News

As drug candidates discovered via AI move into later-stage clinical trials, the technology seems to be doing as promised: speeding drug development.

FEATURED STORIES

Henry Gosebruch, who has $3.5 billion in capital to deploy, is thinking broad as he steers the decades-old biotech out of years of turmoil.

Following the hard-won success of early anti-amyloid drugs, a new generation of Alzheimer’s modalities—from tau-targeting gene silencers to blood-brain barrier delivery platforms—is entering the pipeline to anchor future combination therapies.

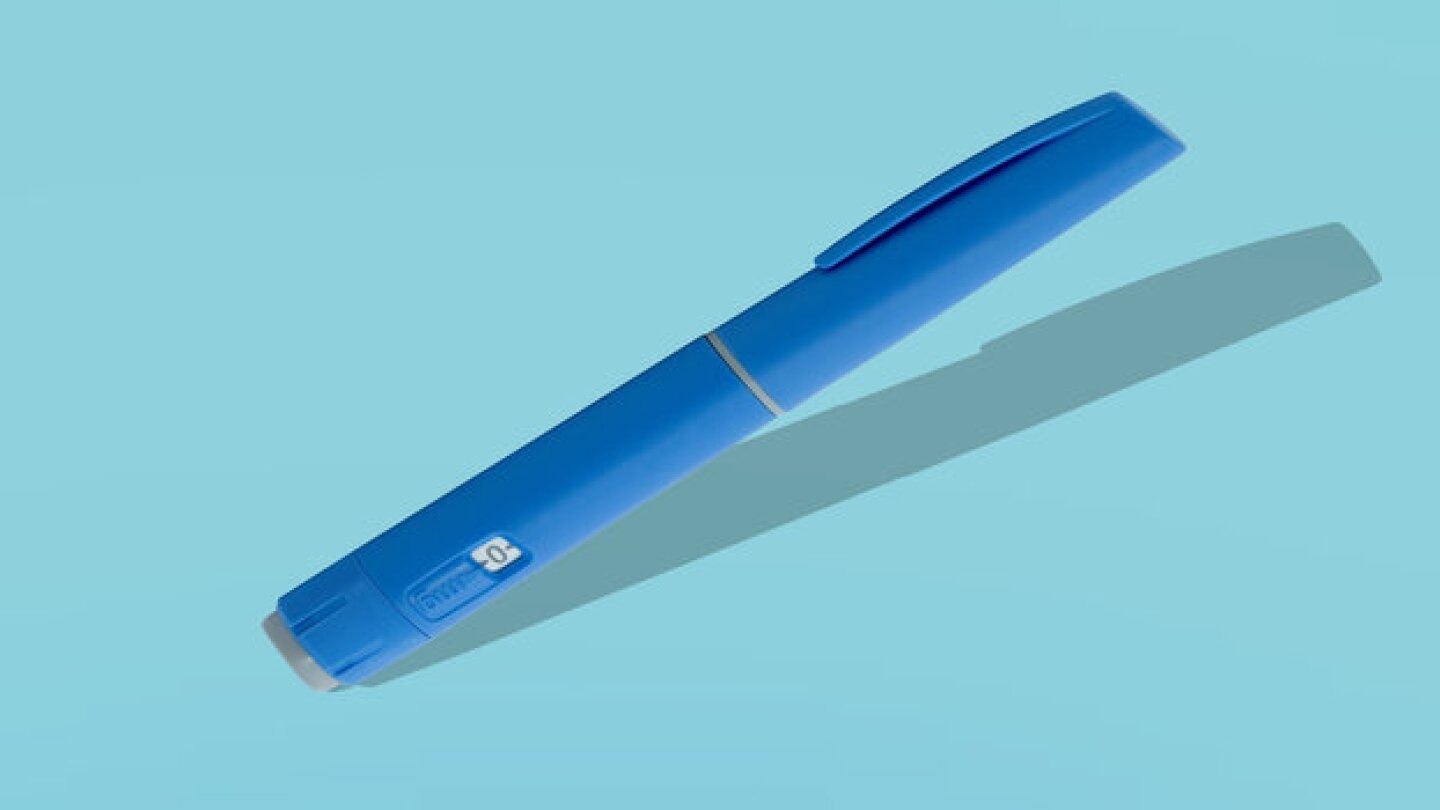

Speaking on the sidelines of the J.P. Morgan Healthcare Conference, Novo business development executive Tamara Darsow said the company is gunning for obesity and diabetes assets.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

It doesn’t matter how many times you have traversed Union Square; no one knows which way is north, or where The Westin is in relation to the Ritz Carlton. A Verizon outage brought that into focus on Wednesday.

THE LATEST

According to BMO Capital Markets, Medicare coverage of Lilly’s Zepbound opens the door to using secondary indications to secure CMS coverage for obesity drugs.

Being laid off is bad enough. When companies mishandle the layoff process, it can make the situation even worse. Four biopharma professionals share how some employers are getting it wrong.

J.P. Morgan releases its quarterly look-ahead days before the entire biopharma industry descends on San Francisco for the annual J.P. Morgan Healthcare Conference.

Backed by ARCH Venture Partners, F-Prime Capital and Mubadala Capital, the new company will develop a pipeline of brain-penetrant small molecules to address inflammation, metabolic dysfunction and restoring lysosomal function.

In a deal expected to close in Q1 2025, Roche will gain access to Poseida’s off-the-shelf CAR T candidates.

By mid-2025, the biotech will split into two entities: a new, as-yet-unnamed innovative medicines specialist and a cell therapy company, the latter of which will inherit the Galapagos name.

The FDA recommended maintaining a minimum of 5% weight-loss for drug developers seeking to establish the efficacy of their investigational obesity candidates.

Maze’s IPO comes on the heels of its oversubscribed Series D funding round, which infused the biotech with $115 million in funding to support the development of its kidney disease pipeline.

A post-marketing review by the FDA detected an increased risk of the autoimmune condition in patients inoculated with GSK’s Arexvy and Pfizer’s Abrysvo, prompting the regulator to require adjustments to the vaccines’ labels.

The investment continues a Novo dealmaking spree to cement its leadership status in the cardiometabolic space, with partnerships with Photys Therapeutics, Ascendis Pharma and two Flagship-backed start-ups.