News

With $6 billion left in firepower, Pfizer is planning transactions in the hundreds of millions to the low-billions range, particularly in internal medicine and immunology and inflammation, Guggenheim reported.

FEATURED STORIES

Early decisions about manufacturing and supply chains could prove costly as a company reaches the commercial stage.

While the TrumpRx deals only cover Lilly and Novo for now, the agreements are good for any cardiometabolic biotechs waiting in the wings, according to a new 2026 preview report from PitchBook.

Venture capital flow to women-founded companies has stabilized in the post-pandemic environment. BioSpace looks back at five companies that have nabbed the most over the past two decades.

Job Trends

As Novo Nordisk cuts 9,000 people from its organization in a restructuring effort, BioSpace looks back on the Danish pharma company’s rise.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

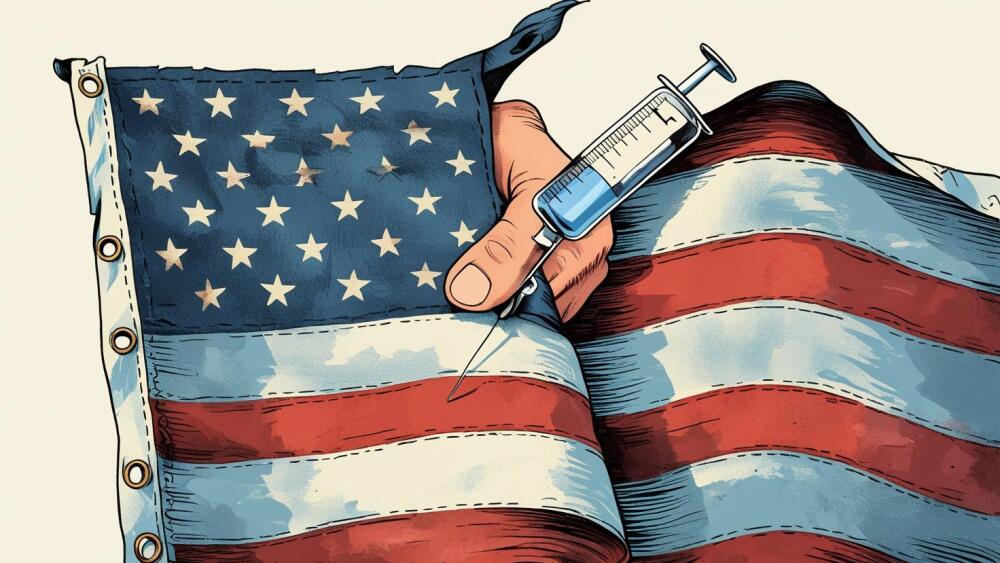

Vaccine skepticism is at an all-time high in the U.S., and HHS Secretary Robert F. Kennedy Jr. is making some drastic moves in the name of reversing that trend. But misinformation and inconsistencies within the country’s healthcare agencies highlight problems with his approach.

THE LATEST

GSK and Ideaya first linked up in 2020 to advance novel therapies for solid tumors. It is unclear why the pharma terminated the partnership.

Analysts at Jefferies see blockbuster potential in zorevunersen in Dravet syndrome, with sales potentially reaching $1 billion to $4 billion.

The pharmaceutical supply chain and device development have become intricately linked. Harmonizing formulation development with drug delivery device design—and leveraging a single‐vendor ecosystem—can deliver significant time, cost, and regulatory advantages for US‑focused drug products, according to industry experts.

As the FDA unveils a parade of initiatives aimed at accelerating drug development for rare diseases, experts appeal for a consistent approval process that will support and further catalyze momentum.

The R&D pipeline for depression therapies faced a demoralizing 2025 as five high-profile candidates, including KOR antagonists by Johnson & Johnson and Neumora Therapeutics, flunked late-stage clinical trials, underscoring the persistent challenges of CNS drug development.

Innovative outcome measures coupled with a focus on patient-centered clinical differentiation can help the biopharma industry make meaningful progress in the highly complex area of neuroscience.

Commissioner Marty Makary said that the FDA will soon start requiring only one pivotal trial, instead of two, for companies seeking approval for new drugs.

Hypersensitivity reactions in a mouse model prompted the agency to suspend Denali’s planned Phase I development for DNL952 for Pompe disease.

Praxis Precision Medicines has also announced a “successful” pre-NDA meeting with the FDA for its essential tremor drug candidate ulixacaltamide, for which an approval application is slated for early 2026.

The ACIP voted 8-3 to recommend delaying the hepatitis B vaccine, commonly given just after birth. The CDC itself has said the shot is safe and effective.