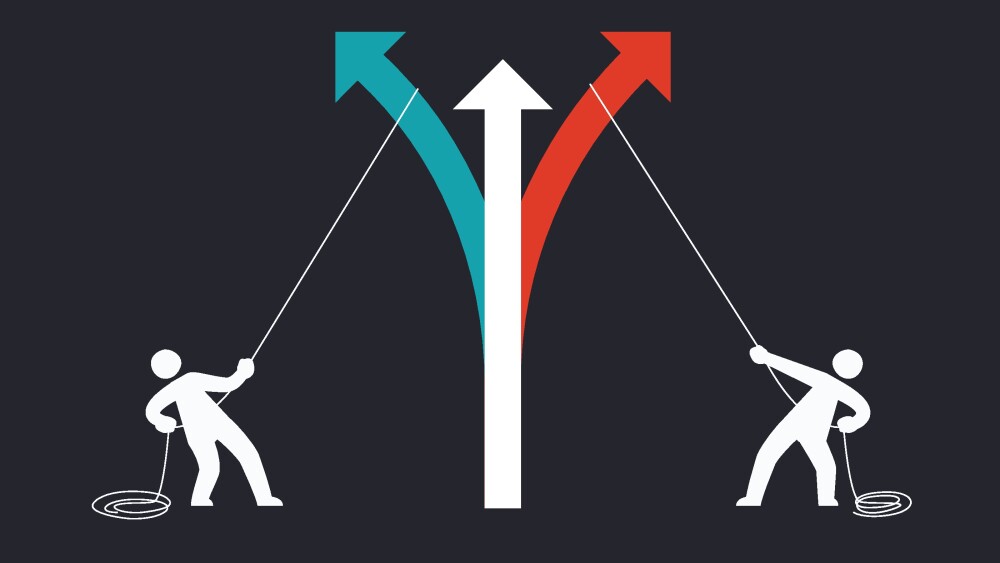

After advancing in lockstep through the pandemic, the fortunes of the biotechs have diverged as their use of COVID-19 windfalls has taken shape.

BioNTech and Moderna were two of the big winners of the COVID-19 pandemic. Having gone into 2020 as leaders in the promising but unproven mRNA space, the biotechs quickly made vaccines that validated the modality, generated billions of dollars and further extended their leads over rivals such as CureVac. Both companies looked set for bright futures.

A few years later, their fortunes have diverged, with BioNTech building an expansive pipeline beyond mRNA as Moderna has grappled with challenges. BioNTech commands a market cap north of $20 billion, making the company more than twice as valuable as Moderna. The valuations reflect Moderna’s decline over the past two years, with the company shedding value as BioNTech has held steady.

Before the recent shift, Moderna and BioNTech followed seemingly similar trajectories. Equipped with mRNA platforms, the companies attracted mega-rounds and partnerships with top pharma companies before seeing their valuations skyrocket as they changed the course of the pandemic. Yet the similarities masked differences that sowed the seeds of the recent divergence in the biotechs’ fortunes.

BioNTech Buys Bumper Pipeline

While mRNA put BioNTech on the map, even early in the company’s history the modality was just one of a range of technologies at its disposal. This is a core difference between the companies. BioNTech applied an array of modalities to one therapeutic area, with some exceptions that took the company beyond its focus on cancer. Moderna applied one modality, mRNA, to a wide range of therapeutic areas.

That difference has shaped the post-pandemic trajectories of BioNTech and Moderna. Flush with money from its Pfizer-partnered COVID-19 shot, BioNTech doubled down on its multi-modality cancer strategy. BioNTech supported its in-house mRNA pipeline with deals for assets including the anti-CTLA-4 antibody gotistobart, HER2-directed antibody-drug conjugate (ADC) BNT323 and PD-L1xVEGF-A bispecific BNT327. The pipeline’s potential has analysts excited.

“All eyes are now on whether BioNTech can move fast and execute on this impressive pipeline in a way that drives value, as they are playing in competitive spaces,” TD Cowen analysts said in a note to investors. “There is a lot here to drive interest, but we note that the company has historically had some slippage of timelines ... or outright attrition for pipeline assets.”

