News

The obesity market and Most Favored Nation drug pricing were among the topics de jour at the J.P. Morgan Healthcare Conference last week, while smaller biotechs sought to assure investors that their regulatory ducks are in a row; Novo Nordisk’s oral obesity pill got off to a hot start while the FDA delayed a decision on Eli Lilly’s investigational offering; and SpyGlass Pharma and AgomAb Therapeutics join the 2026 IPO club.

FEATURED STORIES

Henry Gosebruch, who has $3.5 billion in capital to deploy, is thinking broad as he steers the decades-old biotech out of years of turmoil.

Following the hard-won success of early anti-amyloid drugs, a new generation of Alzheimer’s modalities—from tau-targeting gene silencers to blood-brain barrier delivery platforms—is entering the pipeline to anchor future combination therapies.

Speaking on the sidelines of the J.P. Morgan Healthcare Conference, Novo business development executive Tamara Darsow said the company is gunning for obesity and diabetes assets.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

It doesn’t matter how many times you have traversed Union Square; no one knows which way is north, or where The Westin is in relation to the Ritz Carlton. A Verizon outage brought that into focus on Wednesday.

THE LATEST

With the failure of AbbVie’s emraclidine in two mid-stage trials, Bristol Myers Squibb’s Cobenfy is ‘sole muscarinic winner.’

Bluebird has just two quarters until it’s out of cash. Executives are looking for financing to extend that runway to a projected breakeven point before the end of 2025, with analysts worried they won’t make it.

Eyenovia’s stock craters to its lowest point in its six-year lifespan as a public company following the biotech’s termination of its lead program in pediatric progressive myopia due to lack of efficacy.

Big Pharma had plenty of drama to keep journalists busy this quarter, which painted an accurate portrait of the wild and wonderful world of biopharma.

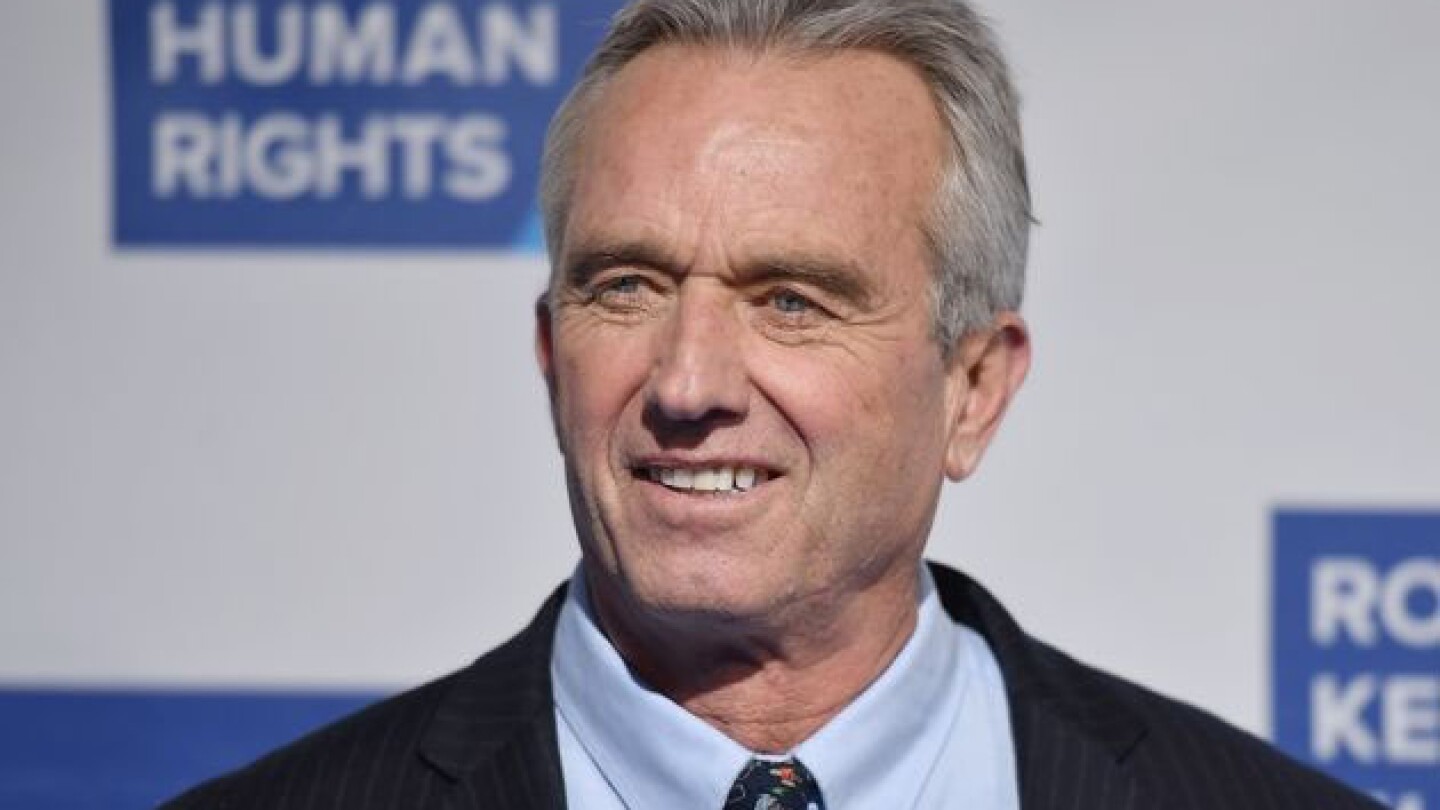

Trump’s HHS pick, Robert F. Kennedy Jr., is an anti-vaccine campaigner who has previously said that he plans to gut the FDA on allegations of corruption and reduce the NIH’s headcount.

BMS has so far been on a winning streak in the contingent value right cases, which allege that the pharma intentionally delayed regulatory activities for Breyanzi in order to avoid a $6.4 billion payout to Celgene shareholders.

Gilead’s layoffs include 72 employees at its Seattle location, which will close. Kite will shut down its Philadelphia facility. The layoffs are attributed to aligning resources with long-term strategic goals.

The November layoffs are the second known workforce reduction this year for Marinus Pharmaceuticals, which previously announced disappointing Phase III results for ganaxolone in two clinical trials.

Allogene is ceasing enrollment in a Phase I trial of cema-cel for patients with relapsed or refractory chronic lymphocytic leukemia after Bristol Myers Squibb’s Breyanzi was approved in the indication earlier this year.

Despite recent enthusiasm around the PD-1/VEGF space, BMO Capital Markets analyst Evan Seigerman noted that Merck’s pact with LaNova Medicines is more “conservativism” on the pharma’s part than confirmatory of recent data in the drug class.