News

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

FEATURED STORIES

The rare disease drugmaker is facing potential competitors for achondroplasia drug Voxzogo. Is a big M&A deal with two approved assets enough to maintain investor interest?

The FDA issued a rare Refusal-to-File letter to Moderna over its mRNA-based influenza vaccine application, in an unusual move that sent the biotech’s shares tumbling.

A rapturous response to data published last year for Pelage’s hair loss candidate overwhelmed the biotech. Now, the company is ready to show the world the science behind the breakthrough.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

Novo Nordisk and Eli Lilly have been battling head-to-head in an exploding obesity market. They should never have been compared apples to apples.

THE LATEST

Novo Nordisk and Heartseed first partnered in 2021 to develop an investigational cell therapy for heart failure.

M&A headlined for a second straight week as Genmab acquired Merus for $8 billion; Pfizer strikes most-favored-nation deal with White House; CDER Director George Tidmarsh caused a stir with a now-deleted LinkedIn post; GSK CEO Emma Walmsley will step down from her role; and uniQure’s gene therapy offers new hope for patients with Huntington’s disease.

J&J still holds the top deal of the year by value with its $14.6 billion buy of Intra-Cellular in January, but the next four biggest acquisitions came in the past four months.

The two most historically deal-conservative Big Pharmas have the most money to play with for a major M&A transaction, according to a recent Stifel analysis.

A new analysis from SRS Acquiom puts into perspective the headline values seen when a company announces a backloaded M&A deal. Biotechs have much on the line when they agree to deals with massive potential but little upfront.

As major pharmas pull away from the U.K. and the U.S. risks ceding its lead through a national brain drain, the U.K. must create a new, more robust model for innovation.

Talks between pharma and successive U.K. governments have failed to deliver the market access terms that the industry wants, contributing to a pullback in investment.

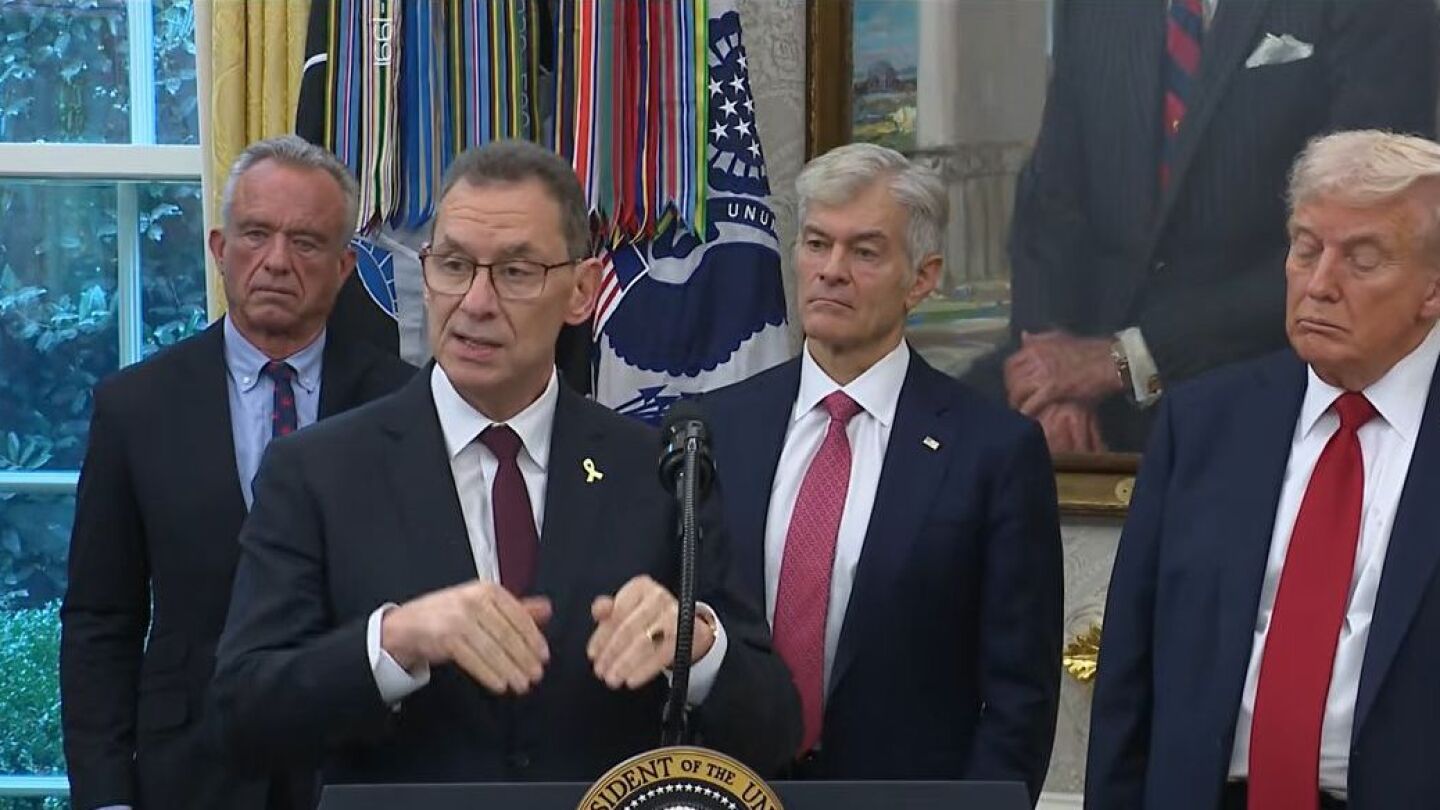

Pfizer CEO Albert Bourla directly credited the threat of tariffs with leading to the deal, in which the company will offer drugs on a soon-to-be-launched website called TrumpRx.

After parting with 50% of its employees earlier this year, Sutro Biopharma will lay another third of its staff in a restructuring effort geared toward reaching key inflection points.

MET-097i’s mid-stage performance “bodes well” for Pfizer’s proposed buyout of Metsera, according to BMO Capital Markets, a deal centered heavily on the investigational GLP-1 drug.