News

Three years after the accelerated approval of its anti-amyloid Alzheimer’s therapy, Biogen—neck and neck in the market with Eli Lilly and its Kisunla offering—is focused on a near-term FDA decision for a subcutaneous induction dose of Leqembi, a presymptomatic readout in 2028 and a clutch of next-generation candidates.

FEATURED STORIES

Speaking to BioSpace at the J.P. Morgan Healthcare Conference, Novartis’ chief dealmaker Ronny Gal explains why the Swiss pharma hasn’t acquired a GLP-1, and why it probably won’t.

There hasn’t been a headline-stealing deal at J.P. Morgan yet. Nevertheless, the mood is positive amid green shoots and a flurry of dealmaking to end 2025.

Acadia Pharma’s Catherine Owen Adams has formed a group of small- to mid-cap biotechs to advocate against a ‘peanut butter blanket’ approach to drug pricing for small companies.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

With five CDER leaders in one year and regulatory proposals coming “by fiat,” the FDA is only making it more difficult to bring therapies to patients.

THE LATEST

While it trails Johnson & Johnson’s Tecvayli, Regeneron still hopes Lynozyfic can differentiate in terms of dosing convenience and efficacy.

An open letter signed by more than 50 industry executives blasts a “fundamentally, fatally flawed” report that urges greater restrictions on the abortion pill.

The women’s health focused company acquired the drug for up to $954 million in 2021 through the acquisition of Forendo Pharma.

As an office of the executive branch, the Department of Health and Human Services “does not have the authority” to implement sweeping changes to the structure of the agency as created by Congress, a judge wrote.

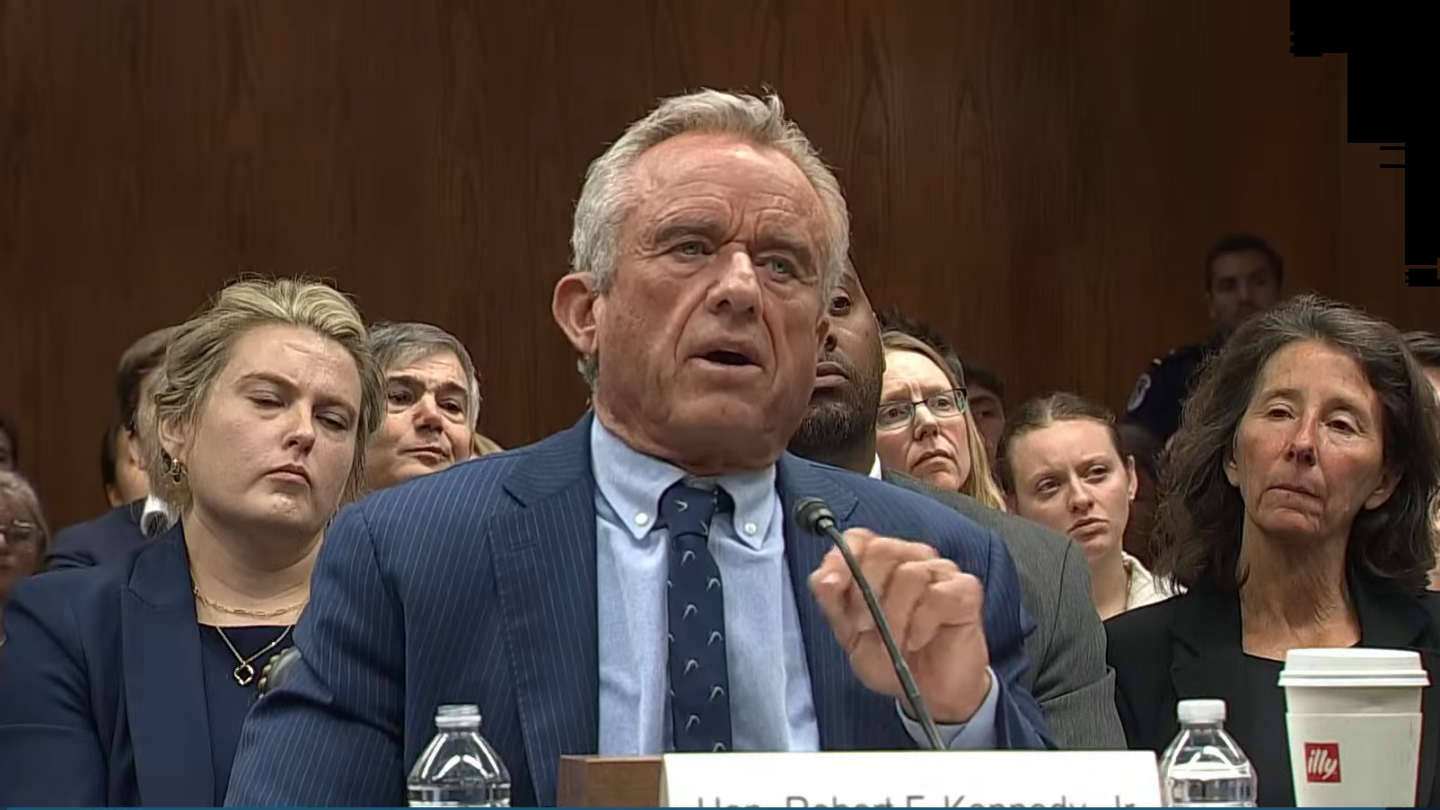

Kennedy wants to expand the injury compensation program to include COVID-19 vaccines, while also stretching the “statute of limitations” to more than three years.

The safety update for Vyvgart rattled argenx’s shares on Monday, a reaction that analysts at William Blair said was “overdone.”

California’s life sciences manufacturing jobs dipped 3.7% in 2024, according to a new Biocom California report. Still, several companies made—and continuing making—significant manufacturing investments in the state as key trends shape the discipline.

The high court sides with HHS on HIV PrEP drugs; Health Secretary RFK Jr.’s newly appointed CDC vaccine advisors discuss thimerosal in flu vaccines, skip vote on Moderna’s mRNA-based RSV vaccine; FDA removes CAR T guardrails; AbbVie snaps up Capstan for $1.2B to end first half; and psychedelics take off again with data from Compass and Beckley.

Why did two private equity firms with more than $460 billion under management want a little old gene therapy biotech called bluebird bio? We wanted to know.

Analysts believe that Gilead’s new PrEP drug Yeztugo could reach peak sales of $4.5 billion. Not if GSK has anything to say about it.