News

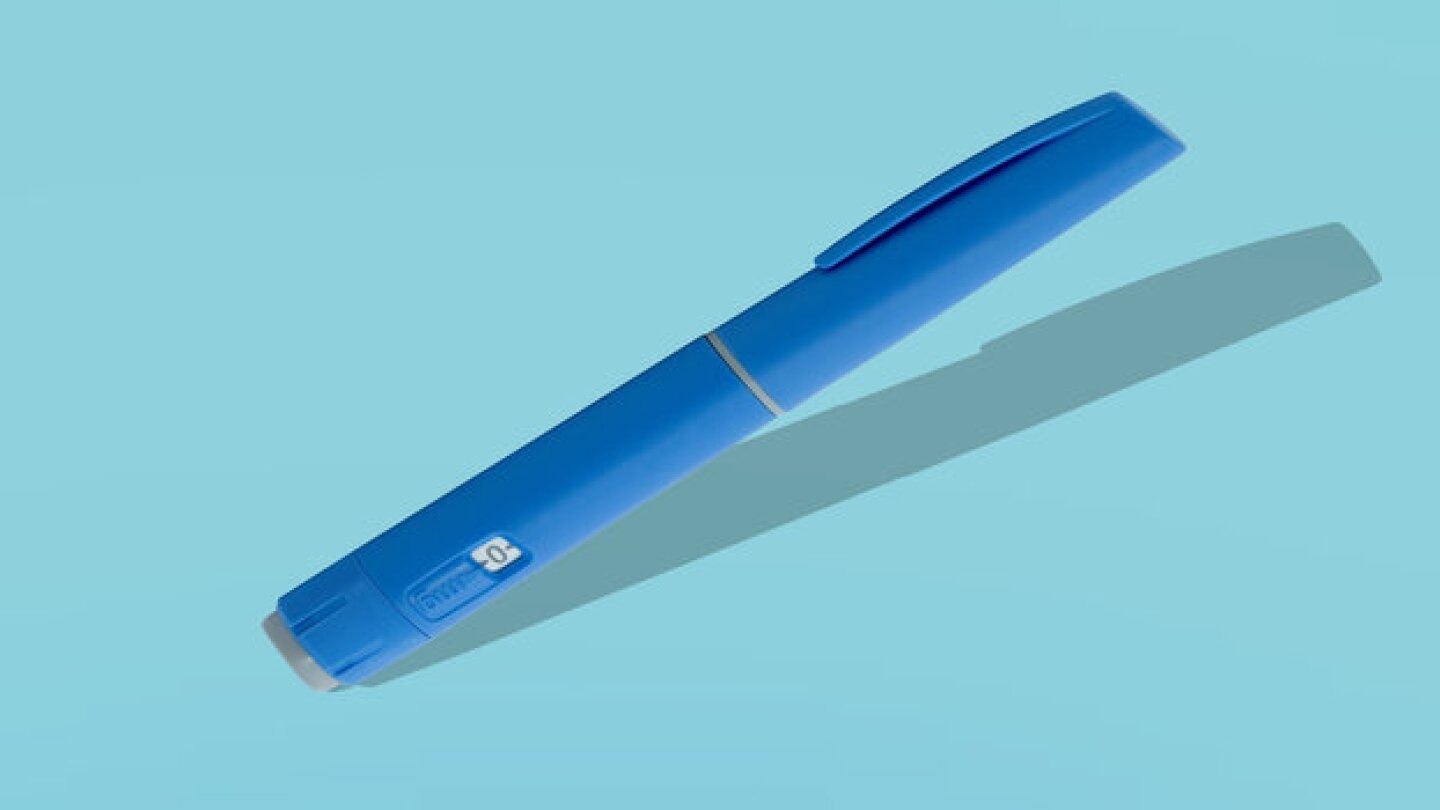

The disagreement between Moderna and the FDA has reached a resolution just eight days after the biotech received a Refusal-to-File letter in response to its application for mRNA-1010. Moderna will now seek approval of the vaccine based on age.

FEATURED STORIES

PitchBook’s 2025 biopharma VC analysis clocked $33.8 billion in capital dispatched in 2025, mainly to companies with later-stage programs ready to roll into the clinic.

Long an R&D company that partnered off assets, RNAi biotech Ionis Pharmaceuticals shifted in 2025 to bring two medicines to market alone. Analysts are already impressed—and there’s more to come in 2026.

Regulatory uncertainty is no longer background noise. It is a material investment risk that reshapes how capital is deployed and pipelines are prioritized.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

The FDA’s refusal to review Moderna’s mRNA-based flu vaccine is part of a larger communications crisis unfolding at the agency over the past nine months that has also ensnarled Sarepta, Capricor, uniQure and many more.

THE LATEST

Eli Lilly on Monday announced a $3.2 billion all-cash deal to purchase Morphic and its pipeline of oral integrin therapies in a move to expand the pharma’s presence in the autoimmune diseases space.

Roche’s tiragolumab, when combined with its PD-L1 blocker Tecentriq, did not significantly improve progression-free and overall survival versus Keytruda and chemotherapy in patients with non-small cell lung cancer.

Eli Lilly, Rivus Pharmaceuticals and more target different biological processes in hopes of generating higher-quality weight loss and avoiding metabolic issues.

Two CRLs from the FDA last week cited concerns with third-party manufacturers, while Indian CDMOs may make a bid for U.S. business if there is a decoupling from Chinese companies under the BIOSECURE Act.

President Joe Biden and Sen. Bernie Sanders in a Tuesday op-ed in USA Today called on Novo Nordisk and Eli Lilly to “stop ripping off Americans” with “unconscionably high prices” for their GLP-1 medicines.

Johnson & Johnson and Legend Biotech’s Carvykti cell therapy significantly improved survival in patients with multiple myeloma when used in the second-line setting, the companies announced on Tuesday.

GSK on Wednesday restructured its contract with CureVac to gain access to the biotech’s influenza and COVID-19 programs for $430 million upfront and up to $1.13 billion in future payments.

Despite an uncertain legislative path to becoming law, the BIOSECURE Act has already impacted the biopharma industry’s confidence in Chinese service providers and prompted efforts to diversify manufacturing partners.

Taysha Gene Therapies looks to move past its pipeline culls and staff reductions by moving its lead asset into a possible billion-dollar market.

As congressional pressure increases on WuXi AppTec and other China-based companies over alleged ties to the Chinese government, India’s contract development and manufacturing organization sector could benefit.