BNT327, now known as pumitamig, is the main event. BioNTech secured rights to the asset before the surge in interest in PD-1/L1xVEGF bispecifics, allowing it to acquire the program for a relatively small sum. Bristol Myers Squibb paid BioNTech $3.5 billion to co-develop the asset, reflecting pumitamig’s potential to replace Keytruda as the backbone of immuno-oncology combinations.

Pumitamig is one of several BioNTech assets that are in Phase III trials. BioNTech is on course to report Phase III results for gotistobart, pumitamig and BNT323, plus mRNA vaccine BNT113, next year. While pumitamig has the highest sales ceiling, TD Cowen analysts said gotistobart is “a nice commercial opportunity.” The analysts were writing after seeing non-pivotal Phase III data.

Moderna’s mRNA Moves Miss the Mark

The deal-driven creation of a pipeline stacked with promising late-phase cancer candidates has enabled BioNTech to move beyond the COVID-19 vaccine that transformed its fortunes. Phase III failures could cause the strategy to unravel but to date BioNTech has performed better than Moderna with investors in the post-pandemic era.

As BioNTech diversified, Moderna bet big on its internal pipeline, seeking to replicate its COVID-19 success by developing mRNA vaccines against an array of respiratory diseases. The biotech’s R&D budget rose from $2 billion in 2021 to $4.8 billion in 2023. With a broad late-phase push planned, Moderna told investors in its 2023 annual report that it aimed to launch up to 15 products in five years.

Multiple factors derailed Moderna’s plans. The contraction of the COVID-19 market and loss of share to Pfizer and BioNTech caused the company’s product sales to fall from $18.4 billion in 2022 to $3.1 billion in 2024. Moderna responded by cutting costs and dropping R&D programs in a push for profitability.

At the same time, the biotech’s efforts to ease reliance on its COVID-19 vaccines suffered setbacks. The FDA approved Moderna’s RSV vaccine mRESVIA in 2024. The timing meant Moderna missed out on the bumper first year of the market. Moderna has struggled to win market share from GSK and Pfizer, with a Guggenheim Securities review of prescriptions for the week ended November 21 putting its stake at just 2%.

Moderna’s plans to launch a third product were delayed when the FDA requested efficacy data from a Phase III trial of its flu vaccine. The request prompted Moderna to withdraw a request for FDA approval of its flu/COVID combination vaccine. Moderna now sees the flu shot as a growth driver for 2027 onward and the combination vaccine as a product that will start to move the needle in 2028.

A norovirus shot, which Moderna sees as a growth driver for 2028 onward, rounds out the biotech’s near-term seasonal vaccine strategy. The oncology candidates intismeran and mRNA-4359, plus the rare disease prospect mRNA-3927, give Moderna more shots on goal that could add to growth in the coming years.

One concern is how the candidates, all of which are based on mRNA, will be received by regulators and patients. Piper Sandler analyst Ted Tenthoff said at an event with Moderna in December 2025 that “under the FDA and [Health Secretary] RFK Jr., it really feels like they’ve declared war on mRNA vaccines.”

Moderna has now bowed to that pressure, with CEO Stéphane Bancel announcing at the World Economic Forum in Davos, Switzerland, last month that the famed biotech would scale down investment in late-stage vaccines as the U.S. market snaps shut.

“You cannot make a return on investment if you don’t have access to the U.S. market,” Bancel said, according to a report from Bloomberg.

Bancel’s remarks were vague, and the company has yet to clarify the future direction of the vaccine programs, and whether the shift will apply to just the infectious disease portfolio or all. Nevertheless, investors were happy with a change in direction. The company’s shares have risen 50% since the year began—but BioNTech’s are climbing too.

Moderna will continue to face the challenge of executing its late-phase strategy while contending with an FDA that recently linked the deaths of children to COVID-19 vaccines and vowed to tighten regulations. Having moved beyond mRNA vaccines, BioNTech’s headaches are largely limited to the R&D uncertainties and operational challenges that are common to all drug development.