News

After years of contraction, investors see biotech reentering a growth cycle driven by scientific progress, asset quality and renewed conviction in oncology, obesity and neuroscience innovation.

FEATURED STORIES

With the biopharma industry performing better of late, analysts, executives and other industry watchers are “cautiously optimistic”—a term heard all over the streets of San Francisco at the J.P. Morgan Healthcare Conference earlier this month.

Bristol Myers Squibb, GSK and Merck are contributing drug ingredients as part of their deals with the White House but are keeping many of the terms of their agreements private.

Some 200 rare disease therapies are at risk of losing eligibility for a pediatric priority review voucher, a recent analysis by the Rare Disease Company Coalition shows. That could mean $4 billion in missed revenue for already cash-strapped biotechs.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

Phacilitate’s annual event dawns as cell and gene therapies reach a new tipping point: the science has hit new heights just as regulatory and government policies spark momentum and frustration.

THE LATEST

Biogen’s effort to buy Sage reveals its “desire to expand its pipeline at a discount,” according to analysts from BMO Capital Markets.

There are currently no treatments available for celiac disease beyond a gluten-free diet. Several late-phase companies aim to change the paradigm and deliver hope and progress soon.

As the year gets underway, analysts and biotech executives highlight cell therapy’s pivot from oncology to autoimmune diseases, a continued appetite for next-generation obesity drugs and an increased focus on neuromuscular, kidney and cardiovascular diseases.

Even before the FDA’s recent approval of Dato-DXd in breast cancer, analysts predicted sales of the antibody-drug conjugate could hit $5.9 billion in 2030. However, the asset faced a series of setbacks in 2024.

Traditionally carrying a dire prognosis, the treatment paradigm for multiple myeloma is changing, with CAR T therapies, bispecifics and more contributing to multifaceted regimens unique to each patient’s needs.

The conversion of Calquence’s accelerated approval in mantle cell lymphoma comes a day before the drug was listed among the 15 products to be subject to IRA-prescripted price negotiations for Medicare this year.

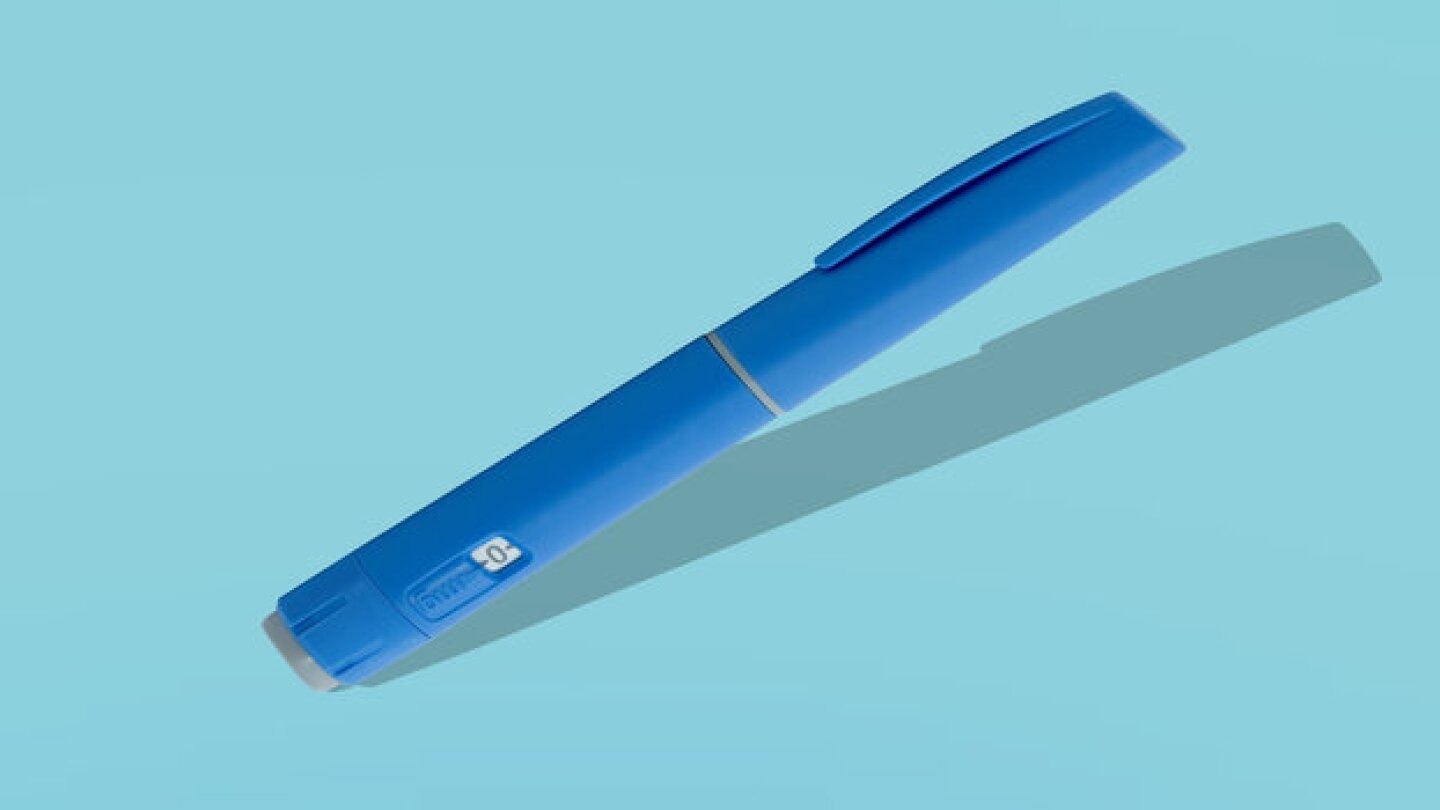

The data suggest the high dose nearly closes the efficacy gap with Zepbound.

Biopharma executives make their predictions for the year ahead, from a bold forecast for the return of the megadeal to a plea for the slow, healthy recovery of the industry at large.

Drugmakers will have until the end of February to decide whether they want to participate in the second round of Medicare negotiations or not. CMS has until June 1 to send an initial offer for the adjusted prices.

The Phase III CodeBreaK 300 study returned disappointing overall survival data for Lumakras plus Vectibix in metastatic colorectal cancer, but in its approval announcement, the FDA pointed to significant improvements in progression-free survival, calling it the “major efficacy outcome” of the trial.