SAN DIEGO, May 8, 2017 /PRNewswire/ -- Pfenex Inc. (NYSE MKT: PFNX), a clinical-stage biotechnology company engaged in the development of biosimilar therapeutics, including high value and difficult to manufacture proteins, today reported financial results for the first quarter ended March 31, 2017 and provided a business update.

Business Review and Update

The Pfenex Annual Stockholder Meeting was held on May 5, 2017. At the Annual Meeting, respected pharmaceutical industry veterans Sigurdur (Siggi) Olafsson and Jason Grenfell-Gardner were elected to serve on Pfenex's Board of Directors. Mr. Olafsson served most recently as President and Chief Executive Officer of Global Generic Medicines Group of Teva Pharmaceuticals Ltd., a pharmaceutical company, and Mr. Grenfell-Gardner serves as the President and Chief Executive Officer and a member of the Board of Directors of Teligent, Inc., a specialty generic pharmaceutical company. Upon election, Mr. Grenfell-Gardner became Pfenex's Chairman of the Board of Directors as well as a member of the Corporate Governance and Nominating Committee. Pfenex previously announced the retirement of Chairman and Board Member, William R. Rohn, on March 31, 2017. The Company thanks Mr. Rohn for his valuable service.

PF708 is Pfenex's product candidate that is being developed as a therapeutic equivalent to Forteo (teriparatide), marketed by Eli Lilly for the treatment of osteoporosis patients at high risk of fracture. Enrollment in the pivotal immunogenicity/pharmacokinetics clinical study in osteoporosis patients was initiated in the fourth quarter of 2016. The completion of enrollment and interim pharmacokinetic data from this study is expected in the second half of 2017, and the immunogenicity data is expected in the first half of 2018. Pfenex believes this study, along with the positive bioequivalence study, is anticipated to satisfy the filing requirements for PF708 through the 505(b)(2) regulatory pathway.

In August 2016, Pfenex regained full rights from Pfizer to PF582, Pfenex's biosimilar product candidate to Lucentis (ranibizumab) for the treatment of retinal diseases, and announced positive results from the phase 1/2 trial which showed that PF582 was pharmacologically active and had a safety profile that was consistent with that of Lucentis. Pfenex has had ongoing interest in PF582 and expects to complete the strategic review of our development options for PF582 by the time we report our second quarter results in August 2017. As we complete the assessment of the strategic options for this program, we are reviewing the PF582 program resource commitments within the context of our broader ongoing development programs.

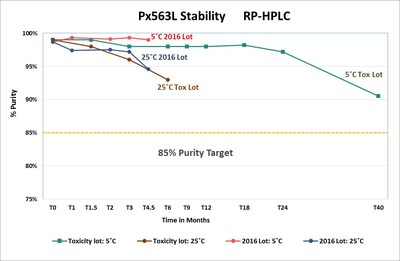

Px563L, a novel anthrax vaccine candidate, is being developed by Pfenex in response to the United States government's unmet demand for increased quantity, stability and dose-sparing regimens of anthrax vaccine. The development of Px563L is funded by the U.S. Department of Health and Human Services, through the Biomedical Advanced Research and Development Authority, or BARDA, in accordance with a cost plus fixed fee advanced development contract valued at up to approximately $143.5 million. Pfenex expects to initiate the phase 2 study in 2018. Ahead of the phase 2 study initiation, the Company expects to continue to demonstrate stability of the vaccine and to complete the manufacturing of the clinical supply. Pfenex has generated stability on its 2016 manufactured lot out to 4.5 months demonstrating the maintenance of approximately 99% purity at 5°C and approximately 95% purity at room temperature (25°C). The purity target is 85% or greater. Pfenex has also demonstrated long term stability data from our toxicology lot showing greater than 90% purity at 5°C at 40 months. Pfenex believes the successful completion of the phase 2 study and activities under this contract could lead to a procurement contract for supply of Px563L to the Strategic National Stockpile.

Financial Highlights for the First Quarter 2017

Total Revenue increased by $0.1 million, or 2%, to $2.8 million in the three month period ended March 31, 2017, compared to just under $2.8 million in the same period in 2016 due primarily to licensing revenue. This was partially offset by a decrease in government contract revenue for our Px563L product candidates. Given the nature of the novel vaccine development process, revenue will fluctuate depending on stage of development.

Cost of revenue decreased by approximately $0.5 million, or 37%, to $0.8 million in the three month period ended March 31, 2017, compared to $1.3 million in the same period in 2016. The decrease in cost of revenue for the periods presented was due primarily to a decrease in costs for our Px563L product candidate under our government contracts related to planning and start-up activities for newly exercised option periods. Given the nature of the novel vaccine development process, these costs will fluctuate depending on stage of development.

Research and development expenses increased by approximately $0.9 million, or 17%, to $6.4 million in the three month period ended March 31, 2017, compared to $5.5 million in same period in 2016. The increases in research and development expenses during the periods presented were primarily due to the increase in development activity of our product candidates, including PF708 and PF582, and the hiring of additional personnel dedicated to our research and development efforts.

To read full press release, please click here.