Drug Delivery

A push to reshore some drug production and progress in advanced manufacturing technologies have been prominent trends this year, industry leaders say.

FEATURED STORIES

Following FDA rejections, Regeneron and Scholar Rock are turning to other facilities to clear regulatory logjams created by quality problems at an ex-Catalent facility in Indiana. Novo Nordisk, meanwhile, has been tight-lipped about whether its own FDA applications have been affected.

Experts suggest the FDA’s Advanced Manufacturing Technologies designation could be a lifeline for improving production processes for approved cell and gene therapies.

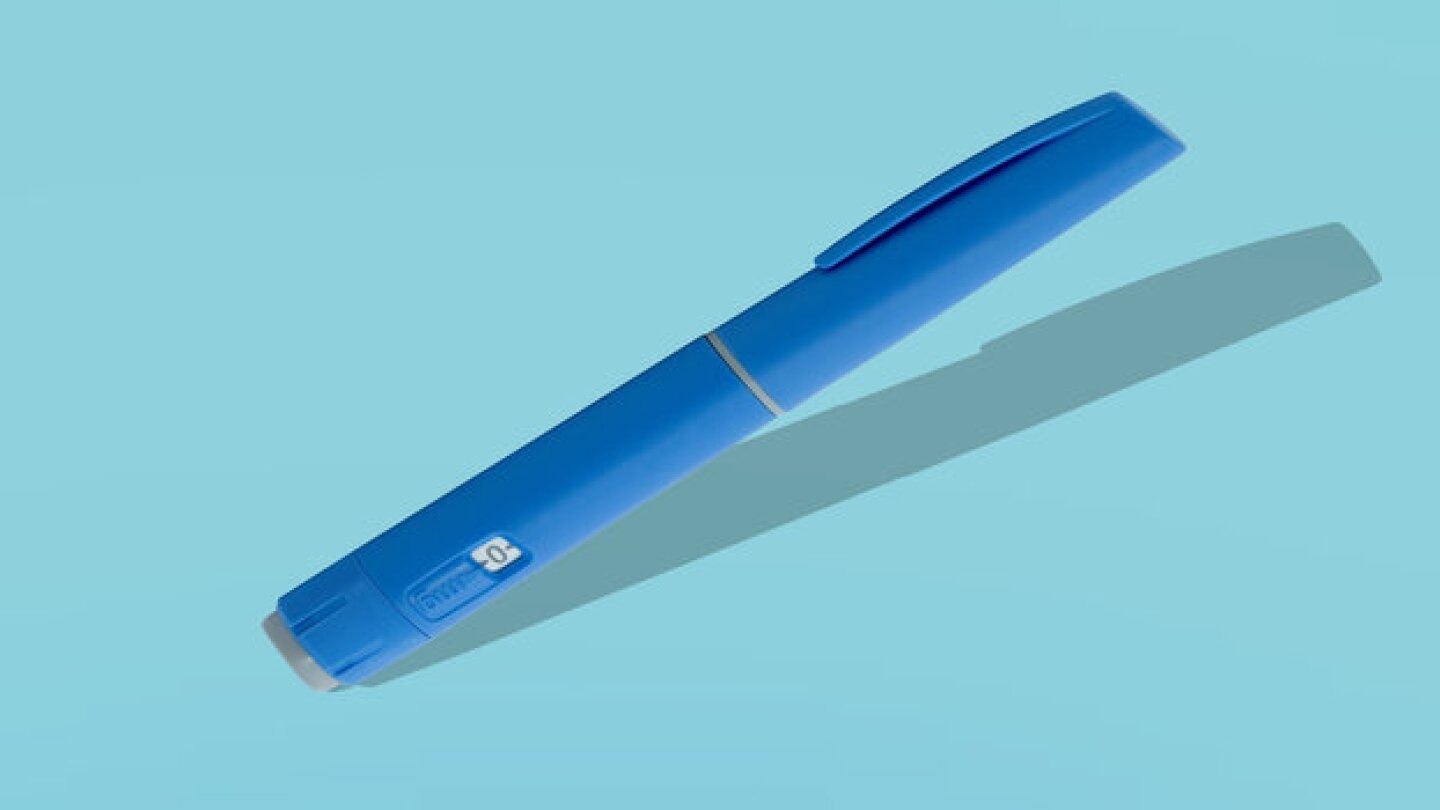

Novo Nordisk goes “on the offensive” following Trump deal that also included rival Eli Lilly, putting an exclamation point on rapidly declining GLP-1 drug prices. Experts say the unusual situation makes it hard to predict what’s next.

Subscribe to Manufacturing Brief!

Weekly insight into the biggest trends in biopharma manufacturing

THE LATEST

While many industry players and observers have high hopes for the EPIC Act, some say budgetary headwinds could make it difficult for the current administration to make meaningful repeals or amendments to the IRA.

The Outsourcing Facilities Association, a trade group representing compounders, filed a similar lawsuit in October last year after the FDA formally ended the tirzepaptide shortage.

Price-negotiation provisions that are out of step with reality are discouraging funders and Big Pharma partners from investing in potentially transformative therapies. Fixing some of the unintended consequences of the IRA will clear the way for innovative medicines to reach patients in need.

President Trump also refused to promise pharma execs that he would hamstring the IRA’s drug negotiation program.

Many of these unlawful and unauthorized shipments were explicitly tagged for compounding, according to a new analysis. Separately, a group of state attorneys general has raised concerns about the unsafe GLP-1 drugs finding their way to American consumers.

Continuing our SCOPE 2025 coverage, Rohit Nambisan, CEO at Lokavant addresses not only current challenges, but the life sciences industry’s responsibility to maintain scientific integrity.

As the Q4 2024 pharma earnings period rolls on through the first month of President Donald Trump’s second term, executives find themselves faced with policy questions ranging from the Inflation Reduction Act to RFK Jr.

Novartis, Eli Lilly and more put on their deal-making caps, Bristol Myers Squibb targets $2 billion in savings through 2027, sales continue to soar for Lilly and Novo Nordisk’s GLP-1s and Regeneron sues Sanofi over an alleged failure to provide adequate information about Dupixent sales.

Compounding pharmacies aren’t the only makers of off-brand versions of Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound. The situation is causing the FDA regulatory headaches and, more seriously, posing potential risks to the public.

According to the lawsuit, Sanofi has failed to provide partner Regeneron adequate information regarding the sales of Dupixent—including agreements with payers and pharmacy benefit managers that determine pricing and rebates for the drug.