Every year, BioSpace analyzes the biotech industry, looking for the hot new biotech startups to watch. Here’s a look at the top 3 companies from the Top 30 Life Science Startups to Watch in the U.S. from 2015.

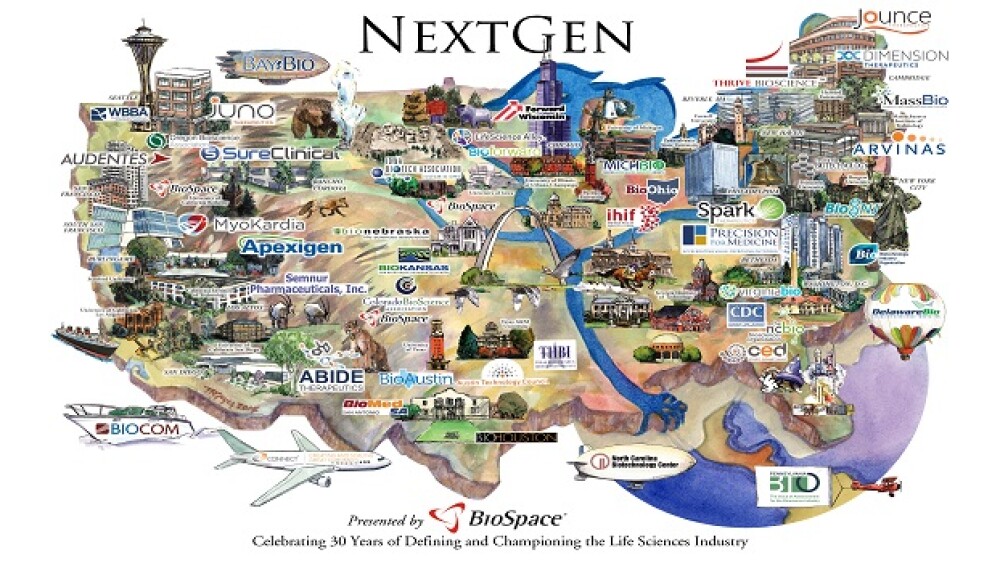

NextGen Bio Class of 2015 Hotbed Map

Every year, BioSpace analyzes the biotech industry, looking for the hot new biotech startups to watch. We then produce the NextGen Bio “Class of…,” twenty companies ranked based on several categories, including Finance, Collaborations, Pipeline, and Innovation. The companies were typically launched no more than 18 months before the list was created.

We thought it would be insightful to look back at our previous lists to see where some of those companies are today. Here’s a look at the top 3 companies from the Top 30 Life Science Startups to Watch in the U.S. from 2015. Yes, in 2015 we chose 30, but since then the count has been 20.

#1. Juno Therapeutics. Founded in 2013, Juno Therapeutics was our top pick for the NextGen Bio Class of 2015. At that time, Juno was noted for partnerships with Fred Hutchinson Cancer Research Center, the Memorial Sloan-Kettering Cancer Center, and Seattle Children’s Research Institute. The initial Series A investment was $120 million followed in April 2014 by a secondary Series A with an additional $176 million. Not long afterward, in August 2014, Juno closed on a Series A and B round worth $134 million, bringing in more than $300 million in less than 12 months. It launched its initial public offering on December 23, 2014, raising another $100 million.

What had investors—wisely—excited about Juno was its novel cellular immunotherapies based on two separate but complementary platforms—Chimeric Antigen Receptors (CARs) and T Cell Receptors (TCRs). The company had its share of setbacks. In March 2017 it had to shutter its lead CAR-T oncology program, JCAR015, because of patient deaths. But it bounced back with JCAR017.

Then, you could say, lightning struck. In January 2018, Celgene acquired Juno for $9 billion. Juno was keeping its name and operating as a wholly-owned subsidiary of Celgene and also staying at its location.

In June 2018, at the Annual Meeting of the American Society of Clinical Oncology (ASCO), Juno presented research for JCAR017 (lisocabtagene maraleucel) in diffuse large B-cell lymphoma (DLBCL), the most common form of non-Hodgkin’s lymphoma (NHL). The results were very positive, and and the product has the potential of becoming only the third CAR-T therapy on the market. Multiple clinical trials are in progress.

#2. MyoKardia. Based in San Francisco, MyoKardia was second on the list for 2015. The company had raised $52 million in three rounds from a single investor. In May 2014, it launched the Sarcomeric Human Cardiomyopathy Registry (ShaRe), a multi-center, international repository of clinical data on individuals with genetic heart disease. And in September 2014, it inked a deal with Sanofi to collaborate on discovering and developing first-of-its-kind targeted therapeutics for heritable heart diseases known as cardiomyopathies. This collaboration provided up to $200 million in equity investments, milestone payments and R&D services through 2018.

MyoKardia’s lead program is for Mavacamten, an orally administered small molecule designed to reduce left ventricular contractility by modulating the function of cardiac myosin. It is currently being evaluated in EXPLORER, a Phase III open-label single-arm study in patients with symptomatic oHCM, a subset of hypertrophic cardiomyopathy (HCM).

The company also has another Phase II product, MYK-491, for dilated cardiomyopathy. The company also has other compounds in preclinical development related to the treatment of cardiac muscle contractility in HCM.

#3. Spark Therapeutics. Based in Philadelphia, Pa., Spark Therapeutics was launched in 2013 with a $50 million capital commitment from The Children’s Hospital of Philadelphia (CHOP) to advance and commercialize its ongoing gene therapy programs, including its lead candidate for RPE65-related blindness, which at that time was in Phase III clinical trials. The company raised $122.8 million in two rounds. It also at that time had a Phase I and II program in hemophilia B.

In December 2017, the U.S. Food and Drug Administration (FDA) approved Spark’s Luxturna (voretigene neparvovec), a gene therapy for a rare, genetic form of blindness. It is the first type approved by the FDA that targets a disease caused by mutations in a specific gene. It was approved for the treatment of pediatric and adult patients with confirmed biallelic RPE65 mutation-associated retinal dystrophy. The disease can lead to vision loss and may cause complete blindness in certain patients.

In what stunned many, the therapy came with an $850,000 price tag to treat both eyes. That price was actually at the low end for many analysts, who expected it to be close to $1 million, or $500,000 per eye. Still, that made the drug the most expensive therapy in the United States. The disease affects between 1,000 and 2,000 patients in the United States.

Part of the price and part of the reason payors, such as Harvard Pilgrim, an affiliate of Express Scripts, were willing to pay for it was an agreed-upon outcomes-based payment system and a payment system. In January 2018, Steve Miller, chief medical officer for Express Scripts, told CNBC that the drug was responsibly priced. “The product is just phenomenally innovative, and we’ve been talking about gene therapy for over 20 years. We’re now at the threshold of having gene therapy reaching patients,” he said.

The therapy was recently approved in Europe. The company is also preparing for a Phase III trial of SPK-8011 for hemophilia A before the end of this year and hopes to get an investigational gene therapy for Pompe disease into the clinic in 2019.