News

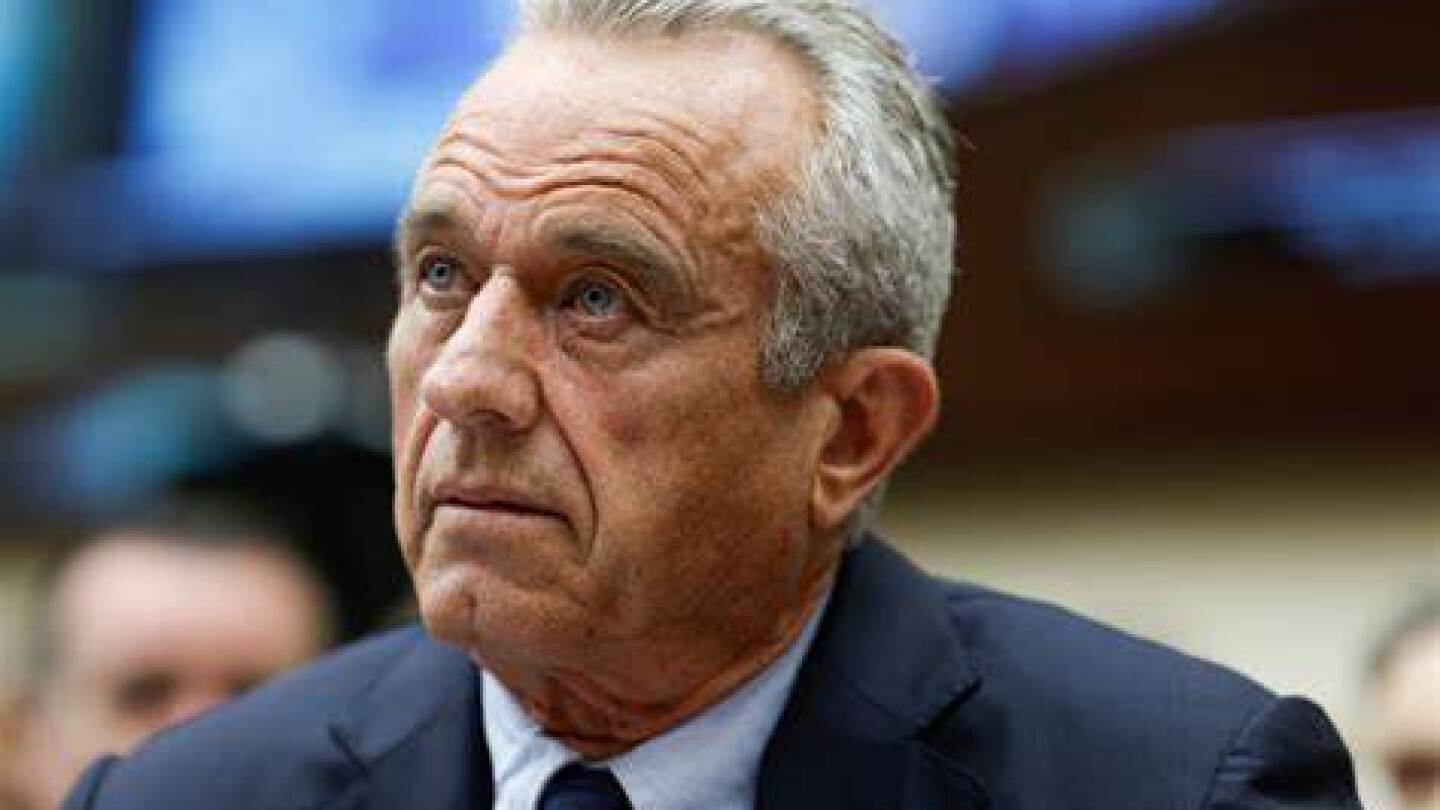

Following the FDA’s refusal to review Moderna’s investigational mRNA flu vaccine last week, Commissioner Marty Makary faced questions from the U.S. president about the agency’s handling of vaccines. It’s a clear signal that the tension long brewing at the drug regulator has now gone all the way to the top.

FEATURED STORIES

Many scientists-turned-CEOs paradoxically abandon scientific principles when it comes to commercializing their innovations. But applying the scientific method to business decisions can help life science entrepreneurs avoid common pitfalls, attract investment and ultimately bring transformative technologies to market.

FDA vouchers are normally a coveted prize for biopharma companies, but a surprise rejection for Disc Medicine’s rare disease drug has biopharma reconsidering.

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

Biogen’s effort to buy Sage against the board’s wishes and a long-time effort by investor Alcorn to scuttle Aurion’s IPO underscore the cutthroat nature of biopharma dealmaking.

The approval of Axsome Therapeutics’ Symbravo for migraine with or without aura came alongside the greenlight for Vertex’s non-opioid treatment Journavx.

Novartis was among the most prolific pharma dealmakers in 2024, a trend that it expects to continue with more bolt-on deals this year to set up for sustainable long-term growth.

Senators on the Health, Education, Labor and Pensions committee were critical of Kennedy’s long history as an anti-vaccine campaigner.

Blackstone joins other big investors such as ARCH Venture Partners and Bain Capital Life Sciences in pumping billions of dollars into the industry.

The greenlight for Journavx (suzetrigine), which comes on the heels of a $7.4 billion opioid settlement, could spark momentum in the fledgling non-opioid pain space.

Analysts were unfazed by the news that Takeda will cease development of soticlestat after Phase III failures, while responding positively to the announcement that Julie Kim will take the helm of the Japanese giant in 2026.

CAR T–focused biotech Cargo Therapeutics surprised and disappointed analysts when it announced that it would discontinue a mid-stage trial of its lead program, firi-cel.

Sanofi’s jump in earnings comes with an increased emphasis on R&D and vaccines, plus an eye cast toward M&A to shore up its pipeline.

For 2025, Roche will continue a careful approach to high-priced deals, putting science at the center of its business development decisions, executives said Thursday.