With a pair of Phase III trial flops, Ultragenyx will explore cost reductions as analysts turn attention to an upcoming Angelman syndrome readout.

Ultragenyx lost $1 billion in value after a genetic bone disease therapy failed to reduce fracture rate, which was the main goal of two Phase III trials. While the drug did achieve a key secondary outcome in the trials, the company’s shares tumbled, and analysts began to look beyond the asset to new milestones.

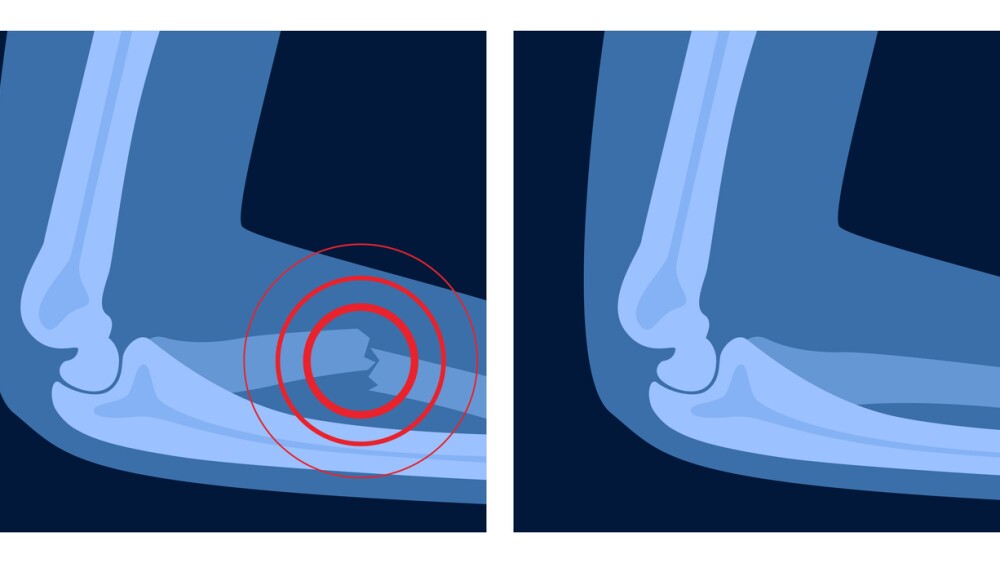

Setrusumab, also known as UX143, was being tested in the late-stage Orbit and Cosmis studies in patients with osteogenesis imperfecta, a rare genetic bone disorder that causes reduced or abnormal collagen and changes in bone metabolism. Ultragenyx and partner Mereo BioPharma were testing setrusumab in patients aged 5 to 25 with three different subtypes to see if the drug could reduce the fracture rate as compared to placebo.

While patients experienced improvements in bone mineral density, which was a secondary endpoint, this was not linked to a reduction in fractures, the biotech said in a press release issued December 29, 2025.

Ultragenyx CEO Emil Kakkis expressed surprise at the failure in a statement. The drug had shown promise in an earlier Phase II trial. Kakkis promised to continue to parse through the data for further learnings. The company is conducting additional analyses on bone health and clinical endpoints other than fractures to consider next steps for the program.

Meanwhile, Ultragenyx said it will look into potential expense reductions but did not provide further details. The company has four approved products and reported $160 million in revenue for the third quarter of 2025.

Over at Mereo, the impacts were more immediate. The company’s shares tumbled 81% to 42 cents. CEO Denise Scots-Knight announced “immediate reductions in our pre-commercial and manufacturing activities” in a press release. Mereo had $48.7 million in cash on hand as of the end of the third quarter and will now accelerate partnering efforts for alvelestat in AATD lung disease.

William Blair analysts were similarly stunned by the results, noting increased enrollment of patients with more severe disease types and the earlier success in Phase II. Writing in a December 29 note, the analysts wondered if there could have been a larger effect size in the pediatric population, but Ultragenyx did not provide full data.

Truist Securities, on the other hand, had been skeptical that setrusumab could improve the condition of patients with osteogenesis imperfecta, as the bone that patients form is “inherently defective,” so growing more of it likely would not result in a reduction in fractures. “Alas, more defective bone does not result in stronger bone,” Truist said in a December 29 note.

Ultragenyx’s stock tumbled about 43%, according to William Blair. As of Friday morning, the company was trading at $22.67, representing a 32% decline since before the trial readout. William Blair said that this represents about the value of the company’s approved products.

Focus will now turn to milestones to come over the next 12 months, including a Phase III readout for antisense oligonucleotide apazunersen in Angelman syndrome. This pivotal readout is expected in the third quarter. Ultragenyx could also receive approval for two gene therapies to add to its roster of rare disease medicines, which already includes Mepsevii for the genetic lysosomal storage disease mucopolysaccharidosis VII.