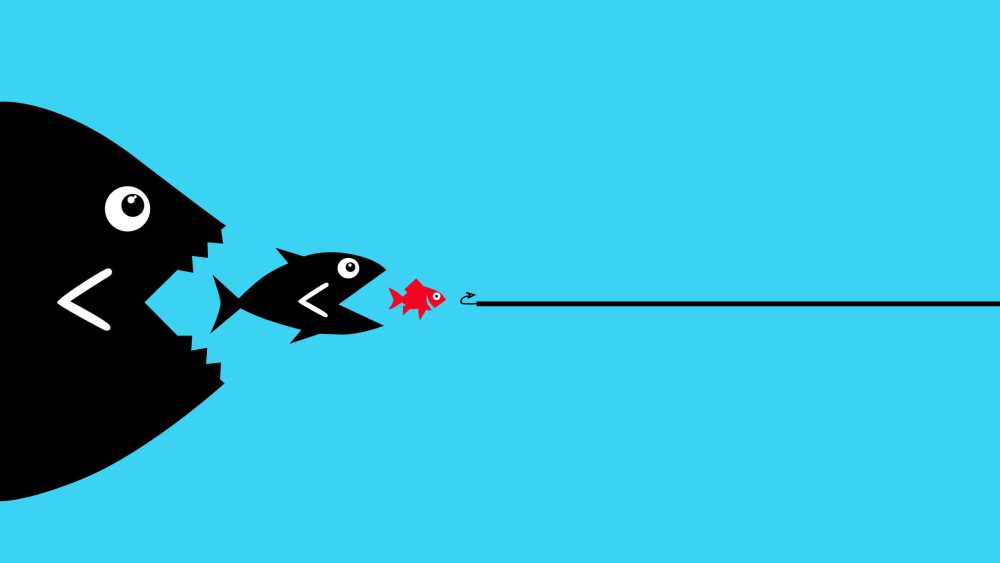

Mergers and acquisitions are not just for Big Pharma. A new report from Leerink Partners takes a stab at identifying the small- to mid-cap pharmas best prepared to bolster their pipelines with a buyout.

While Big Pharmas tend to look for deals that will meaningfully move their bottom lines via mega-blockbusters, there’s a range of companies in the middle of the pack that could purchase smaller biotechs that still bring meaningful sales potential.

Those mid-range biopharmas most likely to strike include Regeneron, Vertex Pharma, Biogen, Moderna and Jazz Pharmaceuticals, according to a report from Leerink Partners, whose analysts tallied a list of 45 companies with 2024 revenue in the range of $2–25 billion.

“Some believe that a mega-cap with $50B topline is unlikely to acquire a company if the acquired assets do not carry peak revenue potential that meaningfully move the topline,” Leerink Partners wrote. “There are several mid- to large-cap companies for which smaller acquisitions make sense, and this list is quite diverse.”

The firm also made some guesses as to companies outside of the noted revenue range who might be interested. Alkermes is one potential acquirer, as evidenced by the Oct. 22 announcement of a deal to buy narcolepsy-focused Avadel Pharma. That deal could be worth as much as $2.1 billion.

Another potential buyer is Insmed, which despite being outside of Leerink Partners’ analysis has strong growth potential, according to the firm’s analysts.

One company unlikely to deal is BioNTech, which is working through a large pile of assets in development at the moment, the Leerink team said. The German biotech bought out mRNA rival CureVac in June for $1.25 billion.

Read on for a profile of five of the companies identified by Leerink Partners as potential acquirers.

Boehringer Ingelheim

Boehringer Ingelheim had revenue of $29 billion in 2024.The German pharma company’s most recent major deal was the $1.3 billion acquisition of Nerio Therapeutics in July 2024. This brought in a preclinical pipeline of novel immune checkpoint inhibitors for cancer.

Elsewhere, Boehringer put nearly $1 billion on the line for an antibody-drug conjugate asset in a partnership with South Korea’s AimedBio earlier this month. Details were slim, but AimedBio had just two disclosed assets available for partnering, an ADC in preclinical development for solid tumors and a monoclonal antibody for atopic dermatitis and dementia.

AimedBio was the latest in a string of licensing deals for Boehringer, which included a January ADC pact with Lonza’s Synaffix worth as much as $1.3 billion. The company is also making bets in immunology, forging a $375 million deal with Cue Biopharma in April.

On the regulatory front, the 140-year-old company recent received FDA approval for Jascayd as the first new treatment for idiopathic pulmonary fibrosis in a decade.

Merck KGaA

Another German pharma, Merck KGaA, has been a frequent buyer of innovative biotechs over the past few years. The company last bought SpringWorks Therapeutics in July for about $3.9 billion, slotting the desmoid tumor drug Ogsiveo into its pipeline.

The deal followed a series of clinical setbacks for Merck KGaA, including the failure and discontinuation of evobrutinib in multiple sclerorsis and the cancellation of multiple trials for xevinapant in head and neck cancer.

To make up for these losses, Merck KGaA has gone shopping. In addition to SpringWorks, the company signed an up to $2 billion licensing deal with Skyhawk Therapeutics to work on small molecule RNA-targeting drugs in August. And in April 2024, Merck KGaA linked up with Caris Life Sciences to find new ADCs in a partnership that could be worth up to $1.4 billion.

