News

While GSK did not provide a specific reason for returning Wave Life Sciences’ WVE-006, the decision comes after the asset in September 2025 came below analyst expectations in a Phase Ib/IIa AATD study.

FEATURED STORIES

AstraZeneca’s $15 billion pledge to its China operations highlights the country’s advantages. But other regions are also hoping to host more clinical studies.

With Lykos’ regulatory failure now squarely in the rearview mirror, Compass Pathways and Definium are leading what one analyst suspects will be “a very big year for psychedelics.”

The Senate failed to pass a massive spending bill on Thursday—which includes the rare pediatric PRV program but also funding for the Immigration and Customs Enforcement’s large-scale crackdown in Minnesota and other states.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

Phacilitate’s annual event dawns as cell and gene therapies reach a new tipping point: the science has hit new heights just as regulatory and government policies spark momentum and frustration.

THE LATEST

Shares of preclinical genetic medicines company Metagenomi tanked more than 30% on Friday afternoon in a disappointing debut for its initial public offering, bucking the trend of positive IPOs so far this year.

Merging six of its portfolio biotechs, Medicxi on Monday unveiled Alys Pharmaceuticals, an immuno-dermatology focused company seeking to deliver up to 10 proof-of-concept readouts by the end of 2026.

Two Florida courts have sided with Novo Nordisk against Ekzotika and Effinger Health, agreeing that their compounded versions of semaglutide are against the law. The Danish pharma has reached confidential settlements with both companies.

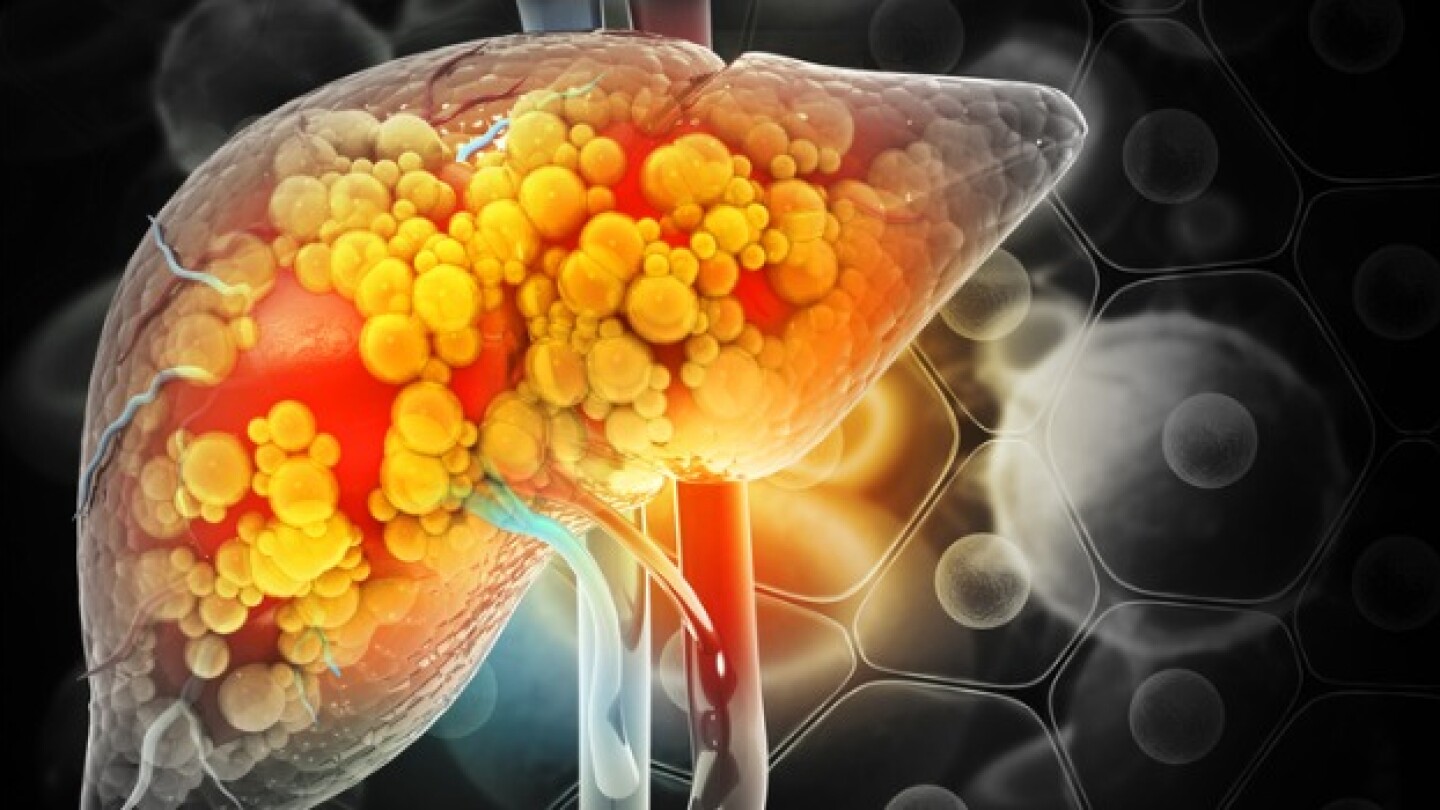

Madrigal Pharmaceuticals announced late-stage results published Thursday in The New England Journal of Medicine for resmetirom as it awaits a March 14 PDUFA date.

Biopharma’s latest earnings season was, in a word, predictable. Companies are consistently beating Wall Street earnings and revenue estimates as they set low expectations for investors.

Despite not having a single candidate in the clinical stage, the Moderna-backed biotech is offering 6.25 million shares for $15 apiece in an initial public offering. Shares are expected to begin trading Friday.

The CEOs of BMS, J&J and Merck testified Thursday before the Senate health committee that pharmacy benefit managers bear much of the blame for high pricing, while declining to commit to price cuts.

Following promising Phase IIb studies, Takeda will advance its oral ORX2 agonist TAK-861 into Phase III studies for narcolepsy type 1, while nixing the candidate’s development in narcolepsy type 2.

Investors drove up the price of Kyverna Therapeutics’ stock by 59% in its initial public offering on Thursday afternoon, the first day of trading, reaching a peak per-share price of $35.01.

Gilead Sciences is ending the development of magrolimab for the treatment of blood cancer following the FDA’s placement of a clinical hold on all its programs related to the drug.