May 12, 2015

By Mark Terry and Riley McDermid, BioSpace.com Breaking News Staff

A delegation of executives of Vertex Pharmaceuticals are meeting today with members of the U.S. Food and Drug Administration (FDA) Pulmonary-Allergy Drugs Advisory Committee to discuss the merits of Orkambi, the company’s drug for cystic fibrosis.

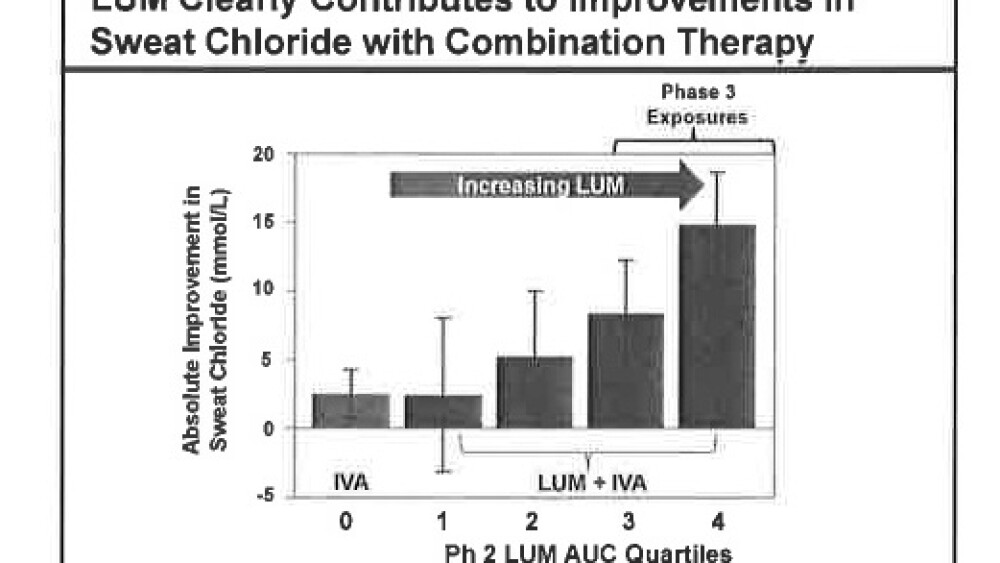

At least part of the meeting will address concerns that one of the drugs in the two-drug combination doesn’t add any particular benefit. Jeffrey Chodakewitz, senior vice president for global medicines development at Vertex, however, said in a statement, “There is compelling evidence that the combination … is needed to provide the greatest benefit for patients.”

One of the ingredients of Orkambi is ivacaftor, which Vertex markets under the name Kalydeco. Kalydeco is used to treat patients with one specific mutation in the CFTR gene, not including F508del, the most common cystic fibrosis mutation. Orkambi combines ivacaftor with lumacaftor. Neither lumacaftor nor ivacaftor, by themselves, help cystic fibrosis patients with the F508del mutation. But a combination of the two has shown positive results in clinical trials.

The relatively modest improvement seen in the trials are behind at least part of the FDA’s questions regarding Orkambi’s overall effectiveness. “The contribution of lumacaftor to the efficacy of the proposed combination product has not been shown,” a study document stated “Treatment with lumacaftor for four weeks produced a small numerical decrease in sweat chloride that was maintained after an additional four weeks of treatment with lumacaftor/ivacaftor. However, the decreases observed for sweat chloride were small when compared to the sweat chloride response noted for ivacaftor in the G551D and R117H mutations.”

The meeting is expected to last all day.

Kalydeco generated $464 million in revenue last year. In the U.S., there are about 30,000 CF patients, but only 7 percent have the specific gene mutation that Kalydeco treats. If Orkambi is effective and gets approved, it could potentially be used to treat about 15,000 of those patients in the U.S. alone, although more likely be applicable about 8,500 patients 12 years and older. However, potential revenue if approved, is projected at $5 billion within a couple years.

The Vertex portion of the presentation was concluded by Bonnie Ramsey, director of the Center for Clinical and Translational Research at Seattle Children’s Hospital and the Washington School of Medicine, saying Orkambi “will have a major impact” on her CF patients.

News last Friday that the FDA’s Pulmonary-Allergy Drugs Advisory Committee has released its briefing notes ahead of the meeting initially spooked the market, but the company has roared back as Wall Street agreed the document is an overall positive.

When parsed thoroughly the documents appeared to show the FDA believes that there is a statistically significant benefit over placebo in FEV1 but has questions about the small treatment effect and the lack of ivacaftor monotherapy and lumacaftor monotherapy controls in the Phase III trials, said analysts.

The lead biotech analyst at Citigroup, Yaron Werber, said a closer look at the FDA’s notes show the regulator is generally open to the idea of approving Orkambi.

“Given that Orkambi has Breakthrough designation, which provides for enhanced interaction, FDA notes that they and EMA agreed with the study designs and continuously provided constructive guidance,” wrote Werber.

“As such we believe that FDA needs to raise this question for discussion but is supportive of the trial design. The key question is whether the benefit is clinically meaningful. We believe that the AdCom will vote positively for approval of Orkambi given the lack of alternative treatment options for cystic fibrosis patients homozygous for the F508del mutation in the CFTR gene.”

In the documents, the FDA agrees that Orkambi shows statistically significant benefit over placebo in FEV1, regardless of the dose—but still had questions about whether the 2.6 percent and 3 percent FEV1 benefit over placebo is clinically meaningful. The regulator is also questioning the additional benefit provided by lumacaftor given the similarity of the treatment effects seen in the 150mg ivacaftor monotherapy study and Orkambi’s pivotal trials.

As part of that, Vertex has faced a barrage of theoretical situations, including the FDA asking a hypothetical question about whether an ivacaftor monotherapy trial might show similar improvements in lung function and reductions in CF pulmonary exacerbations to those seen by Orkambi. But those questions shouldn’t spook investors, said ISI Evercore analyst Mark Schoenebaum.

“Bottom line: despite the questions raised by the FDA in the briefing documents, we believe that the preponderance of evidence will push the clinicians on the panel (and the FDA) to not withhold Orkambi from F508del patients (nuanced statistical arguments unlikely to sway a panel of clinicians, in our view),” wrote Schoenebaum.

“On the question of benefit the double pill over Kalydeco alone, a post-marketing study if deemed necessary would also be sufficient to resolve this issue,” he said. “Therefore, we believe the risk of regulatory non-approval is still low (not zero!) but that we should all bear in mind that some of the questions raised in the document could make reimbursement discussions outside the U.S. more difficult.”

Werber agreed with that assessment, saying in his own note that so far the questions asked have been helpful and shouldn’t affect Vertex too much going forward.

“We believe that these questions are exploratory in nature,” said Werber. “Since FDA agreed with Vertex on the trial design and provided expert advice on statistical analysis and since Orkambi shows a benefit over placebo, it is very likely to be approved.”