News

In light of President Donald Trump’s impending pharma tariffs, several big companies have made massive manufacturing investments in the U.S., including Eli Lilly, Johnson & Johnson and Novartis. BMS is the latest to make a multibillion-dollar push.

FEATURED STORIES

FDA Commissioner Marty Makary last week announced a directive that would limit industry participation in the agency’s advisory committees. But not only do company reps serve only as non-voting members, a 1997 law actually requires industry involvement.

Disruptive conditions are typical in non-Western markets. The U.S. industry, thrown into a period of significant change as the Trump administration overhauls HHS and considers implementing tariffs, could learn a thing or two by looking overseas.

Like they say about the weather in Iceland, if you don’t like an action taken by the new administration, wait five minutes; it’ll probably change. The markets, it seems, don’t react kindly to that kind of policymaking.

Job Trends

Gilead’s layoffs include 72 employees at its Seattle location, which will close. Kite will shut down its Philadelphia facility. The layoffs are attributed to aligning resources with long-term strategic goals.

FROM OUR EDITORS

Read our takes on the biggest stories happening in the industry.

With the failure of AbbVie’s emraclidine in two mid-stage trials, Bristol Myers Squibb’s Cobenfy is ‘sole muscarinic winner.’

THE LATEST

When it comes to vaccination, the COVID-19 pandemic divided American society. President Donald Trump and his new Health and Human Services secretary are bringing down the hammer. What happens when there is no middle ground?

Many companies have foreshadowed deals to come during earnings calls in recent days. The return of M&A would be a welcome sign for the biopharma ecosystem, which has been battered by macro headwinds such as tariffs and the possibility of new drug pricing pressures.

Learn how to extract the full value from executive coaching, starting with being open and honest with your coach.

Entrada is paring back its research staff even as it gears up to hire employees to support a planned clinical trial for a Duchenne muscular dystrophy candidate.

The American Association for Cancer Research’s annual conference featured updates from several companies on key candidates and assets, including Merck’s Keytruda and GSK’s Jemperli.

At the heart of the acquisition is Regulus’ farabursen, an miRNA-targeting oligonucleotide in early-stage development for rare autosomal dominant polycystic kidney disease.

GSK’s dealmaking will be “cautious and disciplined” under the current trade war, but the pharma will focus on looking for “opportunities created” amid these tensions, according to CEO Emma Walmsley. The company also reported a 4% earnings bump for the quarter.

It’s been a fraught road for the proposed merger between Acelyrin and Alumis, with Tang Capital’s Concentra Biosciences in February threatening to upend the deal with a proposed $3-per-share acquisition of Acelyrin.

The drug, a small molecule protein inhibitor, brought in $132 million in the first quarter, missing consensus estimates by 17%.

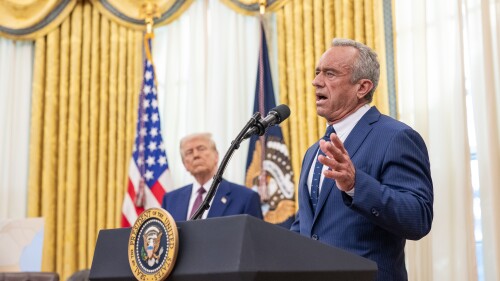

As Q1 2025 earnings season continues, tariffs remain top of mind for pharma CEOs and investors. Meanwhile, the American Association for Cancer Research’s annual event kicks off this year’s oncology conference season. Plus, will the FDA become politicized under HHS Secretary RFK Jr.?