News

Jay Bhattacharya will become the latest leader of the CDC on an acting basis, days after Jim O’Neill stepped aside.

FEATURED STORIES

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

Long an R&D company that partnered off assets, RNAi biotech Ionis Pharmaceuticals shifted in 2025 to bring two medicines to market alone. Analysts are already impressed—and there’s more to come in 2026.

Regulatory uncertainty is no longer background noise. It is a material investment risk that reshapes how capital is deployed and pipelines are prioritized.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

In a Phase Ib/IIa trial, 91% of patients receiving the highest dose of trontinemab were amyloid negative after seven months of treatment, representing what B. Riley Securities called a “paradigm shift” to first-generation FDA-approved antibodies.

The German giant is looking to develop new drugs for undisclosed eye diseases using Re-Vana’s extended-release injectable platform to supply drugs to the eye for months at a time.

The star of GSK’s Hengrui partnership is the COPD candidate HRS-9821, which will complement the pharma’s respiratory pipeline that’s anchored by the anti-asthma drug Nucala.

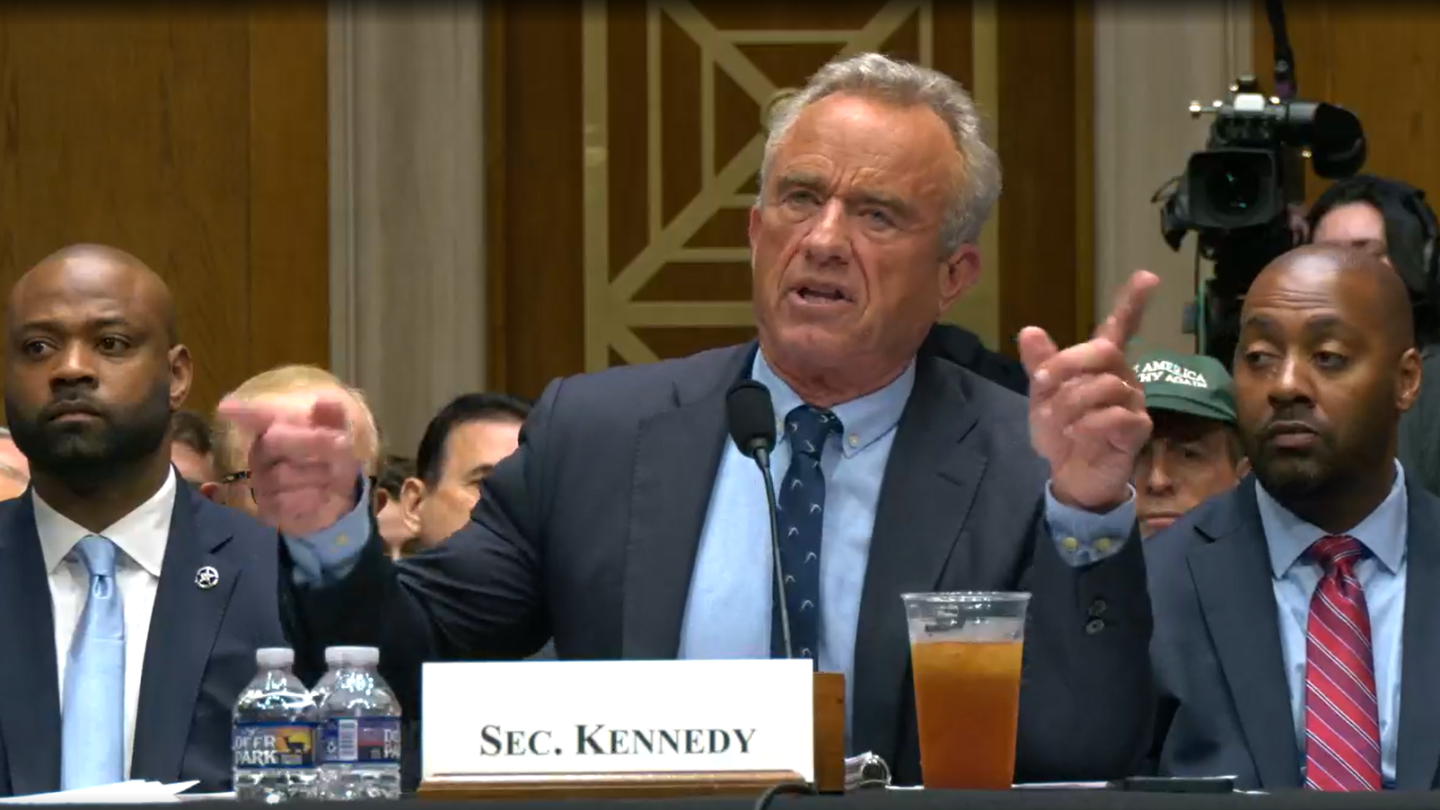

Health Secretary Robert F. Kennedy Jr. wants to remove all members of the USPSTF for being too “woke,” according to reporting by the Wall Street Journal. An HHS spokesperson, however, says no final decision has been made about the panel.

Brazilian authorities said the death was unlikely to have been caused by Elevidys and was instead more in line with severe infection exacerbated by immunosuppression.

Despite the failure of its Recognify-partnered inidascamine, Jefferies analysts do not expect a definitively negative stock impact on atai, given the company’s promising psychedelic pipeline.

Acknowledging the limits of disease-modifying drugs like Leqembi and Kisunla, companies like Bristol Myers Squibb, Acadia, Otsuka and Lundbeck are renewing a decades-old search for symptomatic treatments, including in high-profile drugs like Cobenfy.

These five upcoming data drops could usher in more effective and convenient therapies for Alzheimer’s disease and open up novel pathways of action to treat the memory-robbing illness.

The Commissioner’s National Priority Vouchers aim to offer accelerated pathways to drugs that meet certain criteria, perhaps including a low price-tag. But the policy is vaguely defined and was announced without public input, going against the FDA’s own published practices, experts say.

The collaboration focuses on ‘molecular gates,’ a class of molecules that the startup company Gate Bioscience says can stop pathogenic proteins from leaving the cell.