BioSpace data show biopharma professionals faced increased competition for fewer employment opportunities during the second quarter of 2025, with increased pressure from further layoffs.

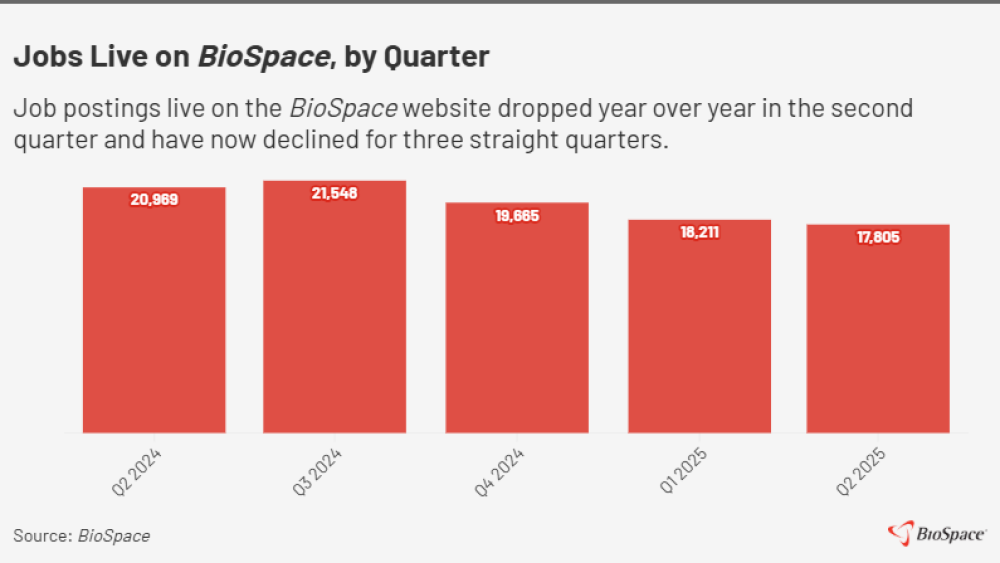

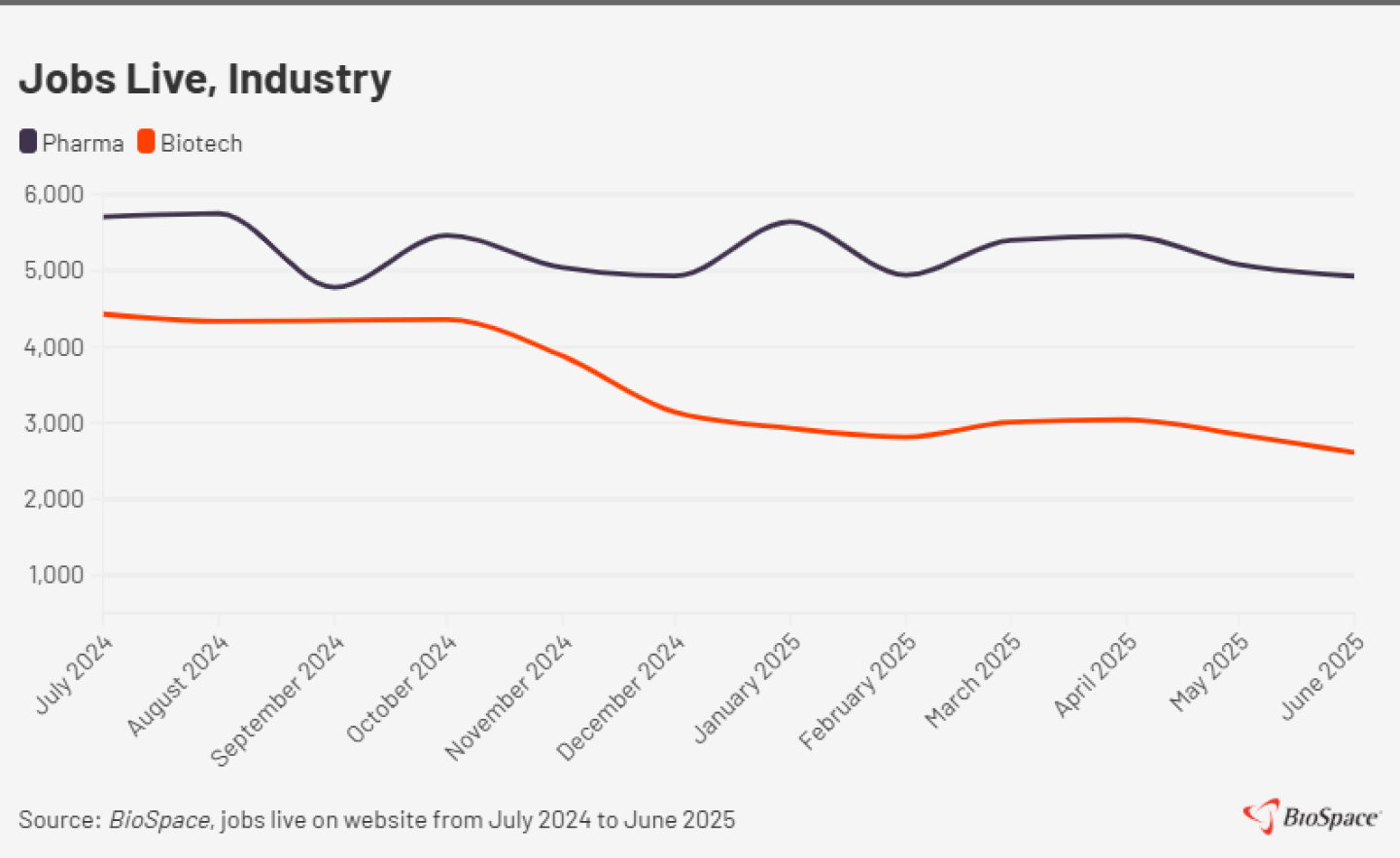

