News

The disagreement between Moderna and the FDA has reached a resolution just eight days after the biotech received a Refusal-to-File letter in response to its application for mRNA-1010. Moderna will now seek approval of the vaccine based on age.

FEATURED STORIES

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

Long an R&D company that partnered off assets, RNAi biotech Ionis Pharmaceuticals shifted in 2025 to bring two medicines to market alone. Analysts are already impressed—and there’s more to come in 2026.

Regulatory uncertainty is no longer background noise. It is a material investment risk that reshapes how capital is deployed and pipelines are prioritized.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

The Japanese pharma had one asset rejected by the FDA and withdrew a regulatory application for another, but already this month the company has secured an approval for AstraZeneca-partnered Dato-DXd, to be marketed as Datroway.

While the last decade has brought considerable progress for patients with DMD, substantial unmet need remains. Several companies including Wave, Dyne and Avidity are looking to answer the call with investigational therapies targeting greater efficacy and broader reach.

Less than a day into his second term, President Donald Trump ordered a freeze on communications at major public health agencies, among other moves that have sent waves through the biopharma industry.

The readout comes on the heels of CagriSema’s disappointing Phase III performance, where it missed Novo’s projection of 25% weight reduction.

The unsuccessful Phase III results are the latest to suggest that the blockbuster cancer drug is finally bumping up against its limits after racking up around 50 approvals since getting its first FDA nod in September 2014.

The San Diego–based company’s molecules avoid the well-trod GLP-1 pathway in favor of an alternate route in the gut.

The settlement is the largest deal to date with the people primarily who played an “instrumental role” in driving the opioid crisis, according to the office of Massachusetts Attorney General Andrea Joy Campbell.

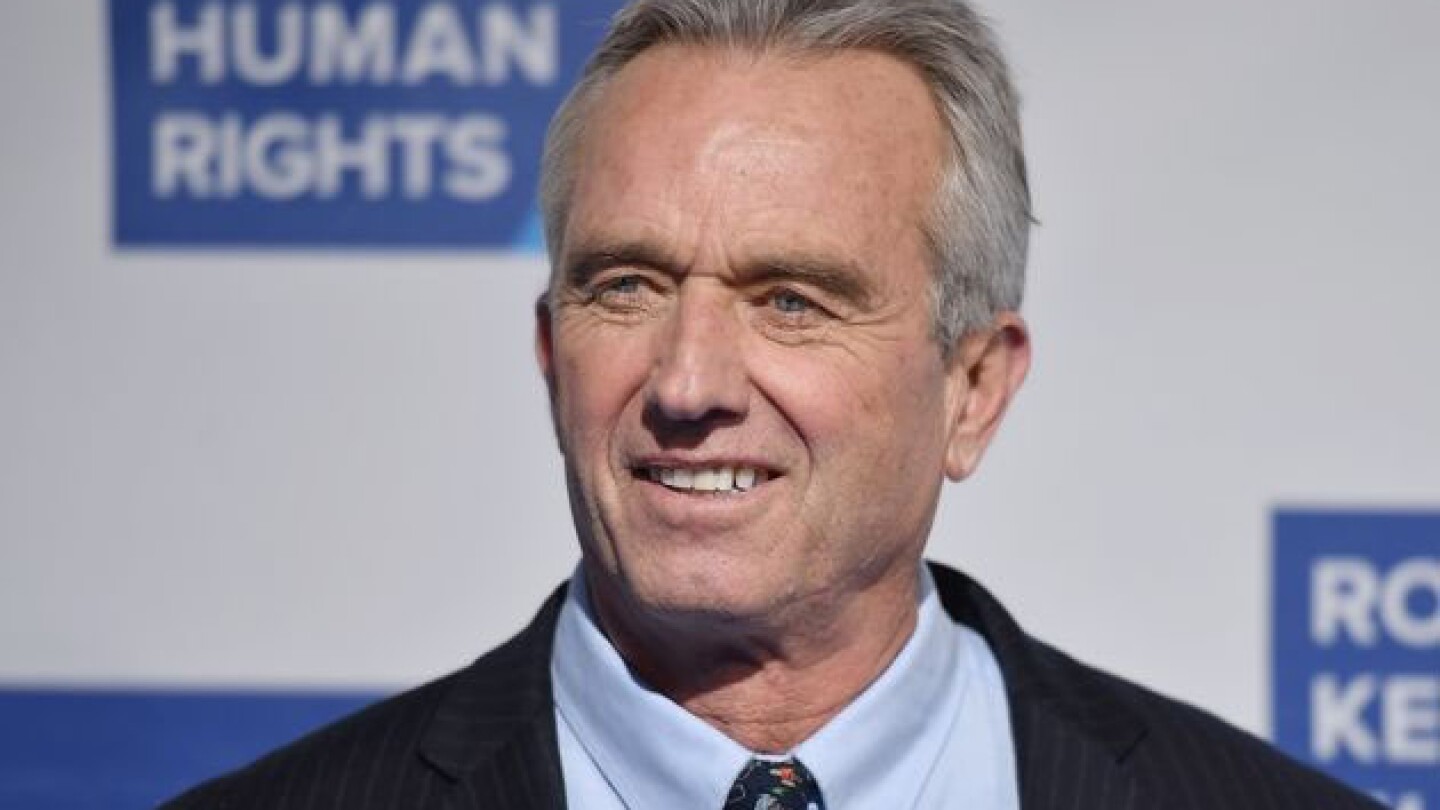

Robert F. Kennedy, Jr.’s recent disclosures have revealed several potential conflicts of interest, including investments in two biopharma companies.

Vigil Neuroscience reported a strong safety profile and 50% sTREM2 reduction in an early-stage trial for VG-3927, potentially representing a new avenue for treating Alzheimer’s disease.

Protein degradation–focused Neomorph nabs its third Big Pharma deal of around $1.5 billion in less than a year.