All News

Lilly’s muvalaplin is the first oral drug to show positive Phase II findings for Lp(a) reduction, eliciting up to an 86% drop in the biomarker after 12 weeks.

In this deep dive BioSpace explores the opportunities and challenges presented by the FDA’s accelerated approval program.

The deal has secured Novartis the chance to work with Ratio Therapeutics on a novel drug candidate that could fortify the Big Pharma against competition from would-be radiopharmaceutical rivals such as BMS and Lilly.

Phase II results for Cybin’s psilocin therapy showed remission rates of 71%, but just eight patients made it to the 12-month milestone.

Neurogene’s shares fell by 36% as the market opened Monday morning following news that a patient experienced systemic hyperinflammatory syndrome in a Phase I/II clinical trial of Rett syndrome gene therapy NGN-401.

Wegovy is being made available to Chinese patients five months after its approval in the country. Novo will sell the medicine for about $193.27 for a one-month supply.

Boston Pharma’s once-monthly injection efimosfermin alfa offers a convenient dosing option for MASH patients while also achieving promising rates of fibrosis and MASH improvement, according to a Phase II readout.

Analysts appear optimistic for Intellia’s gene editor nex-z, which showed a greater serum TTR reduction than Alnylam’s Amvuttra.

SignalChem Biotech provides diverse recombinant Tau proteins for research, helping advance tau-targeted therapies that may modify disease progression in Alzheimer’s and related tauopathies.

With the failure of AbbVie’s emraclidine in two mid-stage trials, Bristol Myers Squibb’s Cobenfy is ‘sole muscarinic winner.’

Bluebird has just two quarters until it’s out of cash. Executives are looking for financing to extend that runway to a projected breakeven point before the end of 2025, with analysts worried they won’t make it.

Eyenovia’s stock craters to its lowest point in its six-year lifespan as a public company following the biotech’s termination of its lead program in pediatric progressive myopia due to lack of efficacy.

Big Pharma had plenty of drama to keep journalists busy this quarter, which painted an accurate portrait of the wild and wonderful world of biopharma.

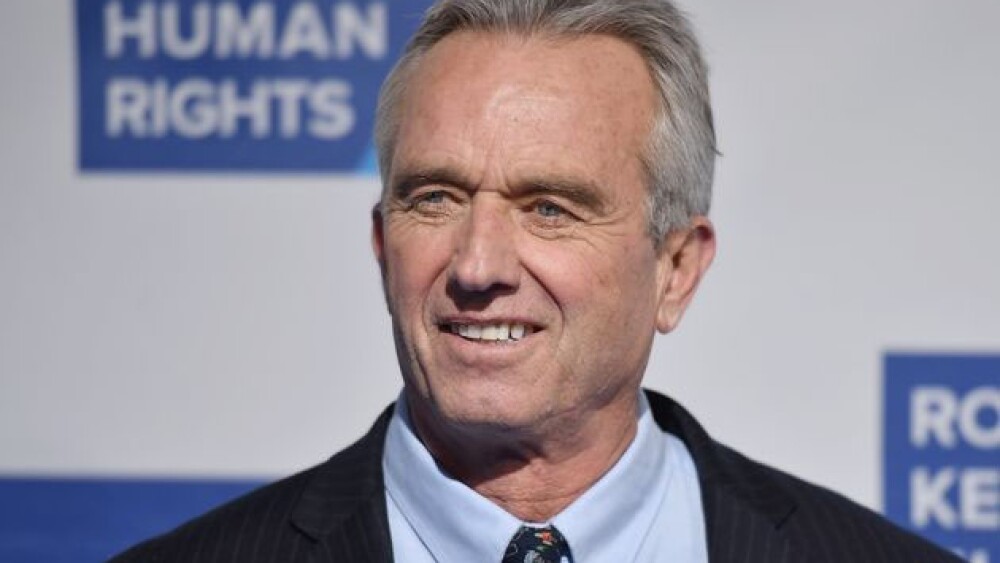

Trump’s HHS pick, Robert F. Kennedy Jr., is an anti-vaccine campaigner who has previously said that he plans to gut the FDA on allegations of corruption and reduce the NIH’s headcount.

BMS has so far been on a winning streak in the contingent value right cases, which allege that the pharma intentionally delayed regulatory activities for Breyanzi in order to avoid a $6.4 billion payout to Celgene shareholders.

Gilead’s layoffs include 72 employees at its Seattle location, which will close. Kite will shut down its Philadelphia facility. The layoffs are attributed to aligning resources with long-term strategic goals.

The November layoffs are the second known workforce reduction this year for Marinus Pharmaceuticals, which previously announced disappointing Phase III results for ganaxolone in two clinical trials.

Allogene is ceasing enrollment in a Phase I trial of cema-cel for patients with relapsed or refractory chronic lymphocytic leukemia after Bristol Myers Squibb’s Breyanzi was approved in the indication earlier this year.

Despite recent enthusiasm around the PD-1/VEGF space, BMO Capital Markets analyst Evan Seigerman noted that Merck’s pact with LaNova Medicines is more “conservativism” on the pharma’s part than confirmatory of recent data in the drug class.

Plus, communication errors that cost job offers and how to craft a LinkedIn “About” section