Business

Moderna will not commit to previous 2028 breakeven guidance as the ripple effects of the FDA’s refusal-to-file decision spread through its pipeline.

FEATURED STORIES

The rare disease drugmaker is facing potential competitors for achondroplasia drug Voxzogo. Is a big M&A deal with two approved assets enough to maintain investor interest?

A rapturous response to data published last year for Pelage’s hair loss candidate overwhelmed the biotech. Now, the company is ready to show the world the science behind the breakthrough.

Pfizer, Eli Lilly, Novartis, Bristol Myers Squibb and AstraZeneca are all ramping up the use of AI, but drug discovery is not the primary success story—yet.

Subscribe to BioPharm Executive

Market insights and trending stories for biopharma leaders, in your inbox every Wednesday

THE LATEST

BioSpace recaps 2024’s top venture capital rounds in biopharma, from Xaira Therapeutics’ blockbuster $1B raise to back-to-back series from obesity-focused Metsera that totaled more than $500M in a space that has garnered more than a fivefold increase in VC dollars this year.

The updated guidance, which was largely driven by lower-than-anticipated sales of GLP-1 blockbusters Mounjaro and Zepbound, sent Eli Lilly’s shares cratering by as much as 8% Tuesday, even as the company forecasted robust 2025 revenue.

Biopharma executives were busy Monday, striking high-value deals and providing updates on cancer, obesity and vaccine pipelines.

J.P. Morgan kicked off with a flurry of deals, with Eli Lilly, GSK and Gilead all announcing deals potentially worth more than $1 billion while J&J committed $14.6 billion to buy Intra-Cellular. These moves have reinvigorated sentiment across the biopharma industry.

In exchange for its investigational gene therapies, Regenxbio will receive $110 million upfront and up to $700 million in milestones. After hitting an all-time low of $6.95 at close of business yesterday, the stock surged on the news by nearly 20% before markets opened Tuesday.

Sarepta Therapeutics’ Duchenne muscular dystrophy therapy Elevidys handily beat analysts’ expectations in the fourth quarter of 2024, reflecting the biotech’s “world-class” execution, according to BMO Capital Markets analysts.

Passage Bio’s workforce reduction could affect about 32 people, leaving the company with 26 employees as it continues evaluating a treatment for frontotemporal dementia with granulin mutations.

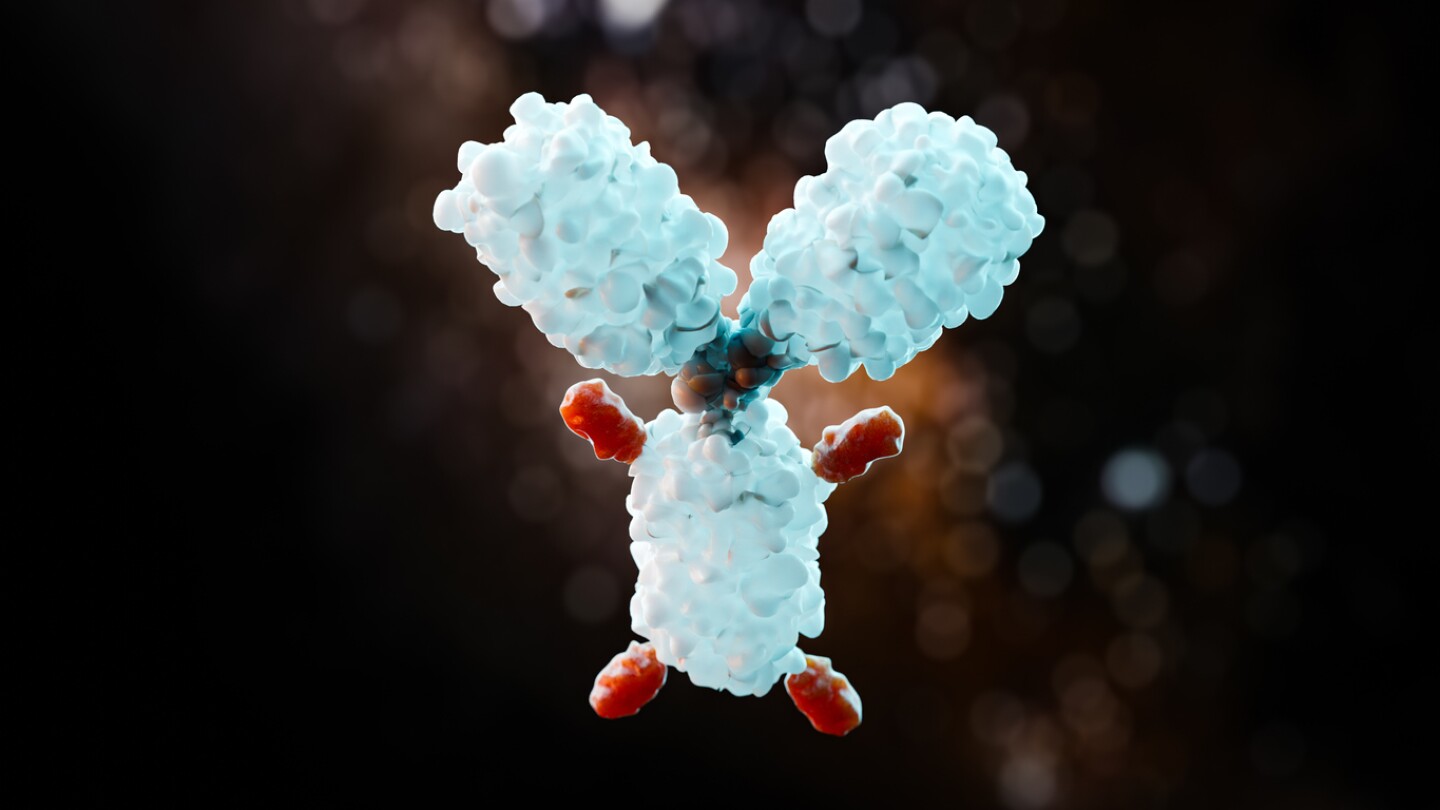

On the heels of an FDA approval for its monoclonal antibody Bizengri, Merus will generate three novel cancer-targeting antibodies that it will pass over to Biohaven to link into antibody drug-conjugates.

Biogen’s proposed acquisition comes after two difficult years of regulatory and clinical challenges, during which shares of Sage Therapeutics have fallen by more than 90%.

Among Intra-Cellular’s neuropsychiatric assets is Caplyta, a pill approved for schizophrenia and bipolar depression and proposed for major depressive disorder.