News

The Repertoire partnership is Lilly’s second immunology play of the year, after the acquistion of Ventyx in early January for a pipeline of NLRP3 assets.

FEATURED STORIES

With the biopharma industry performing better of late, analysts, executives and other industry watchers are “cautiously optimistic”—a term heard all over the streets of San Francisco at the J.P. Morgan Healthcare Conference earlier this month.

Bristol Myers Squibb, GSK and Merck are contributing drug ingredients as part of their deals with the White House but are keeping many of the terms of their agreements private.

Some 200 rare disease therapies are at risk of losing eligibility for a pediatric priority review voucher, a recent analysis by the Rare Disease Company Coalition shows. That could mean $4 billion in missed revenue for already cash-strapped biotechs.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

Phacilitate’s annual event dawns as cell and gene therapies reach a new tipping point: the science has hit new heights just as regulatory and government policies spark momentum and frustration.

THE LATEST

The lawsuit alleges that HHS leadership knew the records they used to guide their layoff decisions were inaccurate and contained errors.

Genrix’s velinotamig complements Cullinan’s own pipeline, according to William Blair, which added that the deal will put Cullinan in a better position to target autoimmune diseases.

Massachusetts’ life sciences jobs grew by just 0.03% in 2024, according to a new MassBioEd report. Still, the report found encouraging signs for the industry, noting it’s expected to grow by 11.6% by 2029, adding an estimated 16,633 net new positions.

Disappointing results for iluzanebart come shortly after Vigil Neuroscience struck a buy-out deal with Sanofi, but analysts say the outcome is unsurprising and shouldn’t affect the deal.

Eli Lilly joins up with Camurus to make long-acting versions of the pharma’s obesity and diabetes drugs, joining the industry’s growing pipeline of programs that are differentiated by the frequency of dosing.

The FDA plans to “rapidly make available” rare disease drugs and make use of surrogate endpoints to get promising medicines to patients before they clear the traditional efficacy bar for authorization, Prasad said Tuesday.

Recent decisions to reduce health and science research funding and limit the participation of international students and researchers could prove damaging in the short and long term.

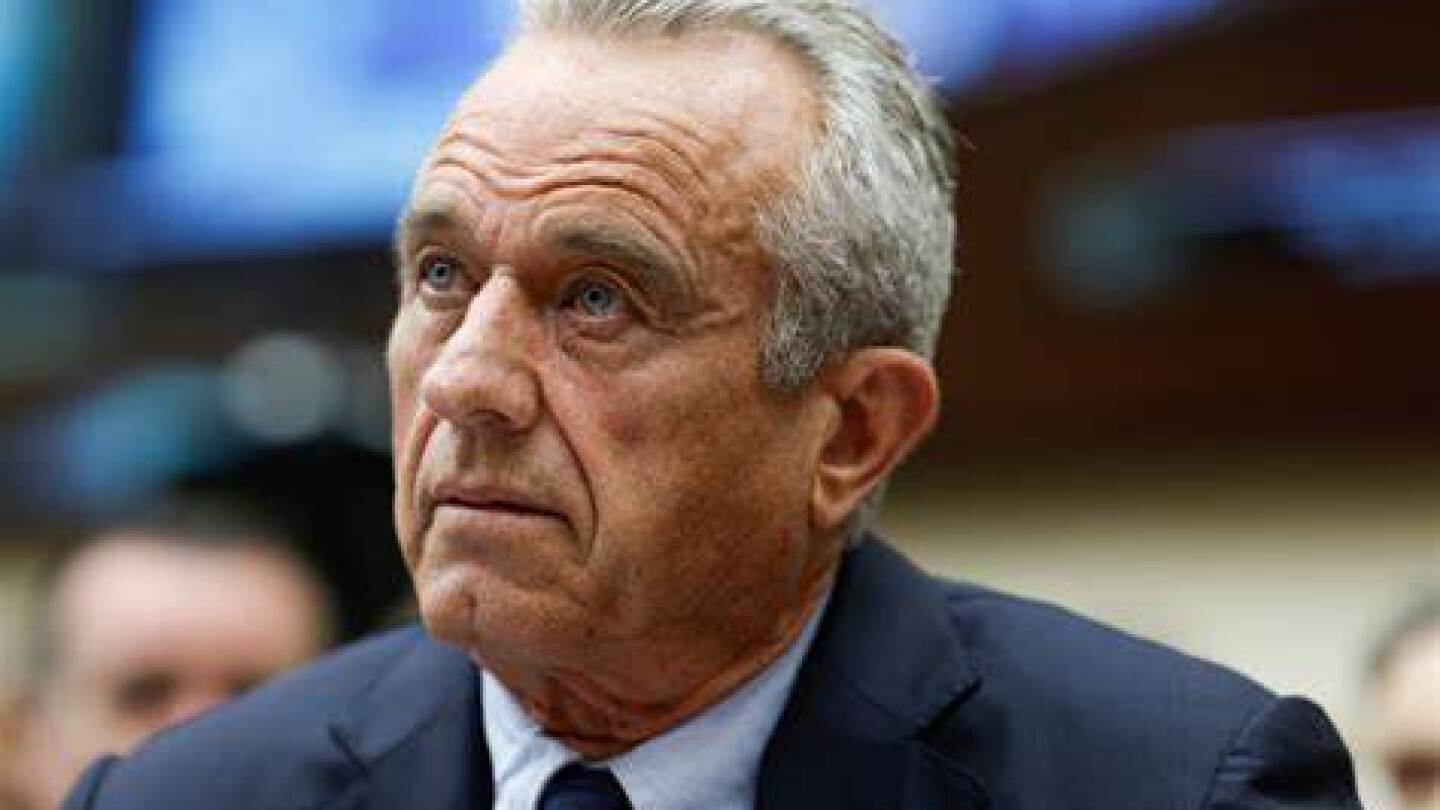

Sanofi and BMS paid big money for rare disease and cancer assets, while Regeneron got in the obesity game; AstraZeneca, Gilead and Amgen shone at ASCO; RFK Jr. and the CDC appeared to disagree over COVID-19 vaccine recommendations and several news outlets are questioning the validity of the White House’s Make America Healthy Again report.

J&J has a multi-year head start, but Gilead believes it can win market share by delivering a drug with better safety and at least as good efficacy.

Jefferies has predicted more small tuck-in deals to come, as biotechs struggle to access capital despite key clinical milestones on the horizon.