News

FDA vouchers are normally a coveted prize for biopharma companies, but a surprise rejection for Disc Medicine’s rare disease drug has biopharma reconsidering.

FEATURED STORIES

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

Long an R&D company that partnered off assets, RNAi biotech Ionis Pharmaceuticals shifted in 2025 to bring two medicines to market alone. Analysts are already impressed—and there’s more to come in 2026.

Regulatory uncertainty is no longer background noise. It is a material investment risk that reshapes how capital is deployed and pipelines are prioritized.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

Looking at licensing deals struck in the past 10 years, Jefferies found that many Big Pharmas do not ultimately follow through with M&A after earning a right of first negotiation. Sanofi, on the other hand, almost always does, as it did with Vigil recently.

Gene therapies have ridden investor mania to huge valuations but commercialization challenges have pushed market caps to the floor. At a roundtable last week, FDA leaders promised faster approvals and broad support to the industry.

BioSpace did a deep dive into executive pay, examining the highest compensation packages, pay ratios and golden parachutes—what a CEO would get paid to leave.

Gilead underscored its faith in the combo therapy and pledged to work with regulators to resolve the hold, which has paused five clinical trials. Gilead also stressed that the hold does not impact any other assets in its HIV pipeline.

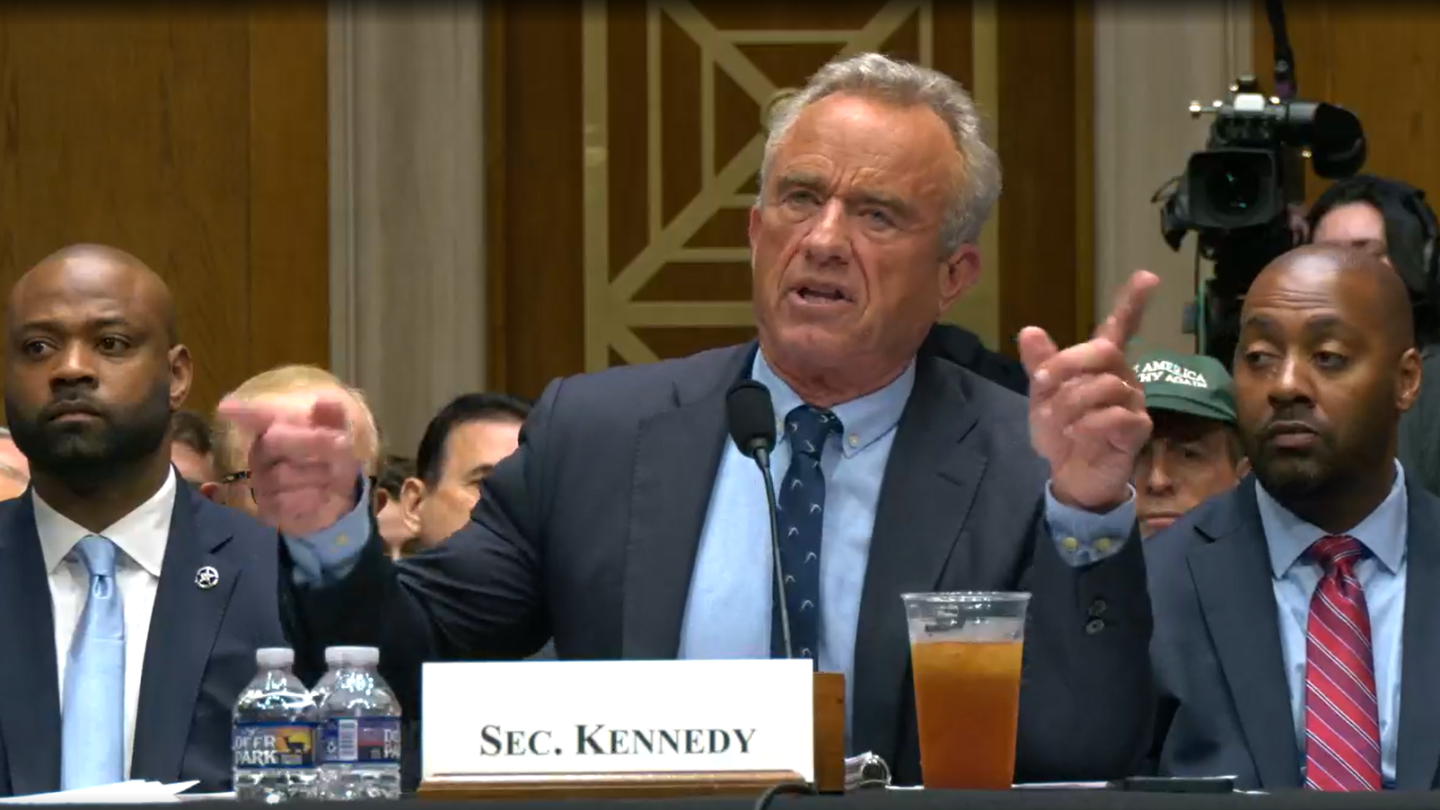

Robert F. Kennedy Jr.’s removal of all remaining members of the CDC’s Advisory Committee on Immunization Practices raises questions about the upcoming meeting later this month. Analysts fear the committee could be more sympathetic to the HHS Secretary’s anti-vax viewpoints.

