News

Jay Bhattacharya will become the latest leader of the CDC on an acting basis, days after Jim O’Neill stepped aside.

FEATURED STORIES

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

Long an R&D company that partnered off assets, RNAi biotech Ionis Pharmaceuticals shifted in 2025 to bring two medicines to market alone. Analysts are already impressed—and there’s more to come in 2026.

Regulatory uncertainty is no longer background noise. It is a material investment risk that reshapes how capital is deployed and pipelines are prioritized.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

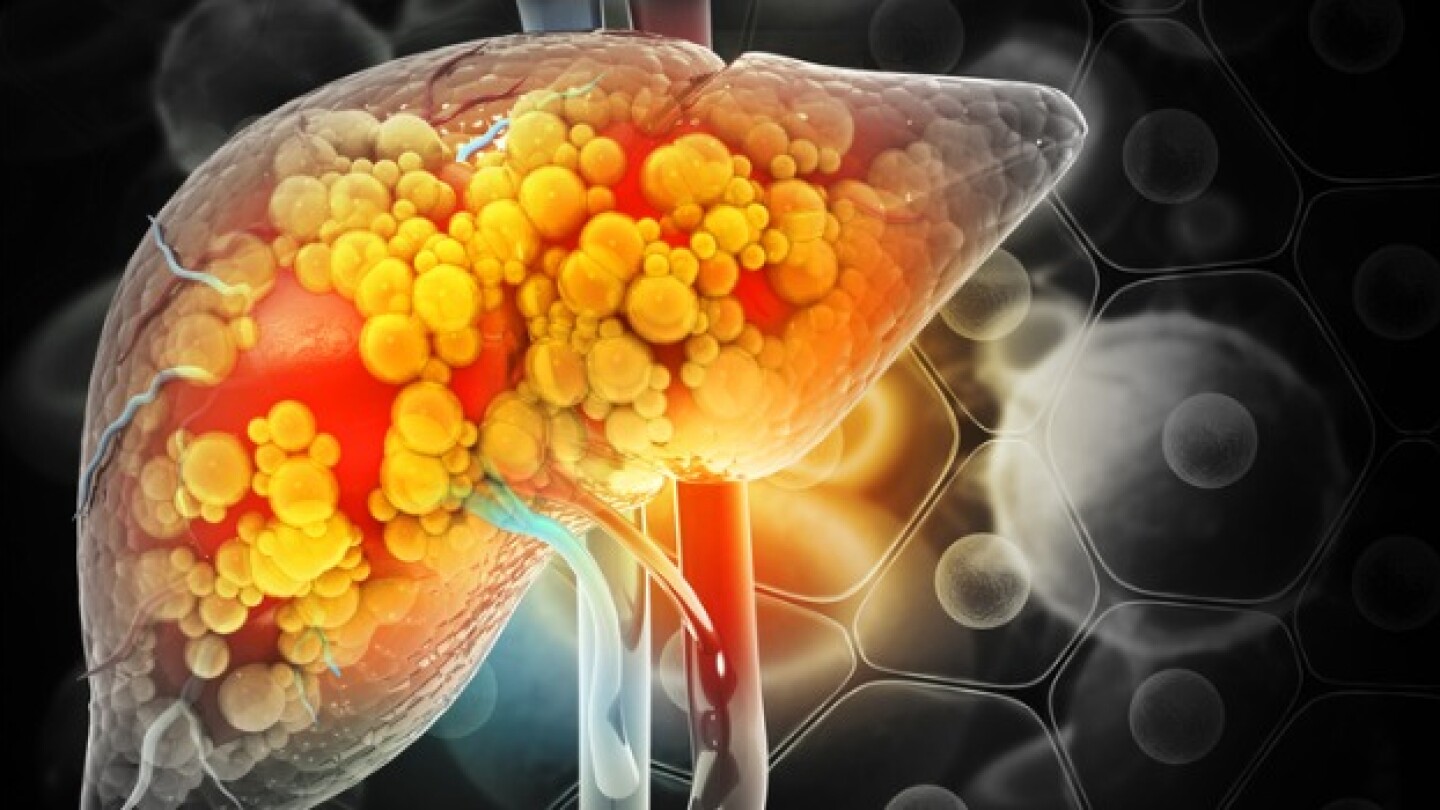

Madrigal Pharmaceuticals announced late-stage results published Thursday in The New England Journal of Medicine for resmetirom as it awaits a March 14 PDUFA date.

Biopharma’s latest earnings season was, in a word, predictable. Companies are consistently beating Wall Street earnings and revenue estimates as they set low expectations for investors.

Despite not having a single candidate in the clinical stage, the Moderna-backed biotech is offering 6.25 million shares for $15 apiece in an initial public offering. Shares are expected to begin trading Friday.

The CEOs of BMS, J&J and Merck testified Thursday before the Senate health committee that pharmacy benefit managers bear much of the blame for high pricing, while declining to commit to price cuts.

Following promising Phase IIb studies, Takeda will advance its oral ORX2 agonist TAK-861 into Phase III studies for narcolepsy type 1, while nixing the candidate’s development in narcolepsy type 2.

Investors drove up the price of Kyverna Therapeutics’ stock by 59% in its initial public offering on Thursday afternoon, the first day of trading, reaching a peak per-share price of $35.01.

Gilead Sciences is ending the development of magrolimab for the treatment of blood cancer following the FDA’s placement of a clinical hold on all its programs related to the drug.

Kyowa Kirin’s dealmaking continued on Wednesday when BridgeBio Pharma granted the Japanese company an exclusive license to develop and commercialize infigratinib.

BioNTech will pay $50 million in cash and purchase $200 million of Autolus Therapeutics’ shares to progress the companies’ respective CAR-T candidates to commercialization.

On Thursday, Kyverna Therapeutics is debuting on the Nasdaq with an upsized initial public offering which the biotech will use to support its pipeline of anti-CD19 CAR T therapy candidates.