Given its market cap of over $50 billion and 2024 revenue of $22.9 billion, Leerink suspects Merck KGaA’s shopping trip is not quite over.

Regeneron Pharmaceuticals

Regeneron continues to see good returns from the mega-blockbuster Dupixent, which it shares with Sanofi, and is heading to the FDA with one of the most exciting therapies in years, acquired through a $109 million deal with Decibel Therapeutics. DB-OTO has demonstrated hearing improvements in children with a genetic form of deafness in early-stage testing. Nevertheless, Regeneron may need to prove to investors its ability to strike a good deal.

While the deafness therapy could be transformative for patients—and the results have generated buzz on the medical conference circuit—analysts see the commercial opportunity as limited. Regeneron also faces competitive pressure from Eli Lilly in the space as well as manufacturing challenges for Eylea, which has delayed an FDA decision for a new formulation of the retinal disease drug.

Moreover, Regeneron’s decision to acquire 2seventy bio’s pipeline of cell therapies has run into some questions after an early CAR T asset for relapsed or refractory B cell non-Hodgkin’s lymphoma was discontinued. Regeneron only paid $5 million for the assets, but just one cell therapy remains in development, an anti-MUC16 asset called 27T51 being tested in Phase I for ovarian cancer.

CFO Christopher Fenimore admitted recently that the executives get a lot of questions about M&A. But the business development team leans more on licensing transactions, such as with Intellia and Alynlam, Fenimore said at Bernstein’s Healthcare Forum on September 24.

“I think when people describe our M&A approach, historically it’s described as being sort of bolt-on opportunities or fairly modest in size,” Fenimore said. “With that being said, we’re constantly looking at various opportunities out there.”

The CFO said that later-stage opportunities tend to be more competitive and the company is “price sensitive.”

To support future deals, Leerink notes the company had revenue of $14.2 billion last year and has a current market cap of $61.9 billion. The company also had more than $6 billion in net cash on hand at the end of 2024.

“We have the balance sheet that offers us a tremendous amount of flexibility that if the right thing came along that we thought made sense, we would obviously be in a position to execute on that,” Fenimore said. “We just haven’t found the right thing right now, but we’re actively out there looking.”

Daiichi Sankyo

You may know Daiichi Sankyo best from its AstraZeneca-partnered oncology assets, Enhertu and Datroway. In addition to that long-time partnership, the Japanese pharma made waves in 2023 with a deal signed with Merck & Co. worth as much as $22 billion.

But Leerink—and other analysts—think the company could soon flip the script on dealmaking, despite a limited history of acting as a buyer. With 2024 revenue of $12.4 billion and a current market cap of $48.6 billion, the company could have some firepower available, according to the firm.

Executives have said as much, revealing to Jefferies in August that they are looking for external opportunities, particularly in immuno-oncology. “Daiichi Sankyo has traditionally relied on in-house innovation, but is gearing up to acquire new growth drivers,” Jefferies analysts wrote.

Daiichi is particularly looking for early-stage oncology assets that could come to market around 2035. The company has not revealed a target value, but “We get the impression it will be billions, rather than tens-of-billions of dollars,” Jefferies wrote.

Jefferies in particular thinks that Daiichi and its Japanese peers will target immuno-oncology assets from Chinese firms, such as Hengrui or European companies like Oryzon Genomics. In the U.S., they could look at Immunocore, a biotech with a robust innovative pipeline of oncology assets.

Vertex Pharmaceuticals

Vertex’s largest M&A transaction ever came in April 2024, with a nearly $5 billion takeover of Alpine Immune Sciences. The deal brought to Vertex povetacicept, a dual antagonist of the BAFF and APRIL cytokines for autoimmune and inflammatory diseases. The company is aiming to file an accelerated approval application for the drug, which was recently granted a breakthrough therapy designation by the FDA, in the first half of 2026.

Vertex has said that the drug has “pipeline-in-a-product” potential, with indications spanning B cell–driven diseases such as IgA nephropathy, primary membranous nephropathy and generalized myasthenia gravis.

Long reliant on a steady and growing cystic fibrosis portfolio, the Alpine acquisition helped Vertex dig into nephrology.

“With continued clinical wins and prudent business development moves to date, we continue to view Vertex as a front-runner in the biotech industry with an unparalleled competitive moat in cystic fibrosis,” wrote William Blair in September.

Speaking at Morgan Stanley’s Annual Global Healthcare Conference on September 9, CEO Reshma Kewalramani admitted that she sounds like a “broken record” when it comes to external innovation. The company sticks to a ratio of 60% internal innovation and 40% external opportunities.

“We stay very close to our knitting on our R&D strategy, and we stay very close to our knitting on our external innovation strategy,” she said. “It is all about our R&D approach. And if the best assets are internal, that’s superb. And if we find great external assets, that’s super. But what matters to us is to execute on our R&D strategy.”

She declined to give any further details on where Vertex may look for those external opportunities.

Should Vertex choose to deal, Leerink noted the company had just under $11 billion in revenue in 2024 and has a current market cap of $107.8 billion. This valuation means that Vertex often ranks with the Big Pharmas in terms of the largest companies in the industry. Vertex also had a healthy $4.4 billion in net cash available at the end of 2024.