As of March 31, Recursion Pharmaceuticals had a cash position of $509 million. Following Tuesday’s layoffs, the biotech expects its runway to last into the fourth quarter of 2027.

Odyssey filed for an IPO in January but never revealed a fundraising target.

Merck’s Enflonsia will go up against Sanofi and AstraZeneca’s Beyfortus, which the partners plan to ship out early in the third quarter.

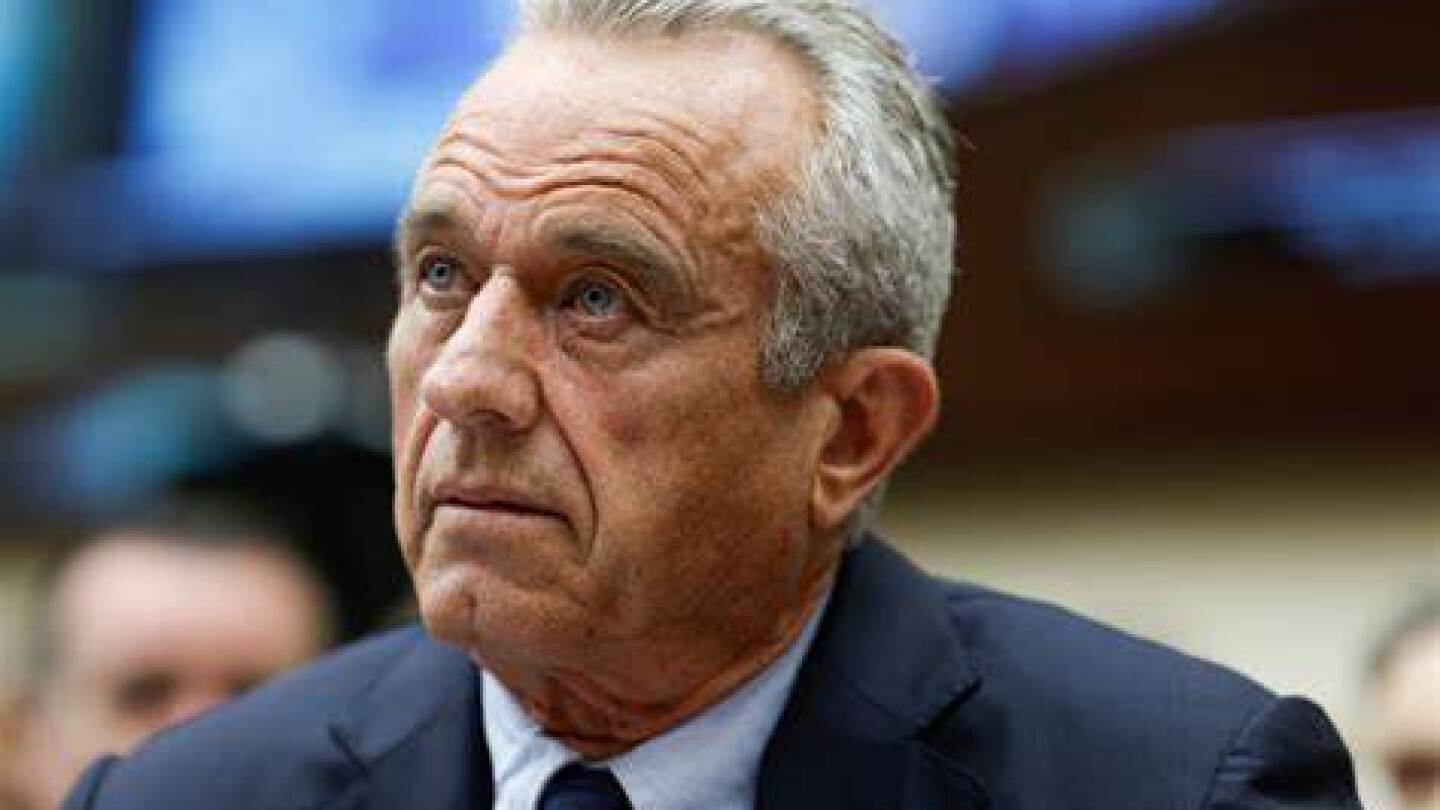

The reinstatement of the generic drug policy office is the latest reversal of course for Robert F. Kennedy Jr.'s HHS, which also recently rehired FDA staff responsible for making travel arrangements and those involved in user fee program negotiations.

Two weeks of upheaval at the CDC culminated Monday in the complete reconstitution of the CDC’s Advisory Committee on Immunization Practices as HHS Secretary Robert F. Kennedy Jr. pens op-ed criticizing “conflicts of interest” he says exist on the current committee.