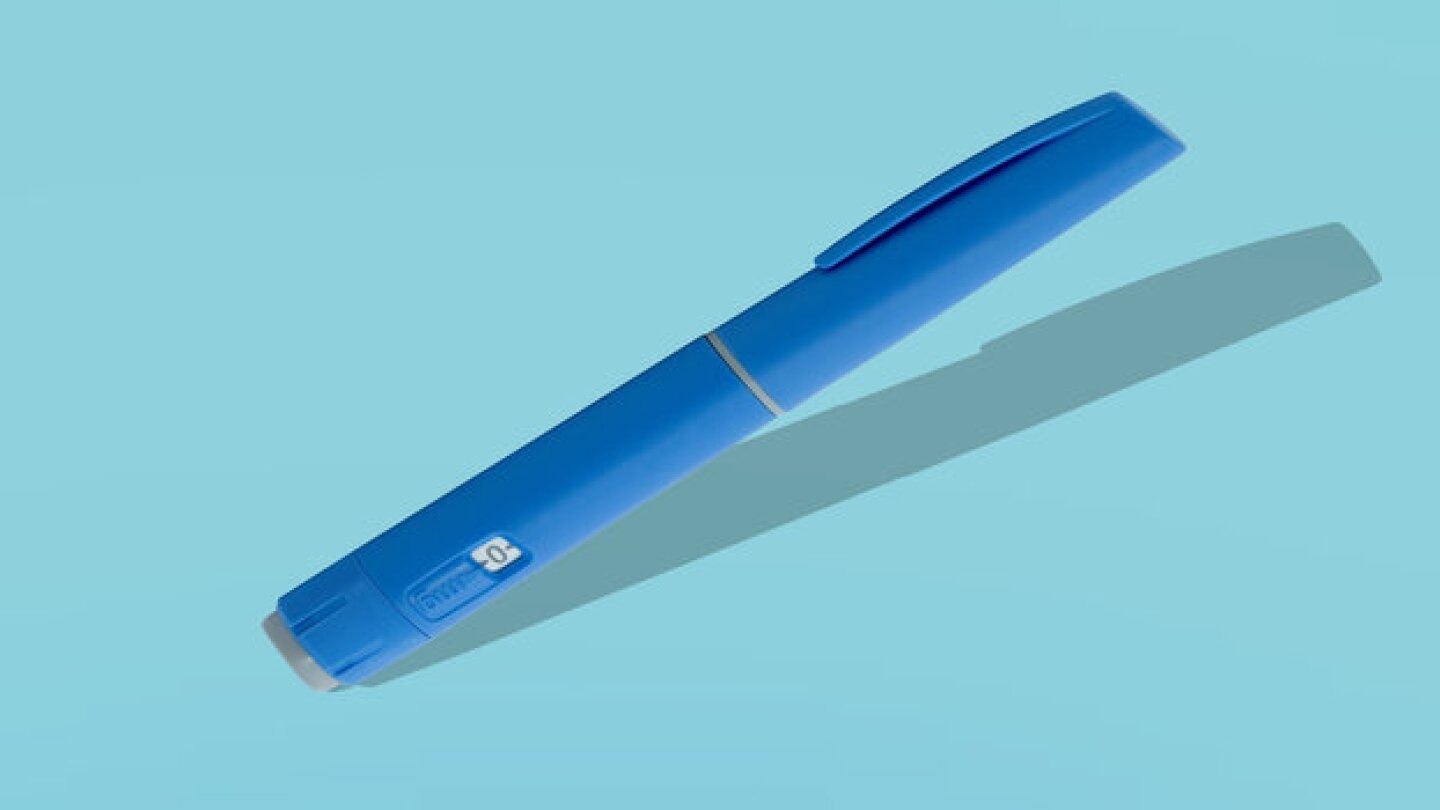

Eli Lilly, Rivus Pharmaceuticals and more target different biological processes in hopes of generating higher-quality weight loss and avoiding metabolic issues.

Two CRLs from the FDA last week cited concerns with third-party manufacturers, while Indian CDMOs may make a bid for U.S. business if there is a decoupling from Chinese companies under the BIOSECURE Act.

President Joe Biden and Sen. Bernie Sanders in a Tuesday op-ed in USA Today called on Novo Nordisk and Eli Lilly to “stop ripping off Americans” with “unconscionably high prices” for their GLP-1 medicines.

Johnson & Johnson and Legend Biotech’s Carvykti cell therapy significantly improved survival in patients with multiple myeloma when used in the second-line setting, the companies announced on Tuesday.

GSK on Wednesday restructured its contract with CureVac to gain access to the biotech’s influenza and COVID-19 programs for $430 million upfront and up to $1.13 billion in future payments.