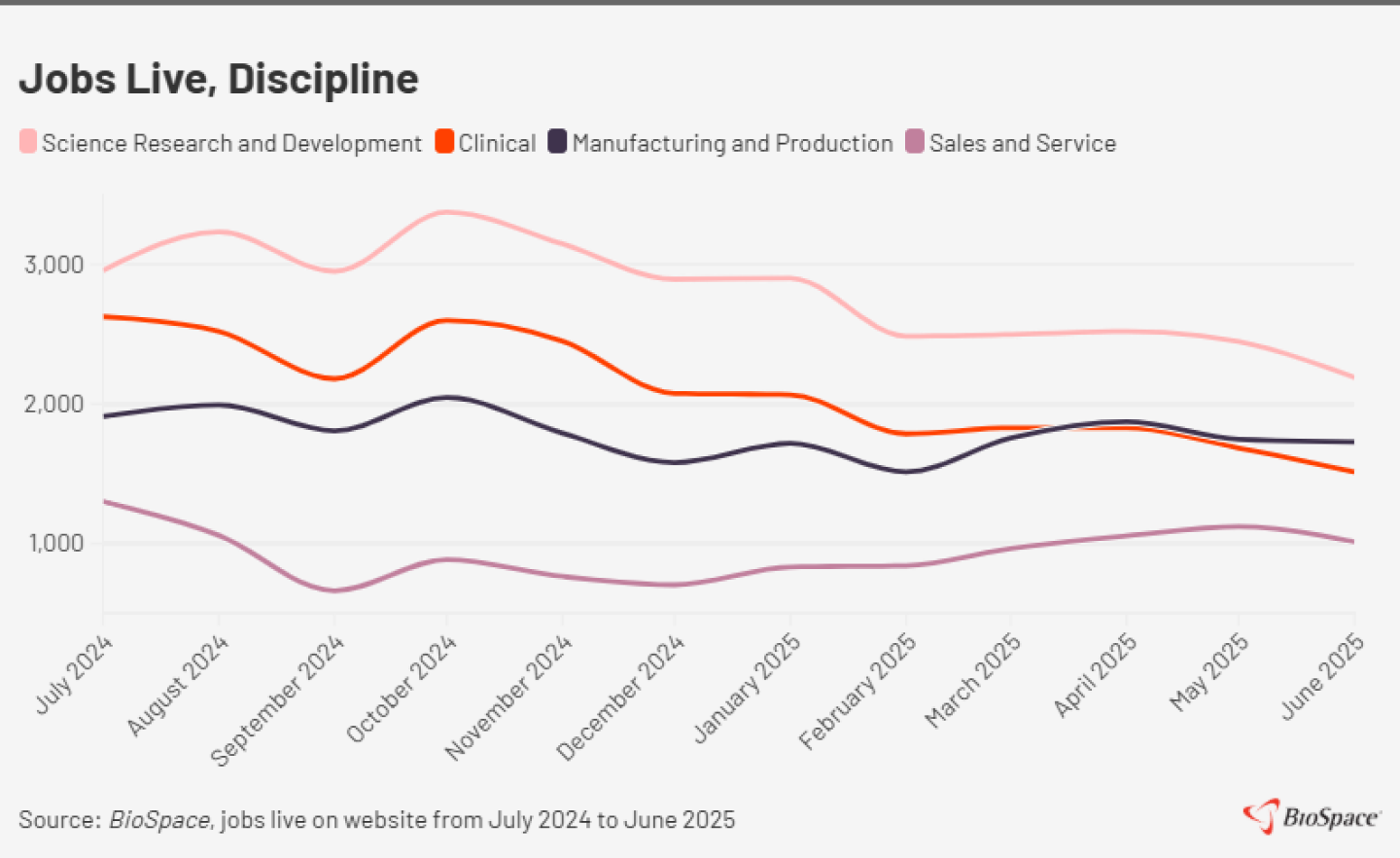

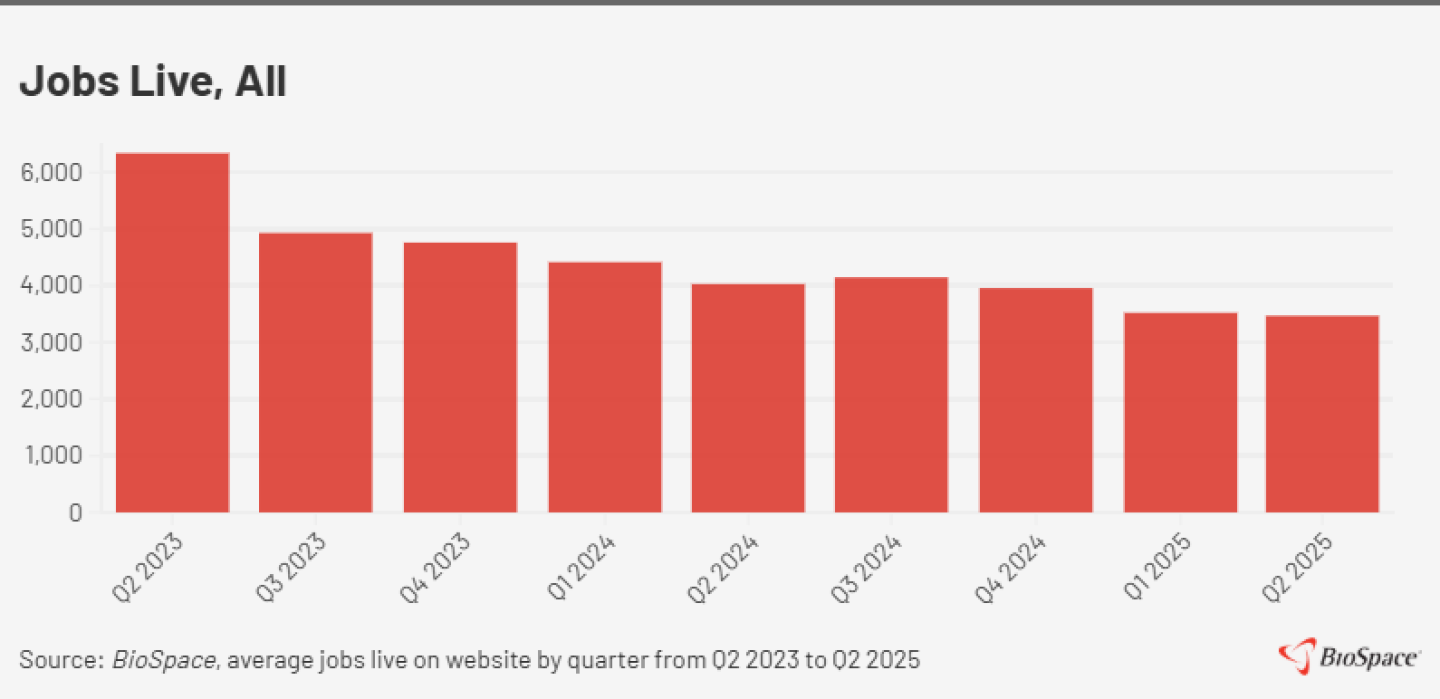

Finding or changing biopharma jobs likely proved difficult for some in the second quarter, based on BioSpace data. During Q2, job postings live on the BioSpace website dipped 15% year over year and applications jumped 79%, signaling increased competition for fewer open roles. Further complicating the situation was the number of employees laid off in the second quarter, which rose 38% compared to the same period in 2024.

