Business

The current state of political affairs in the U.S. does not bode well for the direction of that turn. The country is at real risk of losing its long-held lead in biotech innovation.

FEATURED STORIES

The rare disease drugmaker is facing potential competitors for achondroplasia drug Voxzogo. Is a big M&A deal with two approved assets enough to maintain investor interest?

A rapturous response to data published last year for Pelage’s hair loss candidate overwhelmed the biotech. Now, the company is ready to show the world the science behind the breakthrough.

Pfizer, Eli Lilly, Novartis, Bristol Myers Squibb and AstraZeneca are all ramping up the use of AI, but drug discovery is not the primary success story—yet.

Subscribe to BioPharm Executive

Market insights and trending stories for biopharma leaders, in your inbox every Wednesday

THE LATEST

Executives don’t just get paid big bucks to operate a company. Sometimes they get paid millions to walk away.

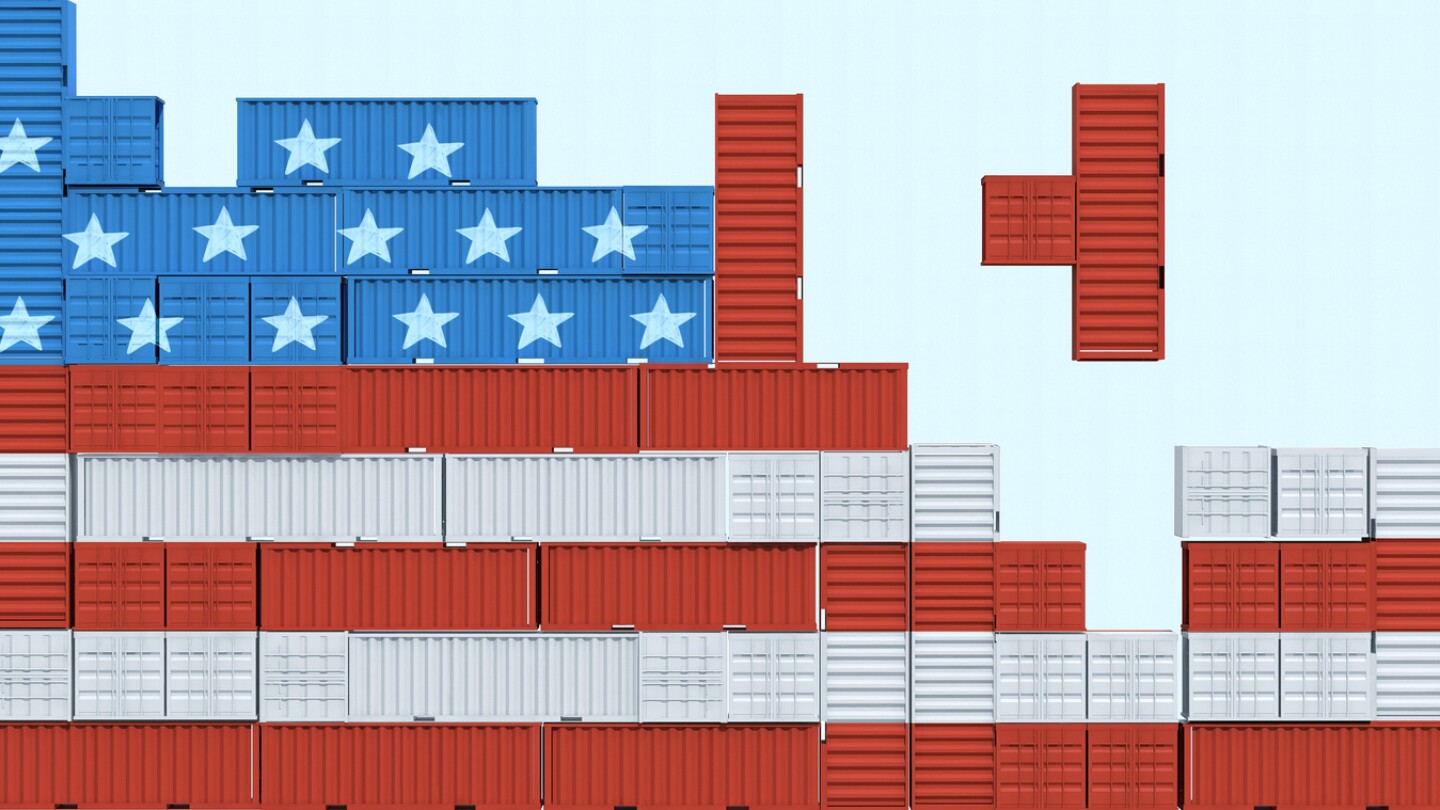

Biotech was starting to show signs of recovery after years of investor pullback—until new tariffs and economic uncertainty sent fresh shockwaves through an already fragile market.

Paul Stoffels left his perch as J&J’s chief scientific officer in 2022 to replace Galapagos’ founding CEO Onno van de Stolpe, inheriting a company that had suffered a series of clinical failures since its 1999 creation.

Alnylam and BridgeBio are competing for people who are switching from Pfizer’s blockbuster ATTR amyloidosis drug tafamidis while all three companies are fighting for new patients.

Roche is committing $50 billion while Regeneron inked a $3 billion manufacturing deal with Fujifilm, allowing the pharma to “nearly double” its U.S. large-scale manufacturing capacity.

California-based Tempest Therapeutics is laying off 21 of its 26 full-time employees. The cuts come while the biotech is exploring strategic alternatives, including a merger or acquisition, as it tries to move its investigational PPARα antagonist into late-stage development.

Disruptive conditions are typical in non-Western markets. The U.S. industry, thrown into a period of significant change as the Trump administration overhauls HHS and considers implementing tariffs, could learn a thing or two by looking overseas.

President Donald Trump in February threatened top pharma leaders, including Eli Lilly CEO David Ricks, with tariffs unless they reshore their manufacturing operations.

BML Capital Management, an activist investor that owns 9.9% of Elevation’s shares, is urging the company to wind down operations given “the current state of the public equity market.”

Alis Biosciences’ plan is a familiar tactic in the private equity world, but the firm will instead be listed on the public markets “in due course.”