News

Following the FDA’s refusal to review Moderna’s investigational mRNA flu vaccine last week, Commissioner Marty Makary faced questions from the U.S. president about the agency’s handling of vaccines. It’s a clear signal that the tension long brewing at the drug regulator has now gone all the way to the top.

FEATURED STORIES

Many scientists-turned-CEOs paradoxically abandon scientific principles when it comes to commercializing their innovations. But applying the scientific method to business decisions can help life science entrepreneurs avoid common pitfalls, attract investment and ultimately bring transformative technologies to market.

FDA vouchers are normally a coveted prize for biopharma companies, but a surprise rejection for Disc Medicine’s rare disease drug has biopharma reconsidering.

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

BMS is spinning out a new company with five immunology assets, including oral drugs being developed for systemic lupus erythematosus and plaque psoriasis, and $300 million in funds from Bain Capital.

The swift FDA action removes an overhang from Sarepta and allows Elevidys to return to the market without another safety study, as had been feared, Jefferies analysts said Monday.

In a Phase Ib/IIa trial, 91% of patients receiving the highest dose of trontinemab were amyloid negative after seven months of treatment, representing what B. Riley Securities called a “paradigm shift” to first-generation FDA-approved antibodies.

The German giant is looking to develop new drugs for undisclosed eye diseases using Re-Vana’s extended-release injectable platform to supply drugs to the eye for months at a time.

The star of GSK’s Hengrui partnership is the COPD candidate HRS-9821, which will complement the pharma’s respiratory pipeline that’s anchored by the anti-asthma drug Nucala.

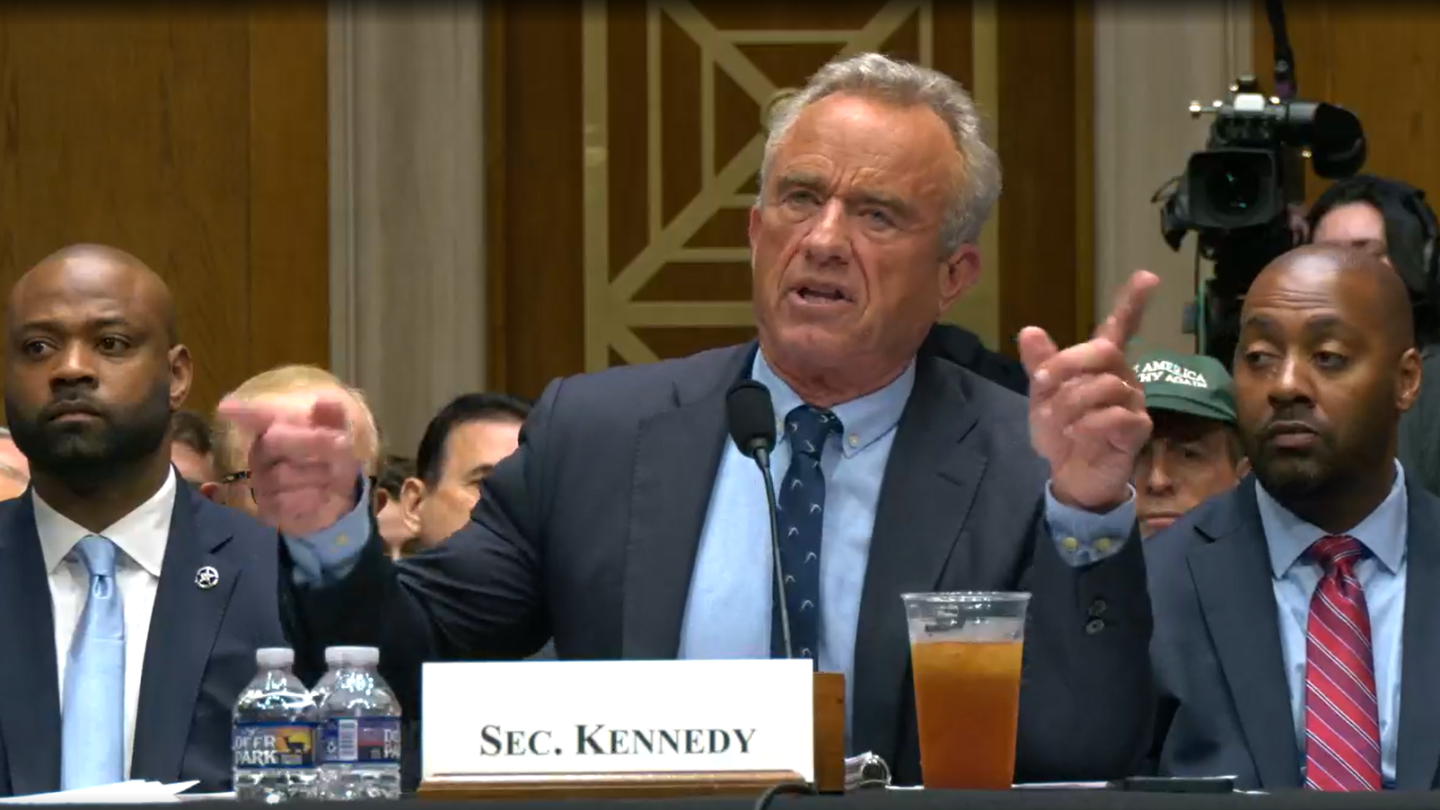

Health Secretary Robert F. Kennedy Jr. wants to remove all members of the USPSTF for being too “woke,” according to reporting by the Wall Street Journal. An HHS spokesperson, however, says no final decision has been made about the panel.

Brazilian authorities said the death was unlikely to have been caused by Elevidys and was instead more in line with severe infection exacerbated by immunosuppression.

Despite the failure of its Recognify-partnered inidascamine, Jefferies analysts do not expect a definitively negative stock impact on atai, given the company’s promising psychedelic pipeline.

Acknowledging the limits of disease-modifying drugs like Leqembi and Kisunla, companies like Bristol Myers Squibb, Acadia, Otsuka and Lundbeck are renewing a decades-old search for symptomatic treatments, including in high-profile drugs like Cobenfy.

These five upcoming data drops could usher in more effective and convenient therapies for Alzheimer’s disease and open up novel pathways of action to treat the memory-robbing illness.