The decline in positions live on BioSpace wasn’t a new occurrence—it’s the third straight quarterly decrease. Also noteworthy: The number of jobs live in Q2 was lower than in any quarter of 2024.

Recent U.S. Bureau of Labor Statistics (BLS) and ADP data underscore the difficulty some biopharma professionals likely experienced when looking for work last month. Although the U.S. added 147,000 jobs in June, according to BLS, about half (73,000) were government roles. State government employment alone went up by 47,000, largely in education (40,000).

On the other hand, private employers shed 33,000 jobs in June, according to ADP’s latest national employment report, which is based on anonymized payroll data from more than 25 million U.S. employees.

In their analysis of BLS’ employment data, Wells Fargo economists noted that the headline numbers, including unemployment dropping from 4.2% in May to 4.1% last month, were generally encouraging. However, they added, the details underneath the surface were consistent with a cooling labor market. For example, the economists noted that the jump in state and local government education employment could be a seasonal quirk related to the school year ending. They also stated that hiring outside of two sectors—healthcare and social assistance as well as leisure and hospitality—was relatively flat.

“Furthermore, the decline in the unemployment rate was partially driven by workers leaving the labor force,” the economists said. “The labor force participation rate fell to 62.3%, its lowest reading since December 2022.”

Year Over Year, More Companies Cut More Staff

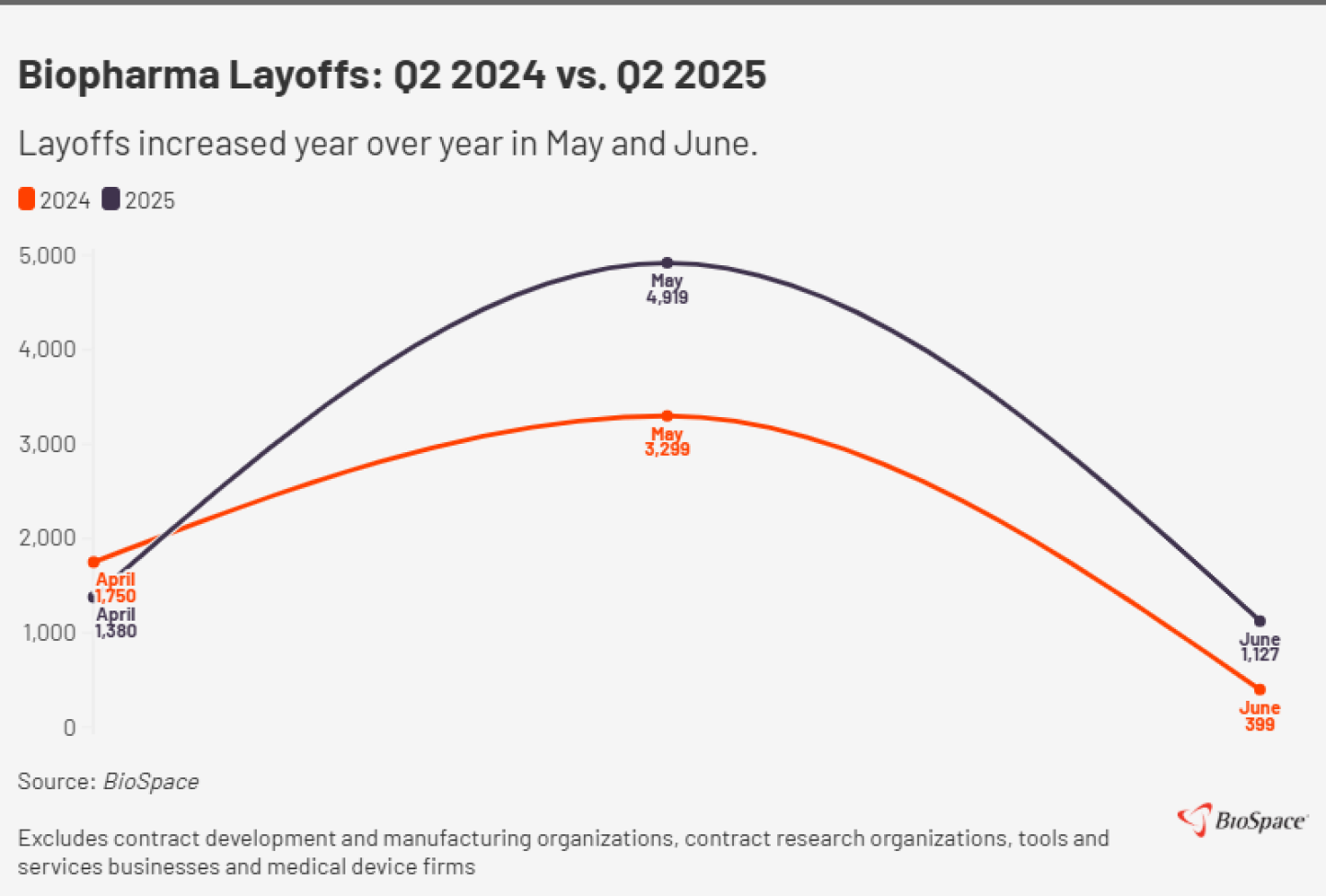

Unemployment has become all too familiar to biopharma professionals as companies continue laying off employees to cut costs and stay afloat. During the second quarter, 62 biotechs and pharmas laid off 7,426 people, according to BioSpace tallies. Those numbers exclude contract development and manufacturing organizations, contract research organizations, tools and services businesses and medical device firms.

The second-quarter cuts represent not only a 38% year-over-year increase in affected employees but also a near doubling of companies making cuts, as 32 businesses let go of 5,388 staffers during the same period in 2024.

Q2 began on a somewhat hopeful note, as the number of employees laid off in April declined 21% compared to the same month last year. However, year-over-year increases popped up for May (+49%) and June (+232%), with May hitting the highest monthly total for people let go in 2025 (4,919). The number of companies making cuts was higher throughout the quarter when compared to 2024, especially in May, when it more doubled (28 this year vs. 11 last year).

The largest second-quarter layoff round—also the biggest mass cut in the first half of 2025—occurred in May at Teva Pharmaceuticals. The company will cut about 2,900 employees worldwide by 2027.

Teva’s layoffs far outnumbered Q2’s second-largest workforce reduction. In May, Bristol Myers Squibb disclosed it was letting go of 516 employees in Lawrenceville, New Jersey. It wasn’t the pharma’s only Q2 staff cut. BMS had three layoff rounds total, totaling 717 people. The workforce reductions are part of the company’s strategic reorganization intended to save $3.5 billion through 2027.

Leap Therapeutics also had multiple workforce reductions in the second quarter. In May, the company announced it would cut about half of its workforce, an estimated 24 employees, at its lone location in Cambridge, Massachusetts. Then last month, Leap announced it would let go of 75% of its remaining staff, which could leave the business with fewer than 10 people.

For some biopharma professionals, job loss resulted from company closures. During the second quarter:

- iTeos Therapeutics, Octagon Therapeutics, Third Harmonic Bio and Vincerx Pharma announced they were winding down operations.

- Unity Biotechnology shared it might shut down and noted that it was cutting its entire workforce.

- Sage Therapeutics laid off all its staff after being acquired by Supernus Pharmaceuticals.

Wells Fargo economists who track layoff data across industries recently voiced doubts about how easily the unemployed will land their next roles. In a July 2 analysis, they noted that in addition to jobless claims gradually climbing since January, continuing claims for unemployment insurance are also increasing, “indicative of it becoming more difficult for workers laid off to find suitable new employment.”

In biopharma, massive cuts at the Department of Health and Human Services contributed to the flooded job market. Some of those affected, however, have been rehired. Meanwhile, the legality of the cuts has been under review. This week, for example, the U.S. Supreme Court reversed a California court’s May ruling that had temporarily suspended the government’s workforce reductions at federal agencies, including the HHS. With the Supreme Court’s decision, the sweeping reorganizations can continue.

Job Activity Trends

This article’s content originally appeared in a July 10, 2025, special edition of Career Insider. Subscribe for the latest job market reports, job trends and career advice.