News

Following the FDA’s refusal to review Moderna’s investigational mRNA flu vaccine last week, Commissioner Marty Makary faced questions from the U.S. president about the agency’s handling of vaccines. It’s a clear signal that the tension long brewing at the drug regulator has now gone all the way to the top.

FEATURED STORIES

Many scientists-turned-CEOs paradoxically abandon scientific principles when it comes to commercializing their innovations. But applying the scientific method to business decisions can help life science entrepreneurs avoid common pitfalls, attract investment and ultimately bring transformative technologies to market.

FDA vouchers are normally a coveted prize for biopharma companies, but a surprise rejection for Disc Medicine’s rare disease drug has biopharma reconsidering.

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

Against steep odds and well-established paradigms, these four companies have successfully been commercializing their products on their own.

Though nerves abound for funders and founders in the industry, money continues to flow into startups, sometimes in eye-popping numbers. BioSpace rounds up the biggest raises so far this year.

Under the Inflation Reduction Act, medications with the same active ingredient will be treated as the same drug for price negotiation purposes—even if approved by the FDA under a separate application—disincentivizing companies from investing time and money in gaining approval for new formulations and indications.

The FDA’s dramatic summer continues to unfold as news broke late Tuesday evening that Vinay Prasad will depart the agency, where he had been the head of the Center for Biologics Evaluation and Research for less than three months.

Pascal Soriot’s comments came during AstraZeneca’s Q2 earnings call in regard to President Donald Trump’s newly announced European pharma tariffs. The company also announced estimate-beating earnings, with its cancer portfolio driving earnings despite clinical roadblocks.

CEO Rob Davis referred to the cost reduction program as a ‘reallocation’ rather than a cut, with the savings to be reinvested to support up to 20 new product launches.

In a surprise double announcement Tuesday, Novo reduced sales guidance by 5%—attributing the change to slowed growth of its semaglutide franchise in the U.S.—and named current international operations head Maziar Mike Doustdar as its new president and CEO.

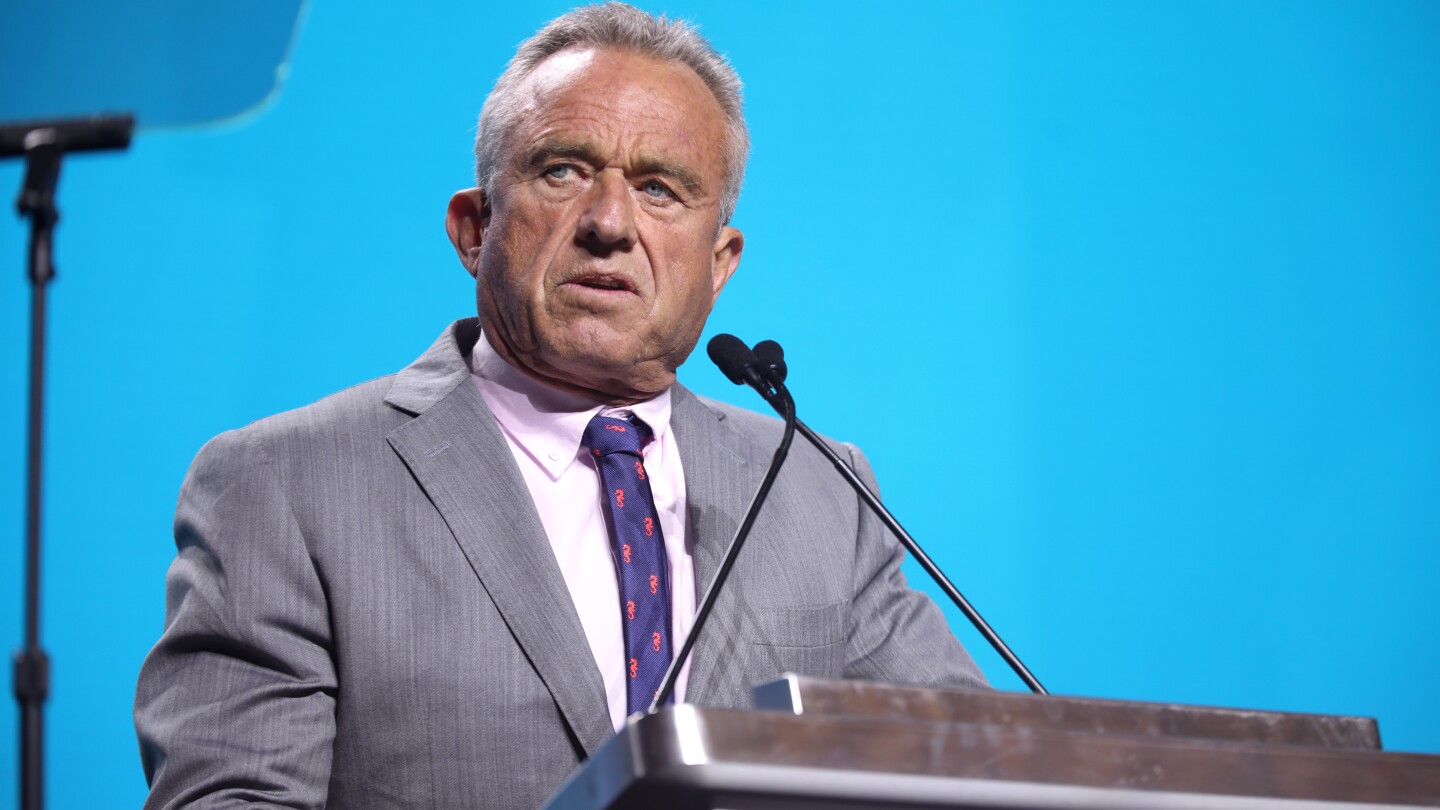

Six weeks after HHS Secretary RFK Jr. cited unexplained conflicts of interest in dismissing all 17 members of the CDC’s vaccine advisory committee, Democrats are asking for details.

While some analysts forecast the tariffs could mean billions in additional industry expenditure, others expect the overall impact to be “manageable.”

In a post on X, Health Secretary Robert F. Kennedy Jr. alleged that the Vaccine Injury Compensation Program has “devolved into a morass of inefficiency, favoritism, and outright